kanam,mills,xanadu meadowlands trouble continues/ärger geht weiter

das kanam in der letzten veröffentlichung bei der faktenlage noch immer für 2006 7,5% an ausschüttungen errechnet und insgesamt seit auflegung 2004/2005 18% errechnet erscheint mit als vorsichtig formuliert nicht gerade "konservativ"......... (fonds xxii im pdf)

http://www.kanam.de/kanam_dt/servicecenter/downloads/02a_kanam_lb_usa_nov_2006.pdf

the whole complex looks more and more like a neverending story. it should be clear that the longer the solution takes and the us economy is further slowing down in the meantime the worse the losses for the investors should be.

kanam calculates in november 2006 still with a yield of 7.5% and since the the placement in 2004/2005 with 18%. mhhhhhh?!

http://www.kanam.de/kanam_dt/servicecenter/downloads/02a_kanam_lb_usa_nov_2006.pdf

mehr zu mills/kanam/xanadu

http://immobilienblasen.blogspot.com/2006/08/wall-street-journal-zu-mills-kanam.html

http://immobilienblasen.blogspot.com/2006/08/update-kanam-mills-xanadoubts_12.html

http://immobilienblasen.blogspot.com/2006/08/update-mills-kanam-xanadu.html

http://immobilienblasen.blogspot.com/2006/08/xanadu-wo-bleiben-die-mieter.html

New Jersey's Meadowlands Financing Gap Lands Project in Limbo http://tinyurl.com/ybl69x

Nov. 2 (Bloomberg) -- Transforming parking lots and wetlands into an engine of regional economic growth is proving more difficult than New Jersey officials foresaw.

Two years ago, offices, shops, a hotel, a 30-story Ferris wheel and the first indoor ski slope in the U.S. were envisioned for a state-owned tract in the Meadowlands, in New Jersey's northeastern corner. Then-Governor James McGreevey forecast 21,155 construction jobs over six years and almost 20,000 permanent jobs by 2012.

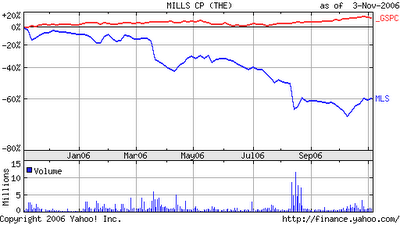

So far, developer Mills Corp. has built just one parking garage for the $2 billion project called Meadowlands Xanadu. Mills is running short of funds, its accounting is under investigation, the company is up for sale, its chief executive officer quit and its stock price plunged. Talks with a possible financial savior missed two deadlines.

....The Meadowlands is one of the largest contiguous blocks of open space in the New York metropolitan area, .....

Revenue Forecast

When it signed a 75-year lease for the property 5 miles (8 kilometers) west of Manhattan, Mills said the project would generate $133 million annually in state and local revenue.

Corzine, a former CEO of Goldman, Sachs & Co. who became governor in January, said during his election campaign that he would use his Wall Street experience to fix the state's finances and expand its economy. In March, Corzine and former Goldman colleagues in his administration brokered a revised agreement with the National Football League's Giants and Jets on their plans to build a new stadium on Meadowlands property.

Mills stock plunged 77 percent in August, after it said restating earnings would cut net income by $210 million and the cost of Xanadu had surged to $2 billion from $1.3 billion, beyond Mills's ability to finance. http://immobilienblasen.blogspot.com/2006/08/mills-corp-mls-kanam-und-scope.html#links

Corzine said then that he was ``deeply troubled'' and would evaluate the state's deal with Chevy Chase, Maryland-based Mills.

On Aug. 22, Los Angeles-based Colony Capital Acquisitions LLC said it would pump $500 million into Xanadu and arrange for construction loans for the balance, ending Mills's financial participation. ......

Missing Deadlines

Investors boosted Mills's stock price 15 percent in one day. Corzine warned that Colony's offer was non-binding and filled with contingencies, making it ``a start, not a finish.''

Since then, talks between Mills and Colony have dragged on past two self-imposed deadlines; the last was Sept. 27. Three retail tenants have signed on, while others have backed out, including Balducci's, a gourmet supermarket chain, and House of Blues Entertainment Inc., which planned a 1,500-seat theater.

``Everybody's a little alarmed,'' said state Senator Paul Sarlo, whose district includes the Meadowlands. ``Everyone's sitting and waiting.''

Mills has spent $485 million on Meadowlands Xanadu, according to company filings. It has received help from Munich- based KanAm USA Management XXII LP, which invested $342 million, and Mack-Cali Realty Corp., a Cranford, New Jersey-based office landlord, which chipped in $32.5 million.

Caroline Luz, a spokeswoman for Colony, declined to comment. A KanAm spokesman didn't return calls.

New CEO

``We're working incredibly hard to get it done,'' Mark Ordan, the new chief executive officer of Mills, said in an interview. Ordan, 47, took over on Oct. 1. .....

.... The Meadowlands complex would be 4.8 million square feet.

Repaying Goldman

Mills last month sold its interests in the Spain and Canada projects, as well as a mall in Scotland, for $988 million to help pay down a $1.91 billion loan from Goldman, a financial adviser and lender. http://immobilienblasen.blogspot.com/2006/08/fire-sale-notverkauf-bei-mills.html

Israeli real-estate developer Gazit-Globe Ltd. bought a 9 percent stake in Mills for $110 million last week and proposed investing as much as $1.2 billion of new equity. .....

``It would be disastrous'' if the Colony talks broke down, Codey said. ``When they announced this deal, there were more contingencies than Heinz has pickles. But they said they'd sign all the papers within a month.

``It's been, what? Two months? I guess the check is in the mail,'' he said.

fortsetzung folgt/to be continued.......

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home