nachfolgend ein bericht von man höre und staune aus "builder online" einem infomagazin der bauindustrie. hat also halboffiziellen charakter. finde die aufschlüsselung der einzelnen märkte hervorragend. zeigt sehr deutlich das einige redgionen die bis vor kurzem noch einigermaßen im rahmen waren nach und nachj vom "rolling bubble" erfaßt werden. am besten beschrieben im ersten beispiel.

dank geht an

bubbel butt und

ben http://thehousingbubbleblog.com/?p=1508#commentsdas nachfolgende ist ne

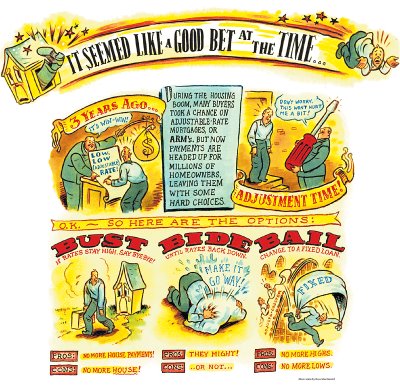

zusammenfassung/summary/highlightshttp://tinyurl.com/fcyd6 AFFORDABILITY PORT ST. LUCIE:An Imperfect StormMany buyers at the start of the boom came from cities farther south, such as Miami and Fort Lauderdale, where Florida's extreme price appreciation appeared first, says Larry Brians, co-owner of Port St. Lucie–based Town and Country Home Builders, which closed 75 homes last year. Most of his buyers sold their existing homes at enormous profits, bought in Port St. Lucie, and had cash to spare. “They could get a brand-new home here that was twice as big and twice as nice as the homes they had in Miami or [Fort] Lauderdale,” he says. The equity those buyers brought enabled builders in Port St. Lucie to raise prices accordingly. Brians says the market easily absorbed the $5,000 increases he was adding to his homes every 30 to 60 days. Brians recalls what happened with land prices: “You could find lots for $5,000. Then it got to a point where lots were at about $25,000—and I'm thinking this has to be the max that anybody would be willing to pay—but then they were $35,000, then $45,000, then $50,000. When they hit $50,000, I really thought there was no way anybody in Port St. Lucie would spend $50,000 on a lot. Over the next year, they hit $100,000 to $120,000. One area that turned out to be a really nice area started to go for $120,000. Two years ago [the lots there] went for $3,500 a piece. We would have bet millions that this would never have happened in our lifetimesIt's difficult to know just how many homes speculators bought—especially because builders said throughout the boom that they were not selling to investors—but McCabe estimates that they may have accounted for as much as half of South Florida's single-family home sales. Some Port St. Lucie builders and industry observers say it was an open secret that investors accounted for a large share of the market's sales. “Absolutely, they were selling to investors,” says Bart Johnson, a Realtor with ReMax 100 Riverside, based in Port St. Lucie, adding that he knew one investor who bought 250 from one builder alone.Prices on those highly priced lots have begun to retreat, too, though they're unlikely to fall to their pre-boom levels. “They will probably bottom out around $50,000,” Brians says, adding, “but I also thought they would top out at $50,000.”AFFORDABILITY:

