If the recent handling from the Fed & Treasury ( and their western counterparts ) is offering any guide i think the chances that we will see much transparancy is not looking very promising ( same has hapened in Germany with the IKB bailout ) . That Obama has choosen Geithner ( just a younger version of Paulson ) isn´t quite helpful and was a big disappointment ( see also the "rant" from Barry Ritholtz

The Moral Hazard of the “Bad Bank” ). Read the following articles and it should be clear that there is no way the Bad Bank will pay nowhere near market prices and make the process of how they "model" their inflated "market price" transparent..... Just another attempt to rip off the taxpayer and to avoid the long overdue punishment of equity and especially debt investors......

Wenn die bisherige Handhabung der Bailouts von Seiten der Fed und des Finanzministeriums ( gleiches gilt auch für Steinbrück in Sachen IKB/KFW!) irgendwelche Anhaltspunkte geben wie es bei der kommenden Bad Bank um die Transparenz bestellt sein wird sieht es, wie nicht anders zu erwarten, zappenduster aus...... Trotz aller großen Reden Obamahs das in allen Bereichen vollkommene Transparenz obersterstes Gebot seiner Regierung sein wird. Das Obama ausgerechnet Geithner nominiert, hat der schon zu Zeiten als Fed Verantwortlicher eine einzige Katastrophe gewesen ist und mir eher wie ne jüngere Version von Paulson vorkommt, spricht Bände ( siehe auch die wenig schmeichelhaften Kommentare zu Geithner via Barry Ritholtz The Moral Hazard of the “Bad Bank” )...... Lest bitte die folgenden Artikel und es dürfte kristallklar sein das die Bad Bank nicht mal ansatzweise aktuelle Marktpreise zahlen wird. Zudem dürfte es keinerlei schlüssige Erklärung geben wie die Bad Bank die deutliche Überbezahlung der Anlagen rechtferigen kann...... Alles in allem ein weiterer Versuch den Steuerzahler ohne entsprechenden Gegenwert die Last der geballten Inkompetenz der Bänker und Aufseher zu schultern..... WICHTIG: Unbedingt diesen Link "Bad Bank - Bad System" von "Querschüsse" lesen um am Beispiel der Wets LB mit offenem Mund zu bestaunen was für Lasten kommen werden.....

> I think it´s safe to say that you can add central bankers to this list......

> Ich denke man kann getrost auch die Zentralbänker dieser Welt dieser Liste (Cartoon) zuordnen.....

Obama Records Pledge Tested By Citigroup Guarantees Jan. 29 (Bloomberg) -- U.S. government guarantees on securities totaling $419 billion for bank bailouts provide an early test of President Barack Obama’s pledge to be open with taxpayers about what they have at risk in the credit crisis.

Bloomberg News asked the Treasury Department Jan. 26 to disclose what securities it backed over the past two months in a second round of actions to prop up Bank of America Corp. and Citigroup Inc. Department spokeswoman Stephanie Cutter said Jan. 27 she would seek an answer. None had been provided by the close of business yesterday.

As Congress debates an $875 billion economic stimulus bill, the guarantees represent a less publicized commitment. The public’s stake has grown along with assurances tying the Treasury to the fate of corporate loans and securities backed by home mortgages, car loans and credit card debt.

Obama promised a new era of government openness as he took office last week, issuing a statement telling agencies “to adopt a presumption in favor of disclosure” in responding to requests under the Freedom of Information Act. Treasury Secretary Timothy Geithner and Lawrence Summers, head of the National Economic Council, said they would emphasize accountability and transparency in using the second half of a $700 billion bank bailout fund.

New Disclosures

Late yesterday, Geithner’s office put hundreds of pages about the fund on the department’s Web site. They did not include documents describing the guaranteed assets.

Members of Congress from both parties have complained about the Bush administration’s lack of disclosure about the spending of the first $350 billion from the fund.

“We have requested information in the past three months and have been rebuffed by the administration,” said Representative Scott Garrett, a New Jersey Republican and member of the House Financial Services Committee. “President Obama comes down the pike now, and maybe, in a week or a month, we’ll know.”

