bank at risks / construction and development (C&D) loans

it will be interesting to see how the credit quality will perform in the next downturn. my opinion should be clear to the readers of this blog.......

mehr/more c&d loans

http://immobilienblasen.blogspot.com/2006/08/big-bank-home-construction-conondrum.html

dank geht an calclatet rsik http://calculatedrisk.blogspot.com/

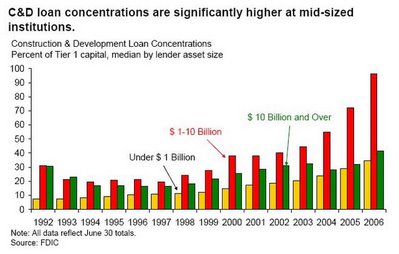

Small and mid-size institutions have been increasing their concentrations in riskier assets, such as CRE loans and construction and development (C&D) loans. This suggests that, although small and mid-size institutions have been more successful in limiting the erosion of their nominal NIMs (net interest margin), they have achieved this success in part by assuming higher levels of credit risk.

... continued increases in concentrations and reports of loosened underwriting standards at FDIC-insured institutions signal the potential for future credit quality deterioration. In addition, regulators have noted increasing C&D and overall CRE loanconcentrations, especially at institutions with total assets between $1 billion and $10 billion. Four of six Regional Risk Committees expressed some level of concern about CRE lending, in part due to continuing increases in concentrations.

größer/bigger http://photos1.blogger.com/hello/243/2888/640/FDIC4nov06.jpg

größer/bigger http://photos1.blogger.com/hello/243/2888/640/FDIC4nov06.jpg

make sure you read the rest of the story about margins etc with great charts!!!!! http://calculatedrisk.blogspot.com/2006/11/fdic-economic-conditions-and-emerging.html

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home