no cheap securities to buy.....

when you look at the markets it feels sometimes that there are almost "momentumplayers"(hedgefunds etc...). it is good to hear and read something about some guys that are watching valuations and fundamentals to invest. unfortunatly this crowd is no longer an importend marketplayer it used to be in the past.

wenn man sich das marktgeschehen so ansieht fühlt es sich manchmal so an als wenn der markt nur noch durch momentumspielern wie z.b. hedgefonds getrieben wird. da tut es gut mal die vergessenen valueinvestoren zu hören die offen sagen das es immer wenig günstig bewertete titel zum investieren gibt. leider spielen diese marktteilnehmer eine immer kleinere rolle.

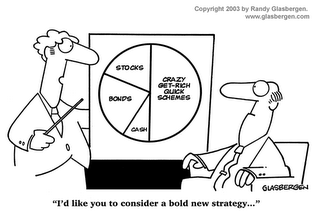

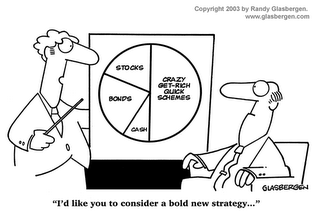

this seems to be the new investmentstrategie for too many players these days ........ :-)

Cash Lures Bear, J.P. Morgan as Rates Rise Amid Stocks' Rally http://tinyurl.com/y6dzll

Nov. 13 (Bloomberg) -- Charles de Vaulx, who manages $11 billion at the First Eagle Overseas Fund in New York, has increased his proportion of cash to 25 percent from 18 percent since midyear because he can't find anything to buy.

``We haven't been able to identify enough cheap securities to replace the ones we've lost to takeovers and those we decided to sell,'' de Vaulx said.

Value investors such as de Vaulx are avoiding equities because stock prices have met their targets. Other investors are adding to cash holdings, exceeding their benchmarks, because they doubt the 13 percent increase in the Standard & Poor's 500 Index since mid-June will last. At the same time, economic growth is weakening and analysts predict slower earnings increases.

At 5.4 percent, three-month dollar deposits yield more than the 4.6 percent a 10-year Treasury note will fetch. With interest rates rising in Europe and likely to go up in Japan, the rewards of being in cash are going up.

Thomas McManus, chief investment strategist at Banc of America Securities LLC in New York, recommends a cash allocation of 25 percent, up from 20 percent in August. Francois Trahan at Bear, Stearns & Co. says investors should keep 20 percent of their investments in cash. Abhijit Chakrabortti, head of global equity strategy at J. P. Morgan Chase & Co. in New York, also calls for 20 percent, as do strategists at Merrill Lynch & Co.

Trahan and Chakrabortti's suggestions are double the proportion in their respective benchmarks, while Merrill's cash recommendation has been raised from 15 percent in May.

Rally

Normal cash levels for U.S. mutual funds are less than 10 percent of total assets, with many funds at less than 5 percent, (at the end of august the cashlevel was 4,4% http://immobilienblasen.blogspot.com/2006/10/3-signs-that-stock-crash-is-coming.html )

The risk in allocating money to short-term, interest-bearing securities such as Treasury bills and commercial paper is that investors stand to miss out should stocks keep climbing at their current pace.

Morgan Stanley Capital International's World Index has rallied 15 percent since June 13 as measured in dollars, making for an annual increase of 43 percent. The S&P index increase of 13 percent is exceeded by the 19 percent increase in the Dow Jones Stoxx 600 Index in Europe. ..

No New Ideas

``We're finding it increasingly difficult to generate new buy ideas,'' he said. ``The last time we felt like this was in April, just before the sell-offs of May and June.''

He said he is concerned about investors' ``reckless'' appetite for risk. The MSCI Emerging Markets Index has soared 27 percent since bottoming in June.

The extra yield investors demand to buy junk bonds -- high- risk, high-yield bonds -- instead of U.S. Treasuries has narrowed to 3.15 percentage points from 3.62 in January. The spread, as it is called, also is below the average of 5.83 percentage points since the end of 1999, .....

Bear Stearns' Trahan cites investors' complacency and a weakening economy as signs that cash will be a rewarding investment. ``What we went through in May and June is very likely to occur again,''.......... ``We have an overbought market in an economy that's slowing.''

The MSCI World Index slumped 12 percent from May 9 to June 13, while the MSCI Emerging Markets Index plunged 25 percent as rising interest rates prompted investors to flee the riskiest assets.

Volatility

Investors' embrace of risk is also evident in readings of expected volatility in the stock market. Trahan cites the Chicago Board Options Exchange's Volatility Index, or VIX, which measures expectations for volatility that are built into the prices of options on the S&P 500. The index finished last week at 10.79, near its low for the year, indicating investors expect smooth sailing.

``Investors are making very little room for risk in their assessment of the future,''

....First Eagle's de Vaulx said his cash level doesn't mean he's predicting an imminent drop in the market. He has sold stocks because they reached his price target.

Risk Performance

``Markets need to get used to the notion that slower growth is -- up to a point -- a good thing, and risky assets can still perform as the U.S. slows,'' Wilson said.

He noted, for example, that during the first half of 1995, stocks rallied -- the S&P 500 rose 19 percent -- while growth was below 2 percent. Slower growth may allow inflation pressures to ease, thus extending the expansion, he said. (unfortunatly this was the exceptian and not the rule/unglücklicherweise war das die ausnahme und nicht die regel)

.....Earnings expansion at S&P 500 companies may slow to 10 percent this quarter from an estimated 18.6 percent in the July to September period, according to a Thomson Financial survey of analysts compiled on Nov. 3. Profit growth will decelerate to 8.8 percent in the first three months of next year and then 6.8 percent in the second quarter of 2007.