AFFORDABILITY PORT ST. LUCIE:An Imperfect StormMany buyers at the start of the boom came from cities farther south, such as Miami and Fort Lauderdale, where Florida's extreme price appreciation appeared first, says Larry Brians, co-owner of Port St. Lucie–based Town and Country Home Builders, which closed 75 homes last year. Most of his buyers sold their existing homes at enormous profits, bought in Port St. Lucie, and had cash to spare. “They could get a brand-new home here that was twice as big and twice as nice as the homes they had in Miami or [Fort] Lauderdale,” he says. The equity those buyers brought enabled builders in Port St. Lucie to raise prices accordingly. Brians says the market easily absorbed the $5,000 increases he was adding to his homes every 30 to 60 days. Brians recalls what happened with land prices: “You could find lots for $5,000. Then it got to a point where lots were at about $25,000—and I'm thinking this has to be the max that anybody would be willing to pay—but then they were $35,000, then $45,000, then $50,000. When they hit $50,000, I really thought there was no way anybody in Port St. Lucie would spend $50,000 on a lot. Over the next year, they hit $100,000 to $120,000. One area that turned out to be a really nice area started to go for $120,000. Two years ago [the lots there] went for $3,500 a piece. We would have bet millions that this would never have happened in our lifetimesIt's difficult to know just how many homes speculators bought—especially because builders said throughout the boom that they were not selling to investors—but McCabe estimates that they may have accounted for as much as half of South Florida's single-family home sales. Some Port St. Lucie builders and industry observers say it was an open secret that investors accounted for a large share of the market's sales. “Absolutely, they were selling to investors,” says Bart Johnson, a Realtor with ReMax 100 Riverside, based in Port St. Lucie, adding that he knew one investor who bought 250 from one builder alone.Prices on those highly priced lots have begun to retreat, too, though they're unlikely to fall to their pre-boom levels. “They will probably bottom out around $50,000,” Brians says, adding, “but I also thought they would top out at $50,000.”AFFORDABILITY:Average, 1995–2002: 78.3%

1Q2005: 42.6%

1Q2006: 22.7%

THE PHOENIX MARKET Temporary Grounding“HIT THE wall” for Hacienda Builders this summer. In the second week of July, the Scottsdale, Ariz.–based builder sold eight homes in Phoenix, but had seven cancellations. Hacienda has also lowered the price of its most economical home to $170,000 from $220,000. But the company, which became accustomed to closing 800 to 1,000 homes per year, will probably close only 200 to 300 in 2006“Last October, the lines [of customers] started getting shorter. Then, in January, the lines were gone. Every week got a little harder, and by April 1 it was just deada sizable percentage of permits issued in Phoenix in recent years have been for lots in outlying areas that are 45 to 60 minutes away from job centers. The absolute softest parts of the market are where there are no roads,” (wen wundert das.../very surprising....)But he and other builders here believe that any short-term decline will ultimately be a “hiccup” in Phoenix's long-term “exponential growth (dream on / träum weiter )AFFORDABILITY PHOENIX:

Average, 1995–2002: 70.3%

1Q2005: 60.1%

1Q2006: 32.9%

BOSTON Pricing's PowerSOMETHING HAD TO GIVE. Boston's housing market headed upward for 12 years. It shrugged off interest rates approaching 9 percent in 1995. It flourished through the loss of tens of thousands of jobs after the tech crash of 2001. Even as Massachusetts fell into the undesirable group of states losing population, housing prices in the Boston market continued to move higher.By late last year, buyers had had enoughFORECLOSURES BOSTON:

Change from 2Q2005: +85%

Change from 1Q2006: +129%

SALT LAKE CITY Catching Up

Land “has gone haywire, doubling or tripling” over the past year, says Mike Williamson, Sage Homes' vice president, who's seen quarter-acre lots going for $150,000 to $200,000

In mid-July, he was offered 10,000-square-foot unfinished lots in Magna, Utah, for $93,000 per lot; 10 years ago, Hamlet could build homes in that same town at a total cost of $85,000.

prices had increased by one-third, to $280,000, in Salt Lake's Sugar House area during the first quarter of this year, and by more than 57 percent, to $529,000, in Alpine, Utah.

RENO, NEV Move-Up Magnet

Home prices appreciated within a healthy range of 1.9 percent to 4.9 percent between 1993 and 2001, according to data tracked by Kaiser. Back then, median home prices were well below $200,000, and about 70 percent of the homes sold were affordable to median-income households.

Seemingly overnight, the market turned. It was a turn for the better, at least at the start. Job growth picked up, and prices grew 9 percent in 2002, followed by 15.4 percent growth in 2003, 31.3 percent in 2004, and 23 percent in 2005. Prices in some submarkets jumped 40 percent a year.

