Don´t Call It A Bubble........

Nachdem ja vor kurzem die "Pay-If-You-Can-Loans" ins Leben gerufen worden sind ist die noch vor wenigen Monaten undenkbare Wiederaufersteheung der Toggle/PIK Bonds ein weiteres Anzeichen, das nennen wir es mal vorsichtig, eine leichte "Überhitzung" eingetreten ist.... Leider sieht es in etlichen Aktienmärkten nicht bedeutend anders aus ( siehe nachfolgden Chart Mexican Stock Market Back To All Time Highs WOW! )

Treasurers Embrace Pay-in-Kind Bonds as Ghost of Lehman Fading

Treasurers Embrace Pay-in-Kind Bonds as Ghost of Lehman Fading ( Bloomberg ) Companies are selling debt with terms last seen before credit markets froze, showing why the world’s biggest bond fund manager says another bubble may be brewing.

Two years after credit markets seized up, treasurers are luring investors to junk bonds that returned a record 58 percent last year, as measured by Bank of America Merrill Lynch indexes. U.S. sales of $162 billion beat the all-time high of $149 billion in 2006, Bloomberg data show.JohnsonDiversey Holdings Inc., a Sturtevant, Wisconsin, maker of cleaning supplies, and Wind Acquisition Holdings Finance SpA, parent of Italy’s third-largest mobile-phone company, sold bonds that can pay interest in new debt instead of cash, the first such deals since 2007, according to Bloomberg data.

Goodman Global Inc. raised $320 million to pay its owner, leveraged buyout firm Hellman & Friedman, a dividend, one of at least seven similar offerings since November

“Six months ago I wouldn’t have imagined being able to do this deal,” said Karim-Michel Nasr, head of corporate development in Paris at Weather Investments SpA, Wind’s holding company.....Capital Access

At least two dozen borrowers since November have asked lenders to change terms of debt agreements to permit bond sales, extend loan maturities or pay dividends to their owners, Bloomberg data show.Access to capital means defaults will likely drop to 3.9 percent by November from 12.7 percent a year earlier, New York-based Moody’s Investors Service says.

Speculation that companies will have less difficulty making payments has led investors to accept lower interest rates and looser borrowing terms. The extra yield demanded on junk bonds instead of Treasuries narrowed to 6.39 percentage points at the end of 2009 from almost 19 percentage points on March 9, Merrill Lynch indexes show. Speculative grade debt is rated below Baa3 by Moody’s and BBB- by Standard & Poor’s.

‘We Forget’

“I’m looking at some of the things that are being priced and I’m saying, ‘Wow, how quickly we forget,’” said JohnsonDiversey Chief Financial Officer Joseph Smorada. The market is “starting to get a little dangerously aggressive,” he said.The first pay-in-kind bonds since 2007 were part of a $2.6 billion recapitalization in which New York-based LBO firm Clayton Dubilier & Rice Inc. agreed to buy a 46 percent equity interest in the company.

The company sold $250 million of so-called toggle debt due in May 2020 on Nov. 20 that allows it to pay a 10.5 percent interest rate either in cash or notes for the first five years.

Moody’s gave the notes its fifth-lowest ranking of Caa1, saying the debt is five times more than adjusted earnings before interest, taxes and amortization costs. It has had negative free cash flow the past three years, though it’s expected to break even in 2010, Moody’s said.‘Dangerously Aggressive’

“In early 2009, I don’t think we could have borrowed a nickel if our life depended on it,” Smorada said. Investors submitted bids for almost four times the amount of notes offered, he said.Investors haven’t lost discipline and companies are mainly selling bonds to refinance or cut interest expenses, said William Cunningham, the head of credit strategy and fixed-income research at State Street Corp.’s investment unit in Boston.

Wind Acquisition of Luxembourg raised $1.1 billion last month selling 7.5-year, 12.25 percent notes in dollars and euros that allow it to pay interest with more debt until 2014. Wind, controlled by Egyptian billionaire Naguib Sawiris and the parent of Wind Telecomunicazioni SpA, boosted the offering 50 percent as demand rose.The investment flood has undercut efforts to toughen restrictions that protect investors, said Alexander Dill, senior covenant officer at Moody’s in New York. Many covenants are “largely replicating” rules from 2006 and 2007, Dill said in a Dec. 10 report.

TRW Automotive Inc., the world’s biggest supplier of vehicle-safety equipment, sold $250 million of eight-year notes in November rated Caa1 with covenants “substantially unchanged” from its 2007 indenture for debt graded four steps higher at Ba3, according to the Moody’s report. The Livonia, Michigan-based company said Dec. 22 it raised $400 million in term loans as lenders amended and extended its revolving credit facility.FT Alphaville

Global high yield debt volume for the week of January 11th totaled $11.7 billion, the biggest week for high yield debt on record. The previous record was set during the week of November 5, 2006 when $11.4 billion was raised. With $14.4 billion raised so far this month, it is the best all-time start for the high yield markets since records began in 1980.Update High Yield Bonds Continue To Do Well Bespoke

Over the past month or so, the only area of the bond market that has done well is junk. Both Treasuries and investment grade corporates have struggled, while high yield bonds have continued to surge. Below we highlight a six-month performance chart of the high yield bond ETF (HYG) and the investment grade corporate bond ETF (LQD).

