Worst to First: Refco, Delphi, Bonds Beat Market

another example that tells you that something isn´t working and the market is a little bit out of control. more on this importend topic "credit mania" / mehr zu diesem thema

http://immobilienblasen.blogspot.com/2006/10/dangerexplosive-loans-another-credit.html

http://immobilienblasen.blogspot.com/2006/09/shadows-of-debt-economist.html

http://immobilienblasen.blogspot.com/2006/09/credit-machine-is-running-amok-mother.html

http://immobilienblasen.blogspot.com/2006/10/money-supply-is-running-wild.html

http://immobilienblasen.blogspot.com/2006/10/private-equity-excess-business-week.html

http://immobilienblasen.blogspot.com/2006/11/buy-now-worry-later-bring-on-another.html

(Bloomberg) -- The worst are now first in the U.S. corporate bond market. http://tinyurl.com/yf95oz

Securities with the lowest credit ratings gained 33 percent this year after losing 16 percent in 2005, ........ Refco Inc. and Delphi Corp., which stopped paying interest when bankruptcy proceedings began 12 months ago, appreciated more than $900 million this year while below-investment-grade bonds on average gained 8.6 percent.

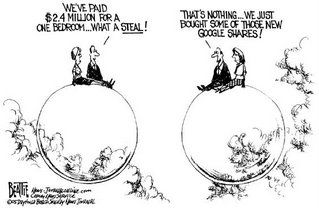

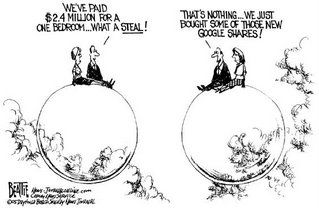

i rhink we can also put all kind of bonds into this cartoon....../denke wir können hier ebenso gut anleihen einsetzen........

Hedge funds, fortified by $110 billion of new money from institutional investors, are snapping up the highest-yielding, highest-risk junk bonds, encouraged by an economy strong enough to reduce defaults without accelerating inflation, according to Chicago-based Hedge Fund Research Inc. So-called distressed debt funds attracted $2.7 billion during the third quarter, the biggest three-month inflow since at least 2003, the group said.

``I'm as surprised as anyone that we're having a rally in dreck,''........

``Hedge funds are increasing institutional demand for yield,'' ....... ``The leveraged debt market has seen explosive growth.''

Defaults Shrink

Bonds of Refco, the New York-based futures broker that filed for protection from creditors in October 2005, have more than doubled in price in the past 12 months. Refco filed the 15th- biggest bankruptcy in U.S. history on Oct. 17, 2005, ......

Detroit-based Delphi, the world's biggest auto-parts maker, gained 58 percent in the bond market during the past six weeks. The company filed for bankruptcy in October 2005. By contrast, the best returns in the stock market this year have been telecommunications shares, which drove up the Nasdaq Telecommunications Index by 23 percent. .....

Top Strategy

Distressed debt is the top-performing hedge fund strategy this year, returning 11.3 percent ....

Just 21 borrowers failed to pay on $7 billion of bonds in the year through October, compared with 28 defaults on almost $20 billion during the same period of 2005, ( i bet that 2007 will be much higher than 2005, wette das 07 höher als 05 sein wird)

``Defaults weren't supposed to go down, and they did go down,''..... ``You can argue that credit risk actually declined instead of increasing.'' (reminds me of the financing that went on in the housing sector in 05. in 06 the musics stopps and financing isn´t so easy to get. that should be enough to kill this kind of bonds/erinnert mich an die finanzierungsrunden im immosektor 05. 06 war die party vorbei und finanzierungen deutlich schwerer zu bekommen. das sollte ausreichen um hier schwierigleiten zu erzeugen)

There have been so few defaults that Standard & Poor's began including bonds with lower yields in its monthly analysis of distressed debt. The New York-based rating company now counts notes that trade at yields with as little as 6 percentage points more than Treasuries, down from a previous limit of 10 percentage points. ( from here the only way is higher defaults, von hier an kann es nur höhere ausfallraten geben)

Easy Sale

S&P estimates that 0.4 percent of company bonds are in distress, the lowest since 1998. The default rate fell to a record low of 1.28 percent in September from 1.44 percent in August, . ..

``A lot of these companies are in adequate shape for this economy,'' .....``Higher- coupon bonds are definitely attractive.'' ( but in total tehy are not high, they are only higher than other bonds that are also very expensive with low risk premiums.../ in der realität sind die aufschläge zawr höher aber sicher nicht hoch)

The lowest-rated companies have had little trouble raising money. Companies rated Caa1 or lower by Moody's have sold more than $34 billion of bonds this year, more than double the $15.1 billion sold in all of 2005. Last month, companies sold $6 billion of bonds that either had no rating or were ranked B and CCC or lower, the most since April 1998. (wow!!!!!!, excess!!!!)

