Buy now, worry later/ bring on another creditinnovation.......

kann es kaum abwarten das diese instrumente mal unter realen bedingungen einen stresstest unterzogen werden und ob dann immer noch risiko reduzeirt worden ist oder ab das nur vorgegaukelt war. besonders wenn man bedenkt das bