singapore / singapur private equity outbidding reits

private equity über alles. das ist zumindest der eindruck den man bekommen kann wenn man sich geschichten wie diese durchliest. schon erstaunlich das spezalisierte reits in bietergefechten keine chance gegen pe haben. das wird sich wohl auch nicht ändern solange die sich immer höher verschulden können und zudem noch niedrige risikoaufschläge zahlen müssen. auf jeden fall gießt das ganze mehr öl ins feuer. immerhin investieren die in asien und nicht in den usa.......

mehr zu private equity und singapur/singapore

http://immobilienblasen.blogspot.com/2006/10/private-equity-excess-business-week.html

http://immobilienblasen.blogspot.com/2006/11/morgan-stanley-seeks-8-billion-for.html

http://immobilienblasen.blogspot.com/2006/09/singapore-bubble-world-tour.html

Soaring Asia Rents Pit CLSA, Goldman Against Cash-Starved REITs http://tinyurl.com/y2kmap

Nov. 7 (Bloomberg) -- CLSA Capital Partners tapped its deep pockets to outbid real estate investments trusts for Singapore Airlines Ltd.'s former headquarters in June, and now it's payback time.

``Rents which we thought we would get in two years we're getting now,'' director of the asset-management arm of CLSA, Credit Agricole SA's Asian brokerage.

Pattar expects rental income to rise 15 percent in the coming year after gains of as much as 30 percent since August, ....

Private equity units of banks including CLSA, Goldman Sachs Group Inc. and Morgan Stanley, lured by returns as much as double those in the U.S. and Europe, are outbidding real estate investment trusts for Asian commercial property.

The publicly traded REITs, as the trusts are called, are losing out on prime sites because they have stricter regulations on investment and less access to funds. Private equity funds, by contrast, can freely deploy any capital they borrow.

``There are large amounts of capital now chasing increasingly limited investment-grade real-estate opportunities in Asia,'' said Michael Smith, head of Asian real-estate investment banking at Goldman Sachs in Singapore. ``The real competitive threat for REITs are the dedicated private-equity real estate funds, which continue to grow at a rapid pace.'' (until they music stopps/bis die musik nicht mehr spielt...)

Doubling Up

Funds raised for commercial property deals in Asia have doubled in each of the past five years, reaching $28 billion in 2005, according to CLSA. The market value of REITs in Asia, excluding Australia, has risen to $55 billion since the first was launched in Japan in 2001. There are now 89 publicly traded REITs in Asia, ex-Australia,

REITs such as Singapore-based Suntec REIT and Champion Real Estate Investment Fund, Hong Kong's first prime office property trust, pay dividends to shareholders from rental income they earn buying and managing properties. Private-equity property funds are not obliged to disclose the value of their investments.

...Office rents in Singapore rose 46 percent in the three months to Sept. 30, their highest quarter-on-quarter increase in more than a decade, as banks such as UBS AG and Deutsche Bank AG took over space. High-end rents rose 13 percent, according to Jones Lang LaSalle. In Hong Kong, top office rents rose 39 percent in August from a year earlier,(wow!!!!!!!!)

Rents in the region are set to jump 8.7 percent over the next five years, compared with 3.3 percent in the U.S. and 3.7 percent in Europe, ..

Coming to Asia

Yields of 8 percent from Japanese real estate and as high as 14 percent for Chinese retail property contrast with the 4 percent to 5 percent that private equity firms get in the U.S. and Europe, said John Saunders, CLSA Ltd.'s Hong Kong-based head of regional property research.

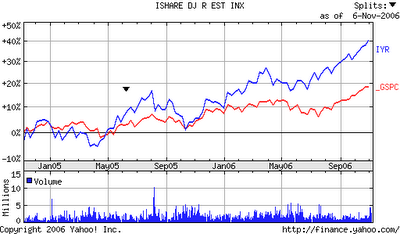

how desperate the valuationsituation is for the reits in the usa shows this must read! analysis from mike larson http://www.moneyandmarkets.com/press.asp?rls_id=433&cat_id=6 !!!!!

``People are looking to shift fund flows relatively towards Asia,'' Saunders said. ``It has profound impact in markets where there's a lot of this money chasing the same assets.''

In Singapore, the region's second-biggest market for REITs after Japan, investments by private real-estate funds accounted for seven of the 19 office blocks, worth S$6.7 billion, sold since September 2005. REITs bought six. ....

Not Aggressive

REITs ``were not the most aggressive,'' nor among the top bidders for Singapore Airlines' SIA Building, said Jeremy Lake, who manages the investment sales team in the city-state at CB Richard Ellis, which arranged the tender. Asia's biggest carrier by market capitalization had a net book value on the building of S$118.8 million, about a third of the sale price. (200% over bookvalue! even if the book value maybe understating the value but this hsows you just how desperate the buyers are/selbst wenn der buchwert niedrig angesetzt sein mag, 200% über dem buchwert ist doch ein klares zeichen wie das ganze etwas aus dem lot geraten ist)

CLSA Capital Partners has equity of $430 million and can borrow three times that to fund purchases, said Pattar. Asian REITs are restricted by borrowing rules and the time it takes to get shareholder approval to raise funds. Singapore's central bank last year raised the borrowing limit for REITS with a credit rating of A or higher to 60 percent of assets, from 35 percent, to help them expand. (yeah, more leverage !!!! to fuelk the fire/klaro, mehr hebel um das feuer weiter anzufachen)

Private-equity investors can afford to put in higher bids in auctions because they ``get in at the right time of the cycle and then take profit when capital values go up,'' said David Tan, chief executive officer of CapitaCommercial Trust Management Ltd. .....(??????????? read this statement twice!. he assumes that private equity will always buy low and sell high. with this calculation you can really justify every price..../lest euch das bitte zweimal durch. der typ unterstellt das private equity immer tief kauft und hoch verkauft. so läßt sich selbstverständlich jeder preis rechtfertigen.)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

1 Comments:

I love your awesome post and love to read everyone's comment. Those are useful. Thank you for information. I hope who like travel this topic, will help them. you can putting on making your site such an travel related information so that traveler can find there write way like me http://goo.gl/V1XiGb.

Post a Comment

<< Home