Enormous Capital

Continental Airlines Inc., the fourth-largest U.S. carrier, last week raised $200 million by selling 8.75 percent senior unsecured notes due in 2011, its first such offering since 1998. The Houston-based company is rated Caa1 by New York-based Moody's.

``There is an enormous amount of capital in the market,'' .......

A weakening U.S. economy may stunt the rally in distressed debt. Growth in the third quarter was the slowest since 2003 as the U.S. housing market slumped. Billionaire investor Wilbur Ross last week said ``it's inevitable that we will see higher default rates'' after announcing a plan to help invest $685 million in bankrupt companies for a group formed by New York-based Goldman.

The surge in prices of distressed-debt bonds may be a sign that the market has reached a peak, said Envision Capital's Cohen. ``For anyone to say this isn't overdone, I think is insane,'' she said.

Refco's $390 million of notes fell more than 70 cents to 34 cents on the dollar in October 2005, ...... The securities have rebounded to trade at 82 cents to yield 13.6 percent, .......

Charter, Adelphia

St. Louis-based Charter Communications' $580 million of 13.5 percent coupon notes maturing in 2014 have returned 63 percent since April. The securities are rated Caa3 by Moody's. The debt trades now at 94.75 cents on the dollar to yield 14.7 percent, Trace data show.

Adelphia Communications Corp.'s $750 million of 10.875 percent notes due in 2010 fell to 23 cents on the dollar before it filed the 11th-biggest U.S. bankruptcy in June 2002 because of an accounting fraud. The securities have returned 53 percent this year as prices jumped to 85 cents on the dollar to yield 15.2 percent.

Delphi's $150 million of 6.197 percent notes due in 2033 have risen to 90.25 cents on the dollar from 57 cents on Sept. ...... The yield is less than 7 percent, down from 11.2 percent.

Bonds ranked below Baa3 by Moody's and BBB- by S&P are considered non-investment grade.

This year, debt of automakers and their parts suppliers have returned almost 37 percent, and airlines have gained 20 percent, according to Merrill Lynch indexes. Airline bonds lost 18 percent in the same period a year ago, and auto parts suppliers fell 11.5 percent, Merrill data show.

Low default rates are ``appealing not just to distressed investors, but to anyone who is just looking for straight traditional high yield,''........

http://immobilienblasen.blogspot.com/2006/10/dangerexplosive-loans-another-credit.html

http://immobilienblasen.blogspot.com/2006/09/shadows-of-debt-economist.html

http://immobilienblasen.blogspot.com/2006/09/credit-machine-is-running-amok-mother.html

http://immobilienblasen.blogspot.com/2006/10/money-supply-is-running-wild.html

http://immobilienblasen.blogspot.com/2006/10/private-equity-excess-business-week.html

http://immobilienblasen.blogspot.com/2006/11/buy-now-worry-later-bring-on-another.html

(Bloomberg) -- The worst are now first in the U.S. corporate bond market. http://tinyurl.com/yf95oz

Securities with the lowest credit ratings gained 33 percent this year after losing 16 percent in 2005, ........ Refco Inc. and Delphi Corp., which stopped paying interest when bankruptcy proceedings began 12 months ago, appreciated more than $900 million this year while below-investment-grade bonds on average gained 8.6 percent.

i rhink we can also put all kind of bonds into this cartoon....../denke wir können hier ebenso gut anleihen einsetzen........

Hedge funds, fortified by $110 billion of new money from institutional investors, are snapping up the highest-yielding, highest-risk junk bonds, encouraged by an economy strong enough to reduce defaults without accelerating inflation, according to Chicago-based Hedge Fund Research Inc. So-called distressed debt funds attracted $2.7 billion during the third quarter, the biggest three-month inflow since at least 2003, the group said.

``I'm as surprised as anyone that we're having a rally in dreck,''........

``Hedge funds are increasing institutional demand for yield,'' ....... ``The leveraged debt market has seen explosive growth.''

Defaults Shrink

Bonds of Refco, the New York-based futures broker that filed for protection from creditors in October 2005, have more than doubled in price in the past 12 months. Refco filed the 15th- biggest bankruptcy in U.S. history on Oct. 17, 2005, ......

Detroit-based Delphi, the world's biggest auto-parts maker, gained 58 percent in the bond market during the past six weeks. The company filed for bankruptcy in October 2005. By contrast, the best returns in the stock market this year have been telecommunications shares, which drove up the Nasdaq Telecommunications Index by 23 percent. .....

Top Strategy

Distressed debt is the top-performing hedge fund strategy this year, returning 11.3 percent ....

