Trade Deficit Has Roots Here, Not in China

it sounds to me that the "tough talk" from the us to china in forcing a revaluation in the yuan is only political talk. the us should be glad that the chinese are the main force that the rates in the us are so low(buying all kinds of very low yielding bonds). will be interesting to see how the us will blame china if they stop buying the bonds ......... until that date the us is the main beneficiary.

das ganze gerede von einem stärkeren yuan ist nichts mehr als politicshes kalkül. die schuld für arbeitsplatzverluste wird auf die chinesische wöhrung abgeschoben. so wird von den eigentlichen ursachen abgelenkt. die usa sollen froh sein das die chinesen haufenweise niedrigverzinsliche bonds erwerbenn und so die zinsen niedrig halten. bin gespannt was die usa sagne wenn tatsächlich eines tages die chinesen aufhören die bonds zu kaufen..... bis dahin sind die usa klar der profiteur dieser praktiken.

more on china and trade

das ganze gerede von einem stärkeren yuan ist nichts mehr als politicshes kalkül. die schuld für arbeitsplatzverluste wird auf die chinesische wöhrung abgeschoben. so wird von den eigentlichen ursachen abgelenkt. die usa sollen froh sein das die chinesen haufenweise niedrigverzinsliche bonds erwerbenn und so die zinsen niedrig halten. bin gespannt was die usa sagne wenn tatsächlich eines tages die chinesen aufhören die bonds zu kaufen..... bis dahin sind die usa klar der profiteur dieser praktiken.

more on china and trade

http://immobilienblasen.blogspot.com/2006/08/wie-rational-ist-china-importierte.html#links

......, the nation is consuming far more in goods and services than it produces.

The ideal resolution of this dilemma would be for the demand for U.S. exports to rise gradually while American households increase their savings and cut spending.

Odds don't favor such a neat combination happening. And new legislation penalizing China's trade policy isn't going to help much.

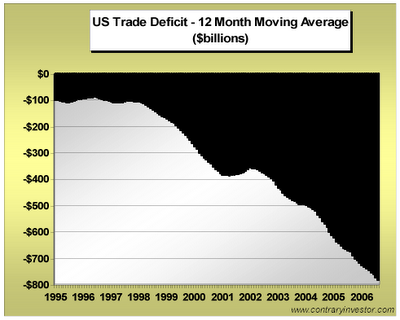

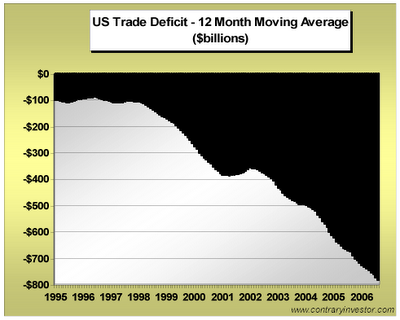

The U.S. trade deficit -- which is likely to approach $800 billion this year -- isn't primarily due to the refusal of China to let the value of its currency, the yuan, rise significantly relative to the dollar. .....

Executives from General Motors Corp., Ford Motor Co. and DaimlerChrysler AG met on Nov. 14 with President George W. Bush to discuss their difficulties and to complain that the Japanese government was artificially depressing the value of the yen.

Most of the attention remains on China, and it's certain there will be attempts by the new Democratic majorities in the House and Senate to press for a faster revaluation of the yuan than the roughly 5 percent that has occurred since the peg to the dollar was loosened in July 2005.

It's not that simple to create more manufacturing jobs in the U.S. Factory employment has been falling for decades, primarily because of rapid growth in productivity in manufacturing, not because of globalization.

The Numbers

Over the past two decades, Bureau of Labor Statistics figures show that manufacturing productivity doubled. As a result of that greater efficiency, U.S. factory output grew by two- thirds while the number of manufacturing jobs declined by almost one-fifth.

This year about $4.5 trillion worth of manufactured goods will be produced in the U.S. Based on trade figures for the first nine months of the year, the U.S. will import about $1.4 trillion worth of goods and export about $775 billion, making a total of $5.1 trillion available for the U.S. economy.

The $625 billion difference in goods imported and exported - - or 12 percent of the $5.1 trillion total -- is a measure of this year's likely net reliance on foreign goods production.