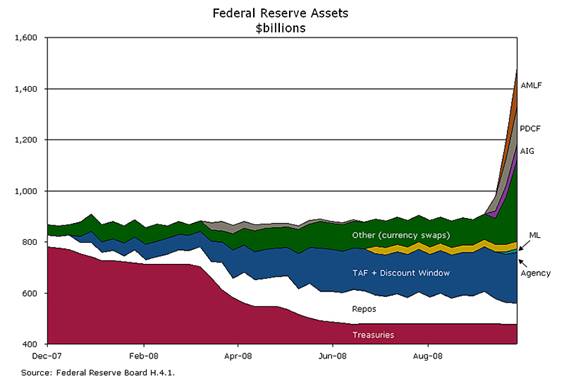

Last fall, the Federal Reserve declined to identify the recipients of about $2 trillion in emergency loans from U.S. taxpayers or the assets the central bank is accepting as collateral.

Fed Is Sued

Bloomberg News asked for details of the lending on May 21 and filed a federal lawsuit against the Fed Nov. 7 seeking to force disclosure. The loans were made under the terms of what became 11 programs in the midst of the biggest financial crisis since the Great Depression. Arguments in the suit may be heard by a judge as soon as next month, according to the court docket.

Bloomberg filed a FOIA request yesterday for the list of what was covered by the Citigroup and Bank of America guarantees. Bloomberg asked for records on the fees paid by banks to the government, which securities were rejected for guarantees, as well as any contracts for data services and experts to assess the value of the securities.

Under the information law, passed by Congress in 1966, Treasury has 20 working days to respond to Bloomberg’s request. The measure allows nine exemptions, such as trade secrets or national security, for blocking disclosure.

During his confirmation, Geithner, the former president of the Federal Reserve Bank of New York, didn’t directly answer a senator’s request for more information about Maiden Lane LLC, a special-purpose entity that holds assets from the takeover of Bear Stearns Cos. by JPMorgan Chase & Co.

$301 Billion Guarantee

Citigroup’s guarantee package, completed Jan. 16, totals $301 billion. It kicks in after the bank goes through its $9.5 billion in current loan loss reserves and the first $29 billion of losses. The government also gets $1 billion of the bank’s benefit from hedging contracts. The Treasury, the Federal Deposit Insurance Corp. and the Fed then assume 90 percent of losses from those assets.

Citigroup’s guarantees include $191 billion of consumer loans, with $55.2 billion of them second mortgages, according to a Jan. 16 news release from the bank. Securities backed by commercial real estate total $12.4 billion and corporate loans add $13.4 billion.

> Unfortunately the US is not alone in this kind of behavior ( see ING Gets Massive Dutch Bailout.... Dumping € 27.7 Billion Alt-A RMBS On The Dutch Taxpayer........ ) On top of this our rumored German version of the Bad Bank is structured in a similar way.......

> Unglücklicherweise macht dieses Beispiel Schule..... ( siehe ING Gets Massive Dutch Bailout.... Dumping € 27.7 Billion Alt-A RMBS On The Dutch Taxpayer........ ) Nach allem was man von Steinbrück hört droht uns in Deutschland eine ähnlich skandalöse Konstruktion......

Citigroup has received $45 billion in cash from selling preferred securities to the government under the Troubled Asset Relief Program.

$118 Billion

Bank of America’s agreement, announced the same day, is similar: $20 billion in cash aid, bringing the total to $45 billion,

and $118 billion in asset guarantees. The government said the assets included securities backed by residential and commercial real estate loans and corporate debt and associated derivatives and hedges

. Scott Silvestri, a spokesman for the Charlotte, North Carolina-based bank, declined comment.

Merrill Lynch & Co., which was bought by Bank of America, was the underwriter for $49.4 billion in defaulted collateralized debt obligations, the most of any bank, since October 2007, according to data compiled by Standard & Poor’s and Bloomberg.

Merrill was the biggest CDO underwriter from 2005 to 2007, with more than $102 billion, said Sanford C. Bernstein & Co. research analyst Brad Hintz.

Since October 2007, Bank of America underwrote under its name $15.1 billion in failed CDOs, according to S&P and Bloomberg. Banks have so far understated losses on such securities, and “the tsunami is on the horizon,” Hintz said.

‘Going to Be Huge’

Past sales of CDOs valued them at pennies on the dollar. In July, New York-based Merrill sold $30.6 billion of the securities to an affiliate of the Dallas-based investment firm Lone Star Funds for $6.7 billion. Merrill provided financing for about 75 percent of the purchase price, and the sale valued the CDOs at 22 cents on the dollar.