A common refrain among institutional investors is that bargains are scarce in the financial markets, said Albert Edwards, head of global asset allocation at Dresdner Kleinwort in London. His 10 percent cash allotment is double his benchmark.

``Clients tell you that many assets are expensive,'' he said. ``If they come to that conclusion, they should be holding cash, not going with the herd.''

wenn man sich das marktgeschehen so ansieht fühlt es sich manchmal so an als wenn der markt nur noch durch momentumspielern wie z.b. hedgefonds getrieben wird. da tut es gut mal die vergessenen valueinvestoren zu hören die offen sagen das es immer wenig günstig bewertete titel zum investieren gibt. leider spielen diese marktteilnehmer eine immer kleinere rolle.

this seems to be the new investmentstrategie for too many players these days ........ :-)

Cash Lures Bear, J.P. Morgan as Rates Rise Amid Stocks' Rally http://tinyurl.com/y6dzll

Nov. 13 (Bloomberg) -- Charles de Vaulx, who manages $11 billion at the First Eagle Overseas Fund in New York, has increased his proportion of cash to 25 percent from 18 percent since midyear because he can't find anything to buy.

``We haven't been able to identify enough cheap securities to replace the ones we've lost to takeovers and those we decided to sell,'' de Vaulx said.

Value investors such as de Vaulx are avoiding equities because stock prices have met their targets. Other investors are adding to cash holdings, exceeding their benchmarks, because they doubt the 13 percent increase in the Standard & Poor's 500 Index since mid-June will last. At the same time, economic growth is weakening and analysts predict slower earnings increases.

At 5.4 percent, three-month dollar deposits yield more than the 4.6 percent a 10-year Treasury note will fetch. With interest rates rising in Europe and likely to go up in Japan, the rewards of being in cash are going up.

Thomas McManus, chief investment strategist at Banc of America Securities LLC in New York, recommends a cash allocation of 25 percent, up from 20 percent in August. Francois Trahan at Bear, Stearns & Co. says investors should keep 20 percent of their investments in cash. Abhijit Chakrabortti, head of global equity strategy at J. P. Morgan Chase & Co. in New York, also calls for 20 percent, as do strategists at Merrill Lynch & Co.

Trahan and Chakrabortti's suggestions are double the proportion in their respective benchmarks, while Merrill's cash recommendation has been raised from 15 percent in May.

Rally

Normal cash levels for U.S. mutual funds are less than 10 percent of total assets, with many funds at less than 5 percent, (at the end of august the cashlevel was 4,4% http://immobilienblasen.blogspot.com/2006/10/3-signs-that-stock-crash-is-coming.html )

The risk in allocating money to short-term, interest-bearing securities such as Treasury bills and commercial paper is that investors stand to miss out should stocks keep climbing at their current pace.

Morgan Stanley Capital International's World Index has rallied 15 percent since June 13 as measured in dollars, making for an annual increase of 43 percent. The S&P index increase of 13 percent is exceeded by the 19 percent increase in the Dow Jones Stoxx 600 Index in Europe. ..

No New Ideas

``We're finding it increasingly difficult to generate new buy ideas,'' he said. ``The last time we felt like this was in April, just before the sell-offs of May and June.''

He said he is concerned about investors' ``reckless'' appetite for risk. The MSCI Emerging Markets Index has soared 27 percent since bottoming in June.

The extra yield investors demand to buy junk bonds -- high- risk, high-yield bonds -- instead of U.S. Treasuries has narrowed to 3.15 percentage points from 3.62 in January. The spread, as it is called, also is below the average of 5.83 percentage points since the end of 1999, .....

Bear Stearns' Trahan cites investors' complacency and a weakening economy as signs that cash will be a rewarding investment. ``What we went through in May and June is very likely to occur again,''.......... ``We have an overbought market in an economy that's slowing.''

The MSCI World Index slumped 12 percent from May 9 to June 13, while the MSCI Emerging Markets Index plunged 25 percent as rising interest rates prompted investors to flee the riskiest assets.

Volatility

Investors' embrace of risk is also evident in readings of expected volatility in the stock market. Trahan cites the Chicago Board Options Exchange's Volatility Index, or VIX, which measures expectations for volatility that are built into the prices of options on the S&P 500. The index finished last week at 10.79, near its low for the year, indicating investors expect smooth sailing.

``Investors are making very little room for risk in their assessment of the future,''

....First Eagle's de Vaulx said his cash level doesn't mean he's predicting an imminent drop in the market. He has sold stocks because they reached his price target.

Risk Performance

``Markets need to get used to the notion that slower growth is -- up to a point -- a good thing, and risky assets can still perform as the U.S. slows,'' Wilson said.

He noted, for example, that during the first half of 1995, stocks rallied -- the S&P 500 rose 19 percent -- while growth was below 2 percent. Slower growth may allow inflation pressures to ease, thus extending the expansion, he said. (unfortunatly this was the exceptian and not the rule/unglücklicherweise war das die ausnahme und nicht die regel)

.....Earnings expansion at S&P 500 companies may slow to 10 percent this quarter from an estimated 18.6 percent in the July to September period, according to a Thomson Financial survey of analysts compiled on Nov. 3. Profit growth will decelerate to 8.8 percent in the first three months of next year and then 6.8 percent in the second quarter of 2007.

A common refrain among institutional investors is that bargains are scarce in the financial markets, said Albert Edwards, head of global asset allocation at Dresdner Kleinwort in London. His 10 percent cash allotment is double his benchmark.

``Clients tell you that many assets are expensive,'' he said. ``If they come to that conclusion, they should be holding cash, not going with the herd.''

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home