Joint Ventures

Whalley and Xian found that what they call Foreign Invested Enterprises -- usually joint ventures between foreign companies and Chinese companies -- accounted for more than half of Chinese exports and 60 percent of its imports in 2003 and 2004. And even though the FIE's produced more than 20 percent of Chinese GDP -- and accounted for about 40 percent of its growth in those years - - they employed only 3 percent of its workforce.

It doesn't seem likely that revaluation of the yuan in any reasonable measure would disturb this entrenched arrangement.

(Bloomberg) -- The harsh reality of America's trade woes is encompassed by two prominent numbers: September's $64.3 billion trade deficit and October's 4.4 percent unemployment rate.

......, the nation is consuming far more in goods and services than it produces.

The ideal resolution of this dilemma would be for the demand for U.S. exports to rise gradually while American households increase their savings and cut spending.

Odds don't favor such a neat combination happening. And new legislation penalizing China's trade policy isn't going to help much.

The U.S. trade deficit -- which is likely to approach $800 billion this year -- isn't primarily due to the refusal of China to let the value of its currency, the yuan, rise significantly relative to the dollar. .....

Spotlight on China

In general, the Democrats have blamed China and its pegged currency for much of the loss of manufacturing jobs, .....

In general, the Democrats have blamed China and its pegged currency for much of the loss of manufacturing jobs, .....

Executives from General Motors Corp., Ford Motor Co. and DaimlerChrysler AG met on Nov. 14 with President George W. Bush to discuss their difficulties and to complain that the Japanese government was artificially depressing the value of the yen.

Most of the attention remains on China, and it's certain there will be attempts by the new Democratic majorities in the House and Senate to press for a faster revaluation of the yuan than the roughly 5 percent that has occurred since the peg to the dollar was loosened in July 2005.

It's not that simple to create more manufacturing jobs in the U.S. Factory employment has been falling for decades, primarily because of rapid growth in productivity in manufacturing, not because of globalization.

The Numbers

Over the past two decades, Bureau of Labor Statistics figures show that manufacturing productivity doubled. As a result of that greater efficiency, U.S. factory output grew by two- thirds while the number of manufacturing jobs declined by almost one-fifth.

This year about $4.5 trillion worth of manufactured goods will be produced in the U.S. Based on trade figures for the first nine months of the year, the U.S. will import about $1.4 trillion worth of goods and export about $775 billion, making a total of $5.1 trillion available for the U.S. economy.

The $625 billion difference in goods imported and exported - - or 12 percent of the $5.1 trillion total -- is a measure of this year's likely net reliance on foreign goods production.

In other words, even with a trade deficit approaching 7 percent of gross domestic product, the U.S. reliance on imported goods isn't nearly large enough to account for the long-term decline in manufacturing employment. Instead, the culprits are the big gains in factory efficiency and the major shift in consumption toward services and away from goods.

Jobs Decline

Since there is no reason to expect those trends to change, there is no reason to expect the number of factory jobs to stop declining.

Since there is no reason to expect those trends to change, there is no reason to expect the number of factory jobs to stop declining.

.....Making the yuan more expensive in dollar terms would only affect the cost of the value added to a manufactured product in China. In many instances, Chinese exports include a substantial share of value produced in other countries in the form of components which are imported into China, assembled and then exported. In that case, the only value added is the assembly.

Only if the country exporting the components also revalued its currency relative to the dollar, would the U.S. buyer's cost rise noticeably. Even that assumes that someone in the production chain does not accept a lower profit margin to keep the dollar price unchanged.

Joint Ventures

Whalley and Xian found that what they call Foreign Invested Enterprises -- usually joint ventures between foreign companies and Chinese companies -- accounted for more than half of Chinese exports and 60 percent of its imports in 2003 and 2004. And even though the FIE's produced more than 20 percent of Chinese GDP -- and accounted for about 40 percent of its growth in those years - - they employed only 3 percent of its workforce.

FIE's production is geared to exports with the foreign partners providing ``both distribution systems abroad and product design for export markets,'' they say.

It doesn't seem likely that revaluation of the yuan in any reasonable measure would disturb this entrenched arrangement.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home