“By June, it’ll become clear that these guarantees are being drawn and they’re going to be huge,” said Christopher Whalen, managing director of Institutional Risk Analytics, a financial-services research company in Torrance, California. “Every day that goes by, Congress figures it out just a little more.”

High Dive Into the Toxic Pool WSJ

Goldman Sachs Group estimates that troubled assets could exceed $5 trillion, if defined as assets that could show a loss rate close to, or above, 10%. To put that in context, $5 trillion is just over 40% of the $12.3 trillion in total assets of U.S. commercial banks.

![[Bad Company]](http://s.wsj.net/public/resources/images/MI-AU821_BADHER_NS_20090129190447.gif)

> Some of the estimated loss rates ( Commercial, Alt-A, Second Lien) seems overly "optimistic...... Will be (no) fun to watch how big the haircut will be and what kind of "magic" formula they will use to defend their "value estimate" when the Bad Bank will take over the toxic paper..... Here is another view via Naked Capitalsim Goldman: Bank Rescue May Reach $4 Trillion (and "Bad Bank" Issues)

> Nach allem was ich so mitbekomme sind einige der Annahmen zu den kommenden Verlusten ( gewerbliche Immobilien, Alt-A, Home Equity Loans) reichlich "optimistisch......Wird sicher (k)ein Spaß zu sehen sein zu welchen Werten diese Positionen in die Bad Bank gehen werden und mit welch "magischer" Formel der Wertansatz gerechtfertigt wird..... Eine weitere Meinung kommt von Naked Capitalism Goldman: Bank Rescue May Reach $4 Trillion (and "Bad Bank" Issues)

Option ARMs See Rising Defaults WSJ

Nearly $750 billion of option adjustable-rate mortgages, or option ARMs, were issued from 2004 to 2007, according to Inside Mortgage Finance, an industry publication. Rising delinquencies are creating fresh challenges for companies such as Bank of America Corp., J.P. Morgan Chase & Co. and Wells Fargo & Co. that acquired troubled option-ARM lenders.

..... more than 55% of borrowers with option ARMs owe more than their homes are valued at, according to J.P. Morgan Securities Inc.

As of December, 28% of option ARMs were delinquent or in foreclosure, according to LPS Applied Analytics, a data firm that analyzes mortgage performance. That compares with 23% in September. An additional 7% involve properties that have already been taken back by the lenders. By comparison, 6% of prime loans have problems.

Problems with subprime are still the worst. Just over half of subprime loans were delinquent, in foreclosure, or related to bank-owned properties as of December. The nearly $750 billion of option ARMs issued from 2004 to 2007 compares with roughly $1.9 trillion each of subprime and jumbo mortgages in that period.

Problems with subprime are still the worst. Just over half of subprime loans were delinquent, in foreclosure, or related to bank-owned properties as of December. The nearly $750 billion of option ARMs issued from 2004 to 2007 compares with roughly $1.9 trillion each of subprime and jumbo mortgages in that period.

Nearly 61% of option ARMs originated in 2007 will eventually default, according to a recent analysis by Goldman Sachs

, which assumed a further 10% decline in home prices. That compares with a 63% default rate for subprime loans originated in 2007. Goldman estimates more than half of all option ARMs outstanding will default.

In a recent conference call, Bank of America said it had added $750 million to its impaired portfolio reserves to offset higher-than-expected losses related to its acquisition of Countrywide Financial Corp. The company said the increase "was focused principally in the pay option ARM product." This week, Wells Fargo said $59.8 billion of its "Pick A Payment" option ARM mortgage portfolio was "credit impaired," including $24.3 billion in loans on which the company has taken a credit write-down.

In a recent conference call, Bank of America said it had added $750 million to its impaired portfolio reserves to offset higher-than-expected losses related to its acquisition of Countrywide Financial Corp. The company said the increase "was focused principally in the pay option ARM product." This week, Wells Fargo said $59.8 billion of its "Pick A Payment" option ARM mortgage portfolio was "credit impaired," including $24.3 billion in loans on which the company has taken a credit write-down.

> Mhhhhh, i wonder how much of this paper will end at the Bad Bank......

> Tippe mal das wir einen gewaltigen Teil aus den unten aufgeführten Bilanzpositionen demnächst in der Bad Bank wiederfinden werden.....

Why Meredith Whitney thinks a “bad bank” is a bad idea FT Alphaville

> Here comes a reminder on how "honest" you should take the estimates for taypayer losses when they come from the Fed, Treasury or 90% of politicians......

