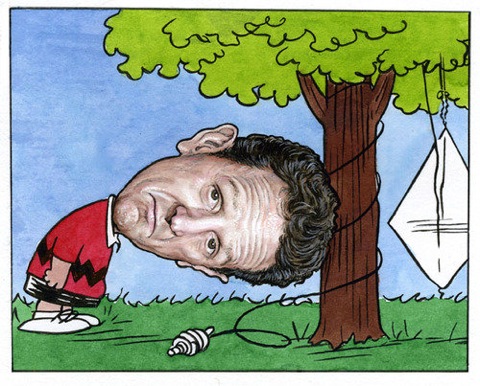

the following story is great.....Clearly a sign of a bubble when the most successful hedge fund manger is unable to collect more than $ 100 million inflows into his funds solely related to GOLD..;-)

Especially when the fundamentals against

GOLD are now dramatically improving even

outside the

"rock solid" US on a daily basis.. Must be the reason why the

"Sovereign Misery Index" is looking just fine.....;-)

Wenn der erfolgreichste Fondsmanager der letzten Jahre es nicht schafft mehr als 100 Mio $ für seinen GOLDFOND einzusammeln muß man klar zum Schluß kommen das sich GOLD in einer Blase befindet...;-) Gilt umso mehr, da die Fundamentaldaten ( u.a. gesunde Banken & Staatsfinanzen.. )die gegen GOLD sprechen ja, wie gerade momentan recht anschaulich selbst in der gängigen Presse präsentiert, tagtäglich nicht nur in den gewohnt ""soliden" USA, sondern besonders für € Anleger besser werden....Ebenfalls wunderbar am "Sovereign Misery Index" zu erkennen....;-) H/T Todd Harrison / Minyanville via

Pragmatic Capitalist  Midas Touch Lost? Paulson Hits Hurdles in Gold Fund

Midas Touch Lost? Paulson Hits Hurdles in Gold Fund WSJ

It took John Paulson months to convince investors that housing would crumble.

Now it's taking him awhile to get them excited about gold, his latest passion

When Mr. Paulson's Paulson & Co. late last year announced it was starting a hedge fund to make a big gold bet, many on Wall Street expected investors to line up. Paulson & Co. scored about $20 billion in profits in 2007 and 2008 wagering against subprime mortgages and financial companies. It then bought financial shares last year to add more gains.

Some gold traders expected Mr. Paulson's new fund, launched Jan. 1, to raise billions of dollars and even help push gold higher when it started buying this year.

That hasn't happened. Despite months of investor meetings, Mr. Paulson has raised $90million or so for his new gold fund, according to people close to the matter. Even the $250 million that Mr. Paulson himself placed in the fund hasn't persuaded many investors to get on board.

Maybe he should do a roadshow among European investors....... ;-)

Empfehle zur Not mal ne Road Show durch Europa........ ;-)

Mr. Paulson has told investors that his gold strategy is a long-term one that will reap rewards over the next few years as the value of leading currencies drop

UPDATE:A STERN REALITY CHECK FOR GOLD NAYSAYERS PC

Furthermore, the US dollar doesn’t have to decline for Gold to do well. Did you know that since the very end of 2004, the US$ is flat but Gold is up 143%? Since July 20, 2007, Gold is up 56% while the dollar is flat. Since early September 2008, Gold is up 35%, while the dollar is up 1%.

CLSA’s Christopher Wood FT Alphaville

A sovereign debt crisis in the West is coming sooner or later though it is probably not right now. This is why the recent correction in gold is an opportunity to buy more bullion and more gold mining shares.

As a German / European investor ( not speculator ) i´ve to repeat myself that it is always important to follow GOLD priced in €..... Unfortunately none of the so called German "business" papers / media takes care of this not insignificant fact.....See this Handelsblatt example in which several German "experts" discussing & charting the recent "correction" in GOLD denominated in $...

Auch auf die Gefahr hin das ich mich wiederhole gerade als Deutscher / Europäischer Investor ( nicht Spekulant ) ist einzig und allein der GOLDpreis in € relevant.... Mit etwas Glück findet man diesen auf den hinteren Seiten im Kleingedruckten der deutschen Fachpresse.....Verweise mal exemplarisch auf Taumelnder Euro zieht Goldpreis mit nach unten vom Handelblatt....

The fundamentals support our view as the financial crisis is entering the most bullish phase for Gold. The sovereign debt crisis, which really began in Iceland, will plague Europe this year and eventually spread to the UK and US by early 2011. Nations have no other choice but to monetize their growing obligations while trying to stimulate their economies with deficit spending and near 0% interest rates. It is a perfect storm for Gold

Chart Net Speculative Gold Long Positions When Gold Was Above $ 1.200

Yesterday / Gestern 222,282 net long gold contracts

To be honest i´m a little surprised that the long positions have only declined 50.000.....Hot money will lead to lots of volatility & great buying opportunities ( wouldn´t rule out something south of $ 1.000 ).... But according to Peter Boockvar this still elevated number means that "net longs in gold and silver both fell to its lowest level since Aug ‘09"

Muß gestehen das ich überrascht bin das die Longpositionen vom Hoch trotz der auf $ Basis heftiger Korrektur nur um 50.000 geschrumpft sind....Dürfte also gewohnt volatil bleiben und hoffentlich die ein oder andere Einstiegsgelegenheit ermöglichen.... Peter Boockvar weist darauf hin das die immer noch hohe Anzahl die Netto long position auf dem niedrigsten Stand seit August 2009 zurückgefallen sind.....

Labels: "Enron-esque characteristics", "quantitive easing", gold, investor sentiment, John Paulson, ponzi, sovereign debt

H/T

H/T

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)