Just 21 borrowers failed to pay on $7 billion of bonds in the year through October, compared with 28 defaults on almost $20 billion during the same period of 2005, ( i bet that 2007 will be much higher than 2005, wette das 07 höher als 05 sein wird)

``Defaults weren't supposed to go down, and they did go down,''..... ``You can argue that credit risk actually declined instead of increasing.'' (reminds me of the financing that went on in the housing sector in 05. in 06 the musics stopps and financing isn´t so easy to get. that should be enough to kill this kind of bonds/erinnert mich an die finanzierungsrunden im immosektor 05. 06 war die party vorbei und finanzierungen deutlich schwerer zu bekommen. das sollte ausreichen um hier schwierigleiten zu erzeugen)

There have been so few defaults that Standard & Poor's began including bonds with lower yields in its monthly analysis of distressed debt. The New York-based rating company now counts notes that trade at yields with as little as 6 percentage points more than Treasuries, down from a previous limit of 10 percentage points. ( from here the only way is higher defaults, von hier an kann es nur höhere ausfallraten geben)

Easy Sale

S&P estimates that 0.4 percent of company bonds are in distress, the lowest since 1998. The default rate fell to a record low of 1.28 percent in September from 1.44 percent in August, . ..

``A lot of these companies are in adequate shape for this economy,'' .....``Higher- coupon bonds are definitely attractive.'' ( but in total tehy are not high, they are only higher than other bonds that are also very expensive with low risk premiums.../ in der realität sind die aufschläge zawr höher aber sicher nicht hoch)

The lowest-rated companies have had little trouble raising money. Companies rated Caa1 or lower by Moody's have sold more than $34 billion of bonds this year, more than double the $15.1 billion sold in all of 2005. Last month, companies sold $6 billion of bonds that either had no rating or were ranked B and CCC or lower, the most since April 1998. (wow!!!!!!, excess!!!!)

Enormous Capital

Continental Airlines Inc., the fourth-largest U.S. carrier, last week raised $200 million by selling 8.75 percent senior unsecured notes due in 2011, its first such offering since 1998. The Houston-based company is rated Caa1 by New York-based Moody's.

``There is an enormous amount of capital in the market,'' .......

A weakening U.S. economy may stunt the rally in distressed debt. Growth in the third quarter was the slowest since 2003 as the U.S. housing market slumped. Billionaire investor Wilbur Ross last week said ``it's inevitable that we will see higher default rates'' after announcing a plan to help invest $685 million in bankrupt companies for a group formed by New York-based Goldman.

The surge in prices of distressed-debt bonds may be a sign that the market has reached a peak, said Envision Capital's Cohen. ``For anyone to say this isn't overdone, I think is insane,'' she said.

Refco's $390 million of notes fell more than 70 cents to 34 cents on the dollar in October 2005, ...... The securities have rebounded to trade at 82 cents to yield 13.6 percent, .......

Charter, Adelphia

St. Louis-based Charter Communications' $580 million of 13.5 percent coupon notes maturing in 2014 have returned 63 percent since April. The securities are rated Caa3 by Moody's. The debt trades now at 94.75 cents on the dollar to yield 14.7 percent, Trace data show.

Adelphia Communications Corp.'s $750 million of 10.875 percent notes due in 2010 fell to 23 cents on the dollar before it filed the 11th-biggest U.S. bankruptcy in June 2002 because of an accounting fraud. The securities have returned 53 percent this year as prices jumped to 85 cents on the dollar to yield 15.2 percent.

Delphi's $150 million of 6.197 percent notes due in 2033 have risen to 90.25 cents on the dollar from 57 cents on Sept. ...... The yield is less than 7 percent, down from 11.2 percent.

Bonds ranked below Baa3 by Moody's and BBB- by S&P are considered non-investment grade.

This year, debt of automakers and their parts suppliers have returned almost 37 percent, and airlines have gained 20 percent, according to Merrill Lynch indexes. Airline bonds lost 18 percent in the same period a year ago, and auto parts suppliers fell 11.5 percent, Merrill data show.

Low default rates are ``appealing not just to distressed investors, but to anyone who is just looking for straight traditional high yield,''........

Labels: hedge funds, junk, riskaversion

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

3 Comments:

WCI goes nuts on icahn management purchase, at same time s&p downgrades debt.

I bought a few more puts.

hi rob,

this market is really nuts.

i have no idea where this will end. it seems the worse the news the better the stockperformance.

maybe it´s the best to take the time off until 2007.....

lacoste polo

new balance shoes

ralph lauren polo

ray ban sunglasses

dsquared2

fitflops clearance

jordan shoes

ugg outlet

christian louboutin

Post a Comment

<< Home