> Nur zur Erinnerung wie glaubhaft Aussagen zu möglichen Verlusten für den Steuerzahler sind die von Seiten der Notenbänker, Finanzminister oder von 90% der Politiker kommen verweise ich auf das Beispiel Fannie Mae und Freddie Mac......

![[Review & Outlook]](http://s.wsj.net/public/resources/images/OB-DA535_oj_fan_E_20090128184432.jpg)

Fan and Fred's Lunch Tab WSJ

It seems a lifetime ago, but it's only been six months since the Congressional Budget Office put a $25 billion price tag on the legislation to bail out Fannie Mae and Freddie Mac. At the time, then CBO Director Peter Orszag told Congress that there was a "probably better than 50%" chance that the government would never have to spend a dime to shore up the two government-sponsored mortgage giants.

A spokeswoman for Fannie promoter Barney Frank said then, "we especially like that there is less than a 50% chance that it will be used." The CBO had figured that there was a 5% chance that losses would reach the $100 billion cap on the credit line created by the July law. Now CBO's best guess is more than double that.

The bigger picture here is that politicians like Mr. Frank have been telling us for years that Fannie and Freddie's federal subsidy was a free lunch. We are now slowly, and painfully, learning the price of Mr. Frank's famous desire to "roll the dice" with Fan and Fred. Keep that in mind the next time you hear a politician propose a taxpayer guarantee. The only sure thing is that the taxpayers will pay.

A quarter-trillion dollars later, and rising.............

Labels: bad bank, bailout, barney frank, bernanke, creative accounting, fed, geithner, moral hazard, nationalization, Phony Mae and Fraudie Mac, tranparancy

![[wall_street_bonuses.jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiG4nYfusu1mZRMTvjJ39u7M2eSf8HAhNHm1mCEOdoSwOE_tDMaVew2Z4LcqwOn4MVaNvga1R6ZU04kk0FKfxUsJqItblTnDLb8c0eC6co5lmAlQbBhXZVsZslStwFhXSsJsliLiw/s1600/wall_street_bonuses.jpg)

![[Rebound]](http://s.wsj.net/public/resources/images/P1-AS021_PAYcov_NS_20091013190028.gif)

H/T

H/T

An "AAA" rating.....

An "AAA" rating.....

![[comparison2.jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhp2lZ1pU_Ixt5OYPBM6izyW3NIlhQqWVI9gvzOR_jUUOsx-ySlaD7-BzXB39g20tI2yUxSDwzlVfbcc2yh05m5C6aAWz_SwXUpQVZk6p6u-nijXENKFsjmbHN9_-2AR46OEIWU/s1600/comparison2.jpg)

![[Bad Company]](http://s.wsj.net/public/resources/images/MI-AU821_BADHER_NS_20090129190447.gif)

Problems with subprime are still the worst. Just over half of subprime loans were delinquent, in foreclosure, or related to bank-owned properties as of December. The nearly $750 billion of option ARMs issued from 2004 to 2007 compares with roughly $1.9 trillion each of subprime and jumbo mortgages in that period.

Problems with subprime are still the worst. Just over half of subprime loans were delinquent, in foreclosure, or related to bank-owned properties as of December. The nearly $750 billion of option ARMs issued from 2004 to 2007 compares with roughly $1.9 trillion each of subprime and jumbo mortgages in that period.  In a recent conference call, Bank of America said it had added $750 million to its impaired portfolio reserves to offset higher-than-expected losses related to its acquisition of Countrywide Financial Corp. The company said the increase "was focused principally in the pay option ARM product." This week, Wells Fargo said $59.8 billion of its "Pick A Payment" option ARM mortgage portfolio was "credit impaired," including $24.3 billion in loans on which the company has taken a credit write-down.

In a recent conference call, Bank of America said it had added $750 million to its impaired portfolio reserves to offset higher-than-expected losses related to its acquisition of Countrywide Financial Corp. The company said the increase "was focused principally in the pay option ARM product." This week, Wells Fargo said $59.8 billion of its "Pick A Payment" option ARM mortgage portfolio was "credit impaired," including $24.3 billion in loans on which the company has taken a credit write-down.

![[Review & Outlook]](http://s.wsj.net/public/resources/images/OB-DA535_oj_fan_E_20090128184432.jpg)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)