No free lunch!: Home Is Not a Piggy Bank !!

please read this carefully and ask yourself what is the endgame when this "free money" or better creditsource disappears?

dank/thanks http://housingdoom.com/ und die nyt

http://tinyurl.com/vh4yr

Economists are fond of pointing out that “there ain’t no such thing as a free lunch.” But for several years, as interest rates have fallen, homeowners have gotten something pretty close to it.

Since January 1999, according to figures compiled by Alan Greenspan, the former Federal Reserve chairman, ...... more than $2.62 trillion has been extracted by homeowners through refinancing and home equity loans

größer/bigger http://graphics8.nytimes.com/images/2006/11/04/business/1104-web-MONEY.gif

UPDATE

calculatet risk does also a calculation on mew and he calculates that the 2006 figures are only 156 b$. the other years seems to be close to his figures.

http://calculatedrisk.blogspot.com/2006/11/ny-times-incorrect-chart-on-mew.html

calculatet risk is correct!

But as rates have gone up, the extraction has continued. In the first six months of this year, even with interest rates rising, more than $511 billion was extracted from homes through cash-out refinancing and home equity loans, and that was more than the amount taken out for all of 2005, a record year for mortgage equity extraction.

More homeowners did cash-out refinancings in the third quarter of this year than at any time since 1990

Economists argue over what effect that money, which they call mortgage equity withdrawal, has had on consumer spending. Homeowners cash out to pay off more expensive credit card debt, remodel the house to build more equity, or just have fun. They may very well have used it to buy another house or not spent it at all, but added it to savings...... ( how can you go into debt and save?/wie kann man schulden machen und gleichzeitiug sparen...?)

The Joint Center for Housing Studies at Havard found that over the last 12 months homeowners have spent only 1.6 percent more on remodeling projects than they did in the preceding 12 months. That rate was running at close to 20 percent throughout 2005 and the first four months of 2006.

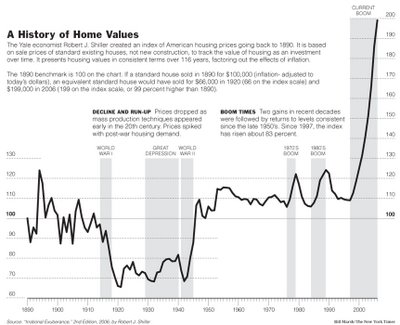

The best thing to do in most cases is to leave the equity alone. No one expects home prices to appreciate sharply. A cautious consensus among economists is developing that prices will decline in some areas, but that the depreciation will not be sharp or prolonged (ha what are they smoking?, that makes sence when you look at the cart/ ha, was rauchen die ? bei dem nicht vorhandenem runup kein starker rückgang....)

größer/bigger http://graphics8.nytimes.com/images/2006/08/26/weekinreview/27leon_graph2.large.gif

There is another change in the market that could block a homeowner’s desire to borrow against the increased value of the home. “Lenders are being very cautious today as they do appraisals,” said Patty McGill, president of Money Marketing, a mortgage broker in Frederick, Md. “They are scrutinizing appraisals so they are not lending on phantom equity.” .....( i like the "phantom equity!)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home