“Subprime Was The Tip Of The Iceberg”.... “Prime Will Be Far Bigger In Its Impact.”

Das nachfolgende Posting liefert nicht wirklich bahnbrechend Neues und soll in erster Linie ein Update in Sachen US Wohnimmobilienmarkt geben. Denke hier werden all diejenigen die schon fast penetrant den Boden ausrufen als Phantasten entlarvt. Wenn man jetzt bedenkt das der Verfall im gewerblichen Sektor gerade erst Fahrt aufnimmt erscheinen einige bullische Kommentare in einem noch fragwürdigerem Licht...... Kein noch so großer Bailout kann die dringend notwendige Bereinigung verhindern.... Bin sogar der Meinung das je länger die Korrektur durch die "Eingriffe" verlängert wird desto größer wird der volkswirtschaftliche Gesamtschaden letztendlich sein. Da aber in der Realität immer irgendwelche Wahlen anstehen muß man wie die aktuellen Beispiele zeigen mit dem Schlimmsten rechnen.....

Housing Lenders Fear Bigger Wave of Loan Defaults NYT

Housing Lenders Fear Bigger Wave of Loan Defaults NYT

The first wave of Americans to default on their home mortgages appears to be cresting, but a second, far larger one is quickly building

The percentage of mortgages in arrears in the category of loans one rung above subprime, so-called alternative-A mortgages, quadrupled to 12 percent in April from a year earlier. Delinquencies among prime loans, which account for most of the $12 trillion market, doubled to 2.7 percent in that time.

Delinquencies on mortgages tend to peak three to five years after loans are made....

Prime and alt-A borrowers typically had a five- or seven-year grace period before payments toward principal were required. By contrast, subprime loans had a two-to-three-year introductory period. That difference partly explains the lag in delinquencies between the two types of loans, said David Watts, an analyst with CreditSights

> You don´t need to be a genius to figure out will happen during the next few years..... The following quotes from Calculated Risk sums it up

> You don´t need to be a genius to figure out will happen during the next few years..... The following quotes from Calculated Risk sums it up

> Denke hier braucht man nun wirklich kein Genie zu sein um zuerkennen das die nächsten Jahre brutal werden. Der nachfolgende Kommentar von Calculated Risk dürfte zutreffen.....

I think the second wave of foreclosures will be smaller in numbers, as compared to the largely subprime first wave, but the price of each home will be much higher. And the second wave will impact prices in the mid-to-high end areas, as opposed to the subprime foreclosures impacting prices in the low end areas.

Barry Ritholtz on "perma-bottom-callers"

Wishful thinking is never a substitute for reviewing the actual data;

thoughtful analysis is better than cheerleading

UPDATE: Click trough pages 61 & 62 from the HSBC Earnings Release to get an up to date picture of their US mortgages, consumer lending, credit card and vehicles credit book.... I also want to highlight page 12 & 13. They are showing the credit trends worldwide ( personal & commercial ) ...... Watch Latin America ( mainly related to Mexico ) ......

UPDATE: Passendweise hat gerade HSBC berichtet. In diesem Report findest man auf den Seiten 61 & 62 Daten nette Charts zu der US Kreditqualität quer durch alle Sektoren ( Kreditkarten , PKW Finanzierungen usw ). Darüberhinaus sollte man einen Blick auf die Seiten 12 & 13 werfen. Hier werden die weltweiten Rsikovorsorgen für den privaten und den gewerblichen Sektor aufgeschlüsselt. Hier sticht besonders und für mich etwas überracshend der starke Anstieg in Süd Amerika hervor ( Lt. Telefonkonferenz überwiegend Mexico )...... Die 200% Aufstockung der Risikovorsorge im gewerblichen US Bereich dürfte erst der Anfang sein.....

Labels: "contained", alt-a, arm resets, delinquencies, hsbc, prime, subprime, us recession

And with news like this

And with news like this

“This will ensure that there is no compelled liquidation of the assets in the SIVs,” said Armin Kloss, a WestLB spokesman, referring to structured investment vehicles. “We are also convinced that the assets that Kestrel and Harrier have could be more highly valued, but that the market is not ready for that.”

“This will ensure that there is no compelled liquidation of the assets in the SIVs,” said Armin Kloss, a WestLB spokesman, referring to structured investment vehicles. “We are also convinced that the assets that Kestrel and Harrier have could be more highly valued, but that the market is not ready for that.” HSH Nordbank, based in Hamburg, is taking a similar step to that of WestLB, covering all of the 3.3 billion euros that its vehicle, called Carrera Capital, has issued. The step has helped secure its stable credit ratings with Moody’s Investor Service and Standard & Poor’s.

HSH Nordbank, based in Hamburg, is taking a similar step to that of WestLB, covering all of the 3.3 billion euros that its vehicle, called Carrera Capital, has issued. The step has helped secure its stable credit ratings with Moody’s Investor Service and Standard & Poor’s.

Here the

Here the

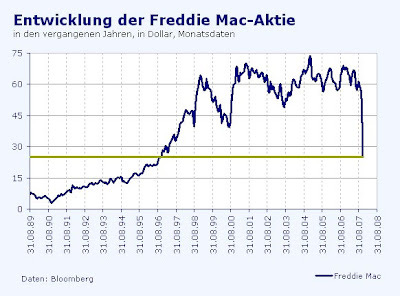

Freddie Mac, the second-largest U.S. mortgage company, warned of a possible cut in the dividend and the need for additional capital. The worst housing slump in 16 years caused ``significant deterioration'' in the third quarter that will continue through year-end, Freddie Mac said after reporting a net loss of $2.02 billion, or $3.29 a share, three times what some analysts estimated.

Freddie Mac, the second-largest U.S. mortgage company, warned of a possible cut in the dividend and the need for additional capital. The worst housing slump in 16 years caused ``significant deterioration'' in the third quarter that will continue through year-end, Freddie Mac said after reporting a net loss of $2.02 billion, or $3.29 a share, three times what some analysts estimated.

What was only a hypothetical question on the Nov. 7 th in the conference call what will happen after a downgrade from the single A rating the management said that ACA would face (hypothetical speaking....) an immediate liquidity call of $ 1.7 billion...... Now after S&P has finally eliminated the "hypothetical" just 2 days later and put ACA on the list for a possible downgrade from A this scenario described from Michael Panzner

What was only a hypothetical question on the Nov. 7 th in the conference call what will happen after a downgrade from the single A rating the management said that ACA would face (hypothetical speaking....) an immediate liquidity call of $ 1.7 billion...... Now after S&P has finally eliminated the "hypothetical" just 2 days later and put ACA on the list for a possible downgrade from A this scenario described from Michael Panzner  The WSJ has a related story

The WSJ has a related story

I´m pretty sure the current housing and credit mess will have a macroeconomic link.

I´m pretty sure the current housing and credit mess will have a macroeconomic link.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)