Monopoly money / reits / economist

wann immer ich geschichten wie diese höre wo zu toppreisen ein wert erworben wird wo die zugrundeliegende rendite unter der risikofreier staatsanleihen liegt und winzig und allein die zukünftige positive renditeerwartung das ganze profitabel macht bin ich sicher das die geschichte übel enden wird.

i wonder why they havn´t figuered out this concept...or maybe the have..... :-)

ich wundere mich warum die noch nicht auf diese idee gekommen sind.. oder sind sie..... :-)

http://www.economist.com/finance/displaystory.cfm?story_id=8326784

http://www.economist.com/finance/displaystory.cfm?story_id=8326784The game of commercial-property investment has gone global

THE barbarians are at reception. No longer are private-equity firms attempting merely to turn round ailing industrial giants. This week, the Blackstone Group bid $36 billion, including debt, for Equity Office Properties Trust, America's biggest owner of office buildings. In nominal terms, it was the largest buy-out ever.http://immobilienblasen.blogspot.com/2006/11/reits-going-gaga-blackstone-to-buy.html#links

The deal showed that the commercial-property market remains piping hot, even as housing shivers. According to David Harris of Lehman Brothers, the Blackstone deal is just the latest “privatisation” of the American property market, a trend that has seen 22 companies worth more than $100 billion disappear from public ownership since the start of last year.

Such companies look ideal from the point of view of buy-out groups. Today's property barons can borrow against the value of the assets and use the cashflow from rental income to meet the interest payments. With property values rising fast in some sectors (the American office sector has returned 38% to date this year), they can afford to strike the deals above their stated asset value. (really?, why?, this kind of justification and calculation shows the bubblementality/wirklich ?wieso? diese art der agumentation zeigt klare tendenzen von blasenrethorik)

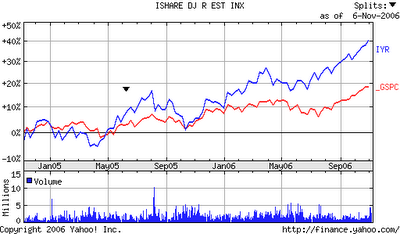

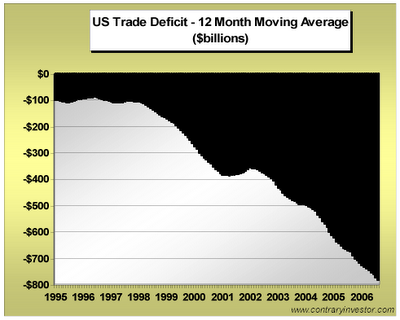

this is a chart of the overall reitindex (not only offices)

This Monopoly-like craze is not confined to America. Just as bonds and shares are freely traded across borders, property is now a global asset too. According to Jones Lang Lasalle, an estate agent, cross-border property investment in the first half of this year hit $290 billion, a 30% increase on the same period in 2005. International deals now comprise 44% of the volume of sales.(read this story from singapore http://immobilienblasen.blogspot.com/2006/11/singapore-singapur-private-equity.html#links )

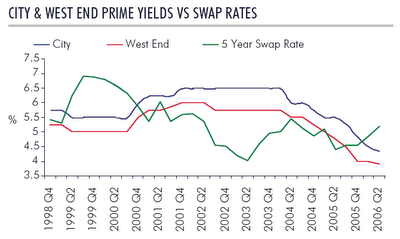

In the process, once-obscure markets have been swept into the mainstream. In 2004-05, the new entrants into the European Union benefited from the “convergence” trend as investors took advantage of high property yields. As yields fell, the same money that chased Warsaw office buildings began looking at Sofia warehouses, betting on Bulgaria's entry into the EU in 2007.

This is really all part of the same “search for yield” that has seen investors pile into other high-income assets, such as corporate bonds and emerging-market debt. Andrew Jackson of Standard Life Investments, a British fund-management company, says office yields in China have fallen from 12-13% a couple of years ago to 8% today. The gap between yields on the highest-quality properties and the second-tier sites has narrowed everywhere. (in china you have a good chance that the rising currency will save or compensate the rentyield/zumindest kann man in china ziemlich sicher sein das die steigende währung die mietrendite aufpeppt)

Property is a hybrid asset. It offers a high yield, giving it bond-like characteristics. But like shares (and unlike bonds), investors can expect that income to grow, at least in line with inflation.

Enthusiasm for the sector waned in the 1980s and 1990s thanks to fat stockmarket returns. Pension funds, however, are now desperate to diversify from shares and bonds, and property is benefiting from the same inflows that are boosting hedge funds and commodities. The catch—and it is a serious one—is the lack of liquidity. It takes time to buy and sell a building, and recruiting and managing tenants involves a lot of hassle.

So the key to the globalisation of the property market has been the growth of the REIT, or real-estate investment trust. These are stockmarket-quoted companies that bundle together portfolios of buildings, allowing investors to buy and sell whenever they wish. REITS have existed in America for decades but in recent years they have spread into new markets, such as Japan and Hong Kong. From January they will be available in Britain.(and also germany, in germany the reits will exclude rentals/auch in deutschland. besonderheit, ausgenommen mietwohnungen)

As the market develops, investing is becoming more sophisticated. A joint venture between GFI Group, a broker, and CB Richard Ellis, an estate agent, has introduced derivatives on property indices in America, Europe and Hong Kong, allowing investors to hedge their portfolios and to bet on falling prices. (derivatives....here we go again, the maybe "false" security against declines..../schon wieder derivate die einem die evtlk. "falsche" sicherheit gegen wertverfall geben....)http://immobilienblasen.blogspot.com/search?q=derivatives

Not that prices are falling at the moment. The National Association of Real Estate Investment Trusts says its All-REITS index has quadrupled since the start of the decade. Of the 15 national markets monitored by IPD, a data provider, 12 achieved double-digit returns last year.

In the process, valuations now look toppy. Yields on the most commonly held American REITS are lower than those on treasury bonds, while prime British properties yield less than gilts. In both cases, enthusiasts say there is no need to worry since rents are set to rise, bringing the prospect of higher yields. (read this twice!!!!/doppelt lesen)

the above cahrt is from am must read about reits from mike larsonhttp://www.moneyandmarkets.com/press.asp?rls_id=433&cat_id=6

the above cahrt is from am must read about reits from mike larsonhttp://www.moneyandmarkets.com/press.asp?rls_id=433&cat_id=6the other chart shows you the situation in london http://immobilienblasen.blogspot.com/search/label/london

Relying on prospective valuations is exactly what stockmarket investors were forced to do in the late 1990s. And it is worth recalling that previous surges of cross-border property investment (Japan in the 1980s, for instance) did not end well. But the peak in commercial property is probably at least a year away—the barbarians still have huge war chests. (i think we saw the in the us with this 36b$ buyout where some smart investors like zell bailed out/ denke in den usa hat der 36b$ buyout den paek markiert. einiger der cleversten investoren wie zell haben abkassiert)

Labels: cartoon, lbo, private equity, reits

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)