geplatze mbs / buyback mbs

mann oh mann. die meldungen schlagen in immer kürzeren abständen ein. dazu auch

heute gibt ne kleine bank die netbank (ntbk) zahlen bekannt.

NetBank, Inc. Reports Loss of $.68 per Share for the Second Quarter

highlights:

Heightened Mortgage Repurchase Activity. Our indirect conforming and non-conforming mortgage operations experienced markedly higher repurchase requests on loans previously delivered to investors. Provision expense within our Financial Intermediary segment totaled $20.3 million this quarter, an increase of $13.2 million from last quarter. (anscheinend sind auch hier bei bereits vertickerten krediten die ausfallraten exoplodiert und die käufer nutzen jetzt ihr rückgaberecht. wird dazu führe das sich die kreditbedingungen unabhängig von der fedentschedung weiter verschärfen)

Negative Net Servicing Results. Net servicing losses steepened from $5.8 million, pre-tax, a quarter ago to $16.7 million, pre-tax, this quarter. This quarter's results include a $15.0 million pre-tax charge to the carrying value of the company's portfolio of mortgage servicing rights ("MSRs") that the company is actively marketing for sale. Management recorded the impairment charge based on market data it has gathered during the sales process. The adjustment brings our valuation into closer alignment with the valuation estimates observed in the third-party marketing data.

Goodwill Impairment. Management wrote off goodwill on the company's recreational vehicle, boat and aircraft lending business following the second quarter, which tends to be the operation's busiest season. Production and performance within the channel remained below historical results and our internal projections. The business continues to be adversely impacted by rising fuel costs and slower boat sales following the severe hurricane season of 2005. We concluded that the existing level of goodwill no longer accurately reflected the value of the operation's brand and other market intangibles in today's more challenging environment and that a pre-tax impairment to goodwill of $6.4 million was warranted.

(abschreibungen wohin man blickt)

``Quarterly results remain unacceptable,"

We are also pursuing a sale of our mortgage servicing platform and portfolio of mortgage servicing rights. This process is ongoing, and we remain optimistic in our ability to get a deal done to free up capital currently allocated to this asset

``Our efforts do not end there,'' Freeman continued. ``We made a number of changes in our non-conforming operation during the quarter. We moved our focus to a set of products that tend to carry better margins and less repurchase risk. This change allowed us to cut staffing by approximately 16%. We are also evaluating other opportunities for this business since we are increasingly concerned that the non-conforming environment will remain under duress for a protracted period. Other institutions announced similar concerns along with their intent to explore alternatives for their non-conforming operations. (anscheinend hat der mbs markt zumindest was die darlehen der ntbk angeht die schnauzu voll von den "kreativen" finanzierungen. verständlich)

auch hier wieder kar zu erkennen. für die geplatzen mbs ist keinerlei ausreichende risikovorsorge getroffen worden. jede wette das hier in den nächsten monaten noch ne lawine auf die banken zurollt die jegliche gewinnprognose in luft auflösen wird.

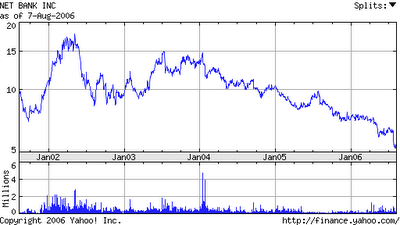

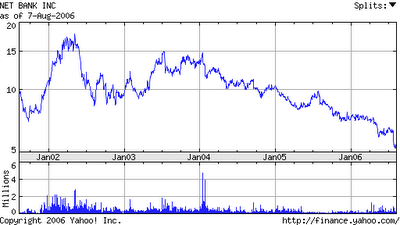

man sollte bedenken das die ntbk ein winziger spieler und schwacher spieler in dem markt ist. der chart spricht bände.

gruß

jan-martin

update conference call:

dre kreative finanzierungsektor soll aufgrund der desaströsen aussichten und der drohenden mbs rückkäufe verlassen werden.

es platzen haufenweise kreative kredite (ohne einkommensnachweis, niedrige bonität, hohe beileihungsgrenzen) befor die ersten raten eingehen!!!!!!!! tolle underwritiungstandarts.

selbst im traditionellen kreditbereich häufen sich die rückkäufe der mbs.

das boot und wohnmobilfinanzierungsgeschäft hat in der hochsaison keine kohle verdient! daher die abschreibung. da kommt sicher nicht mehr.

versteht sich von selbst das das management diese "überraschenden" risiken/rückkäufe nicht hat kommen sehen.

mann war das deprimirend

gruß

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home