BoJ chief has yen-carry 'concern' / mother of all carry trades

he should be very concerned. this trade is one of the greatest sources of liquidity around the world. with interest rates in japan close to zero and the opportunity to invest the "free money" in higher yielding assets.

the only wild card is the exchange rate that fluctuates and can eliminate the investment gains quickly. it will be key to this "mother of all cary trades" what the yen is doing. watch the yen! same thing in a smaller scale is also happening with the swiss franc.

er sollte auch beunruhigt sein. dieser trade ist eine der größten liquiditätsquellen weltweit. mit zinssätzen nahe null und der möglichkeit free money in höherverzinsliche anlagen zu schichten auch kein wunder. wäre da nicht die währungskomponente. jede aufwärtsbewegung des yen kann die kalkulation makulatur werden lassen. der yen is also der schlüssel für die "mutter aller carrytrades". achtet also auf den yen. das gleiche passiert im kleinen rahmen aktuell gerade mit dem schweizer franken.

Bank of Japan Governor Toshihiko Fukui said the central bank is concerned about the risk of a rapid unwinding of the yen-carry trade and its potential impact on asset markets.

"There's a big risk that if there's a sharp shift in the outlook of interest rates, that could spark a rapid unwinding (of those trades) and bring on various distortions," Dow Jones Newswires reported Fukui as saying in parliamentary testimony

Fukui added the central bank was trying to communicate with the market on monetary policy to ensure if an unwinding of the trade were to take place, it would "proceed smoothly", but he added the process would be difficult. Fukui also said the amount of yen-carry positions seemed to be increasing.

more on the carry trade

dank geht hier an Greg Silberman CA(SA), CFA (Retired) http://tinyurl.com/uhjpl (more charts)

chart us$/yen (from june but yen is still at the key level)

The Yen has formed a massive right angle triangle formation. Over an 8 year period the floor on the Yen has steadily risen and now stands at 85. The ceiling has remained around 100.

The yen carry trade is a popular strategy used by speculators who take advantage of Japan's low interest rate to invest in higher-yielding investments outside the country.

A trader / institution borrows money in Japan at Unbelievably Low interest rates (I believe the term Free Money has been used).

Those newly borrowed Yen Notes and are then used to buy Something. Anything. Anything at all that will yield something higher than the ridiculous Borrowing Rate of 0 to 1%.

Banks are borrowing and buying Bonds, Real estate, Stocks, Emerging Markets, Commodities etc. etc. When assets are bought outside Japan the hurdle rate is slightly higher. You need to cover the ridiculous interest payment + the move in the Yen exchange rate.

Get this. For $200 margin deposit, you can SELL ¥1Million for USD$8,900 at the prevailing exchange rate. The interest rate differential between the Yen and the USD is such that everyday you earn US$1.37 in interest

What you're really doing is borrowing Yen and investing it into an overnight US Dollar deposit at the prevailing exchange rate. It so happens that the difference between what you pay on the loan and what you earn on the deposit is $1.37 in YOUR FAVOR.

Sounds crazy?

It's exactly what the Banks are doing. But they ain't making $1.37 per day!

dank geht an russ winter http://wallstreetexaminer.com/blogs/winter/ und http://www.minyanville.com/

i urge everybody to read this piece in full length and see the carts!!!!!!! unbedingt in gnazer länge lesen und sich vor allem die charts ansehen!!!!!!!!!! http://www.minyanville.com/articles/index.php?a=11492

....In May, leverage was the culprit. Rumblings from the Bank of Japan that it was ready to end its Quantitative Easing campaign and, in time, move to tighten, were sufficient to shake specs from their carry-trade roosts. With their cheap yen financing now threatened, they rushed to unwind their various positions, sucking money from all corners of the globe

If these trader commitments are any indication, the yen-carry trade is now more than twice as large as it was in May! Thus any modest shift in the fundamentals underlying the dollar/yen could cause a Liquidity Event that makes May’s dyspepsia seem like a muffled burp

chart aktien indien, brasilien, taiwan und deutschland/germany (watch may/june)

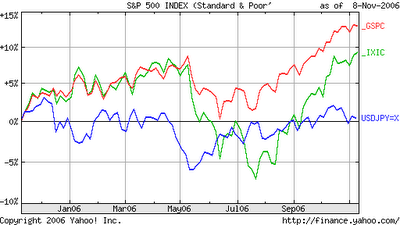

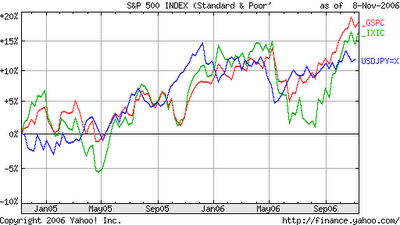

chart nasdag, sp500 plus $/yen

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home