Mortgage-Bond Leverage Reaches 10-to-1

Wall Street firms are loosening terms of their lending to mortgage-bond investors as markets heal, an RBS Securities Inc. executive said.

Repurchase agreement, or repo, lending against the debt has expanded so much since freezing in late 2008 that some banks now offer as much as 10-to-1 leverage and terms as long as one year on certain securities backed by prime jumbo-home loans

Update

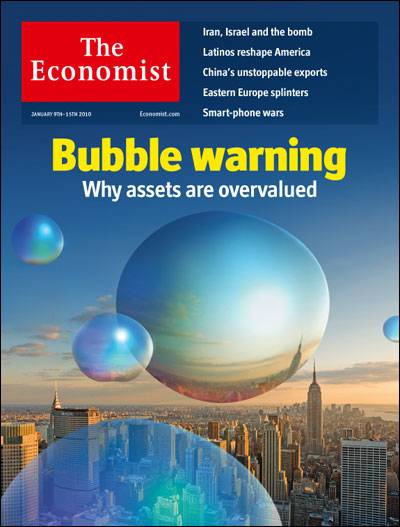

Once again, cheap money is driving up asset prices ( Economist )

Ladies and Gentlemen, We Are Trading On The Moon :-) Reformed Broker

Labels: "echo bubble", "quantitive easing", central banks, investor sentiment, junk, risk taking, spreads, toggle bonds, ZIRP

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

8 Comments:

The mess that Bernanke is making worse Tim

Over the past month or so, the only area of the bond market that has done well is junk.

That is obvious - while the FED is buying up everything else to keep interest rates low, the only place to invest the TARP money will be in junk'ier and junk'ier bonds.

Moin Frithiof,

i really have to admit that i have ruled out that just 9-12 month after the first credit bubble popped the PIK/TOGGLE would stage a comeback....

Congratulations ( no sarcasm ) to the issuers!

I think their window of opportunity will be short lived.....

But with Bernanke preparing for QE Version 2.0 & 3.0 the window might be open for a few quarters longer....

Is Ben Bernanke descended from the Bourbons?

John Cassidy

Behind his white beard, Federal Reserve chairman Ben Bernanke has a wry sense of humour. On reading his recent speech to the American Economic Association, in which he defended the Fed’s actions during the housing bubble, I initially suspected it was a practical joke. Rather than conceding that he and his predecessor, Alan Greenspan, made a hash of things between 2002 and 2006, keeping interest rates too low for too long, he said the Fed’s policies were reasonable and the main cause of the rise in house prices was not cheap money but lax supervision.

The individual elements of his presentation were questionable enough – is it really plausible to suggest that record low mortgage rates did not contribute much to the rise in US house prices? – but most disturbing was its failure to address the larger picture: from the mid-1990s, the Fed adopted a stance that encouraged irresponsible risk-taking. In periods of growth, it raised interest rates slowly, if at all, stubbornly refusing to acknowledge the course of asset prices. But when a recession or financial blow-up beckoned, it slashed rates and acted as a lender of last resort.

On Wall Street, this asymmetric approach came to be known as “the Greenspan put”. It gave financial institutions the confidence to raise their speculative bets, using borrowed cash to do it

And You Thought The Rally in Equities Was Impressive Chart Bespoke

Will investors bond with Vietnam? WSJ

Vietnam suffers from rising inflation, fiscal and current-account deficits and shrinking foreign-exchange reserves. Less than two months ago, it devalued its currency.

Nevertheless, it is counting on strong demand when it taps the global bond market for $1 billion later this month

An audacious effort that will end badly? Not if you view Vietnam the way some global investors seem willing to: as the worst house on the best block in town. Even if its neighbors—flush with foreign exchange, and better able to repay foreign debt thanks to strengthening currencies—offer sounder investments, global bond funds are overloaded with cash and seeking yield. Vietnam will give them that.

Virgin’s triple play FT Alphaville

Virgin Media [VMED] Co priced its new senior secured notes, which was massively upsized to £1.5bn equivalent from £500mm (quite the triple play offering).

HCA Owners' Big Payout: $1.75 Billion WSJ

HCA Inc., the nation's largest hospital operator, will pay its private-equity owners a $1.75 billion dividend, believed to be among the biggest ever, after reporting stellar 2009 financial results.

HCA's large dividend payment brings to mind the financial maneuvers made by private-equity firms during the go-go years. Buyout shops made a chunk of their profits through these "dividend recapitalizations," taking big cash payments out of companies they owned by paying themselves a dividend. These payments totaled $56 billion in 2006 and 2007 combined, according to Standard & Poor's.

The dividend payment will return roughly one-third of the owners' original investment in the company. HCA's owners already have a large paper profit; as of Sept. 30, KKR valued its HCA stake at 70% higher than what it paid. Several analysts expect to see an initial public offering from HCA within the next several months as the outcome of health-care overhaul becomes clearer.

Post a Comment

<< Home