By last year, median prices hit $315,000, and families earning the median income could afford just 31 percent of the homes sold

Prices have already fallen between 5 percent and 7 percent, he says, and he anticipates a total decline of 10 percent to 15 percent for the year due to the oversupply in the marke

companies (centex,pulte) have resorted to sales and price reductions of as much as $100,000 to move standing inventory

AFFORDABILITY:

Average, 1995–2002: 66.2%

1Q2005: 30.9%

1Q2006: 17.4%

CHARLOTTE, N.C. Steady Ahead

“Land is being driven up faster than I've ever seen,” says McManie, of Dublin Homes. “What cost $30,000 three years ago maybe costs $65,000 now.”

Condo buildings, not previously a significant share of Charlotte's housing stock, are popping up,

Some industry observers wonder if condo investors, having pulled out of the Florida markets, have moved into Charlotte

Condo construction has doubled since last year, says Baldwin of the Charlotte HBA, and Branch notes that seven high-rise towers have been planned for the area. Three are under construction, and three others are in presales.

AFFORDABILITY:

Average, 1995–2002: 67.4%

1Q2005: 77.3%

1Q2006: 71.2%

KANSAS CITY, MO./KAN

about 36 percent of the new-home stock is sitting finished and unoccupied right

You couldn't give [a condo] away five years ago, and now they're starting hundreds

Underwood estimates the HBAadded 300 new builders within the last four years, and more than 200 banks in the area write construction loans. That combination may result in a shakeout of overleveraged companies unprepared to absorb the carrying costs of even a few spec homes

FORECLOSURES:

Change from 2Q2005: +53%

Change from 1Q2006: -25%

PORTLAND, ORE. Hemmed In

Over the past four years, land prices in Portland have risen 100 percent

some developers in Portland have paid up to $700,000 per acre for lots.

A study conducted by Portland State University found that, on average, developers spent $187,000 per acre in 2005, or six times what land went for 15 years ago

This price escalation is attributable in large measure to the Urban Growth Boundary (UGB), a land-use plan required under state law that separates rural land from urban land and, in effect, limits development

This year, Renaissance Home's prices are up by 40 percent, to an average of $550,000. Prices in one community have jumped to $750,000 in June 2006 from $500,000 in April 2005

FORECLOSURES:

Change from 2Q2005: +207%

Change from 1Q2006: +237%

SAN DIEGO Paradise Fades

HALLMARK COMMUNITIES IS REDUCING the number of homes it closes this year to 50, from 200 in 2005. And like many of its competitors, Hallmark has downsized its staff—in its case, by 50 percent

Michael Hall wants to double Hallmark's closings, to more than 100 units, within three years, and he's started to stockpile land and search for management “talent” by occasionally picking up employees who have been laid off from or have left other companies. “We've been rolling down hill, but you have to hit the bottom before you can go up again,” says Hall about the market. (bancrupcy is coming / pleite kommt sicher)

This hopeful attitude is shared by many builders here, who believe San Diego's economy is simply too sturdy for any sustained falloff in demand to take hold

there's been a 15 percent “correction” in market pricing this year, “and it's not all on the price sheet” but through incentives and broker co-ops, which he says were “unheard of” two years ago.

19,803 homes were for sale in June 2006, compared with 6,657 in June 2004.

AFFORDABILITY:

Average, 1995–2002: 38%

1Q2005: 7%

1Q2006: 5.2%

SAN ANTONIO Avoiding the Alamo

Ten years ago, San Antonio pulled 6,200 permits; this year it will pull more than 18,000. That growth can't continue, but I don't know where it's going to land yet.”

28 percent of all home buyers still look for a house in the $100,000 to $150,000 range.

But through the first half of this year, the market's median sales price rose 8.6 percent to $139,600

“Homes we sold in the Garden Ridge section for $115,000 in 2004 now cost up to $150,000,” says Mikesell, whose company's average price has risen to between $104 and $108 per square foot, from $88 three years ago

the price of a half-acre in a good location has gone up 30 percent to 40 percent and is now between $80,000 and $100,000

AFFORDABILITY:

Average, 1995–2002: 64%

1Q2005: 71.4%

1Q2006: 59.6%

jan-martin

Real Estate Slowdown in Spain May Cut Sales of `Covered' Bonds

Real Estate Slowdown in Spain May Cut Sales of `Covered' Bonds

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)