Buyout Firms Punish Bondholders by Gorging on Record Dividends

i would bet that the stress test for lbo deals will come 2007/2008 whne the credit market maybe is drying up.

make sure you also read this piece about the excess in private equity from business week/unbedingt lesen!

http://immobilienblasen.blogspot.com/2006/10/private-equity-excess-business-week.html

http://immobilienblasen.blogspot.com/2006/10/dangerexplosive-loans-another-credit.html

http://tinyurl.com/yzf9mf

Nov. 1 (Bloomberg) -- After Weetabix Ltd., the maker of Britain's best-selling breakfast cereal, fired 7 percent of its workers and canceled the employee bus service to free up cash for debt from a leveraged buyout, the Kettering, England-based company borrowed 130 million pounds ($249 million) so it could enrich owner Lion Capital.

Bondholders worldwide are suffering a double whammy this year because more than 80 companies controlled by LBO firms have borrowed at the expense of workers and debt investors just so they can pay themselves dividends, ( but nobody forcec them to buy these bonds! bad luck of course when the bonds are already qwned when the compony is taken over/ niemand zwingt die investoren die anleiehn zu kaufen. blöd natürluch wenn die bonds bereits vor der übernahme im bestand waren)

``We don't like it,'' said Andrew Wilmont, who helps manage $65 billion of fixed-income assets at Axa Investment Managers in London. ``The more you leverage up the company, the less the company has to fall back on if things turn bad.''

Firms such as New York-based Blackstone Group LP and Kohlberg Kravis Roberts & Co. completed $269 billion of LBOs this year by borrowing at least $166 billion in loans and bonds, ...

Companies owned by the LBO groups sold an additional $30 billion of debt this year for dividends, said S&P. The payments have helped the firms recoup 86 percent of their investments within two years, according to Fitch Ratings.

LBO firms, which typically borrow two-thirds of the money they pay for acquisitions, used to wait three to five years before profiting from selling shares in their companies.

Hertz Bonds

The debt of companies owned by buyout firms has risen to the equivalent to 5.4 times their cash flow, the most ever, S&P says. ...

Payouts to buyout firms were partly to blame for the lagging performance of bonds sold by Hertz Corp., Brake Bros Plc and Impress Holdings BV. Their bonds trailed the 8 percent average return this year for securities with junk ratings, costing holders about $70 million in total,

Hertz pummeled bondholders after the rental-car company said in September 2005 it was being acquired for $15 billion. Its $175 million of 7.625 percent notes due 2012 lost as much as 10 percent of their face value. S&P cut the ratings on the Park Ridge, New Jersey-based company to BB- from BBB-.

`Bad for Credit'

Just six months after the buyout, Hertz used a $1 billion loan to pay a dividend to its new owners,

Hertz's $1.8 billion of 8.875 percent bonds due in 2014 yield 334 basis points more than similar-maturity Treasuries, 5 basis points more than before the dividend.

The price of the bonds has risen 1.9 percent in the past two months. That's less than half the 5.3 percent average increase for debt with BB ratings in the same period, according to Merrill. Investors holding Hertz's $3.3 billion of bonds would have made $60 million more by investing in a Merrill index of similarly rated bonds. ( why not sell this crap!/warum vertickert ihr das nicht)

The company plans to reduce debt and pay its owners another dividend, this time $427 million, when it raises as much as $1.83 billion in an initial public offering, (poor buyers of this ipo!/würde ich nicht zeichnen))

``Any time you replace equity with debt, that's bad for the credit,'' said Steven Bavaria, head of loan and recovery ratings at S&P in New York. ``You're bound to see an increase in the risk of default.''

Rise in Defaults

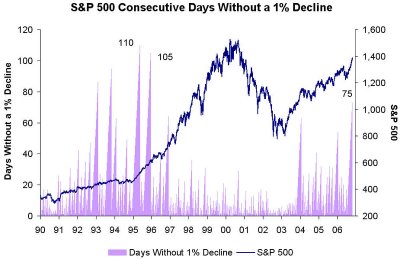

A slower economy may boost yield premiums on companies owned by leveraged buyout firms by more than 2 percentage points, ....

Bondholders typically lose 64 percent of their investment when a company defaults, according to Moody's. More borrowers will struggle with repayments next year, pushing the default rate on junk bonds to 2.8 percent by the end of 2007 from a nine-year low of 1.5 percent now, Moody's said.

``The simple fact is that the more leveraged you are, the more you're going to suffer when the cycle turns,''

Investors haven't turned down the new bonds because they yield as much as 2 percentage points more than debt from companies with similar ratings. (too much liquidity/anlagenotstand)

Higher Yields

Weetabix will pay annual interest of 13 percent for the next decade because of the dividend to Lion Capital. That's almost double the cost on loans it used earlier this year to refinance debt from its 2004 buyout,

``There were people who'd been there for 30 or 40 years,'' Dave Thom, regional organizer of the union that represents production workers at Weetabix, said of the 119 people who lost their jobs. ``They're destroying a community.'' (endgame could be is destroying the company/unternehmen)

When Paris-based cable television company Numericable SA borrowed 500 million euros ($635 million) to pay dividends to London-based buyout firm Cinven Ltd. in July, investors required interest of 9.125 percentage points more than the euro interbank offered rate, a lending benchmark. That was about 2 percentage points above the average for comparable notes,

`Vulnerable to Nonpayment'

Brake Bros, the Ashford, England-based food distributor, sold 275 million pounds of bonds in September to pay a dividend to Clayton Dubilier. The securities yield about 12.95 percent, or 7.75 percentage points more than the London interbank offered rate.

The sale drove up the yield on Brake Bros' existing 105 million euros of 11.5 percent notes due in 2011 to 9.4 percent from 9.2 percent. The securities yield about 2.2 percentage points more than similarly rated bonds, according to Merrill Lynch indexes.

S&P cut Brake Bros' ranking to CCC+. Bonds with that rating are ``vulnerable to nonpayment,

Exit Strategies

``Hedge funds and credit funds like the return and can make a judgment with respect to the company's equity value,'' said Eric Capp, head of European high-yield capital markets at JPMorgan Chase & Co. in London, which arranged the bond sales that paid the dividends by Brake Bros and Impress. ``As long as they're feeling confident the debt will eventually be refinanced with an exit, they're willing to buy it.''

Some firms are choosing dividends instead of selling stock, the traditional exit strategy in an LBO. London-based Doughty Hanson & Co. paid itself almost half the proceeds from a 1 billion-euro bond sale in September by Impress, which makes cans for StarKist tuna and 9-Lives cat food.

The Deventer, Netherlands-based company didn't sell shares because it sees ``considerable further upside,'' said Chief Financial Officer John Geake in an interview. Acquisitions will boost revenue, he said.

Impress's 250 million euros of 9.25 percent notes due 2014 lost 1.5 percent of their face value since the sale. Investors would have gained 1.3 percent in an index of similarly rated debt,

Adding Leverage

The combination of borrowing for dividends and delaying stock sales has triggered five times more downgrades than upgrades, according to Lehman Brothers.

``They're choosing to pay out a dividend, add more leverage and forestall what's typically a good event for bondholders in an IPO,'' said Paul Scanlon, managing director for U.S. high-yield and bank loan assets at Putnam Investments in Boston, which owns Hertz bonds in its $62 billion of funds. ``Any excess cash for paying down debt or reinvesting in the business isn't going to happen.''

Some investors say the LBO firms are getting too greedy.

``There's too much going back to the buyout firms,''

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)