why is this not ongoing business for a reit?

zuerst war als bewertungsgrundlage der innere wert, dann die dividenrendite. jetzt der flow from operations (ex abschreibungen). was kommt als nächstes um den wert zu pumpen ..

das kgv beträgt übrigens 66 (lt. yhoo finance)

| Insider Purchases - Last 6 Months | |||

| Shares | Trans | ||

| Purchases | N/A | 0 | |

| Sales | 709,664 | 11 | |

| Net Shares Purchased (Sold) | (709,664) | 11 | |

| Total Insider Shares Held | 1.86M | N/A | |

| % Net Shares Purchased (Sold) | (27.6%) | N/A | |

more on the reits bubble from mike larson

http://www.moneyandmarkets.com/press.asp?rls_id=433&cat_id=6

Equity Office’s results fall on impairment charges

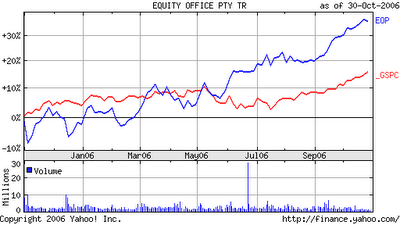

Equity Office Properties Trust Tuesday said third-quarter funds from operations, a key measure of REIT financial performance, swung to a net loss of a penny a share from 50 cents a share in the year-ago quarter.

The office-property owner and operator said quarterly FFO included non-cash impairment and severance charges totaling 54 cents a share. Analysts surveyed by Thomson First Call had forecast, on average, FFO of 51 cents a share. Equity Office said its third-quarter net loss of $139.4 million, or 40 cents a share, was caused by a previously announced impairment charge of $188.9 million taken in anticipation of future asset sales. “We continue to reposition our portfolio to take advantage of the positive momentum in office markets,” said Chief Executive Richard Kincaid in a statement

divyield is close to 3%. riskfree treasuries are 50% higher! that makes sense.......

ha. positive momentum means impairments? / positives momentum bedeutet also abschreibung?

upade conference call:

3.5 b$ assets are on the block for sale and the gain on sale is expectet to be far greater than the bocked impairment (if the markets stay strong..../ 700 mio$ bookgain expectet)

quote ceo " it´s a little crazy out there" deals are in the making that makes no sense.

inflation everywhere: utilities, taxes, construction costs, maintenance cost, labourcosts etc.

if prices hold up maybe more assets up for sale

deleveraging and strong balance sheet are main goal (reason should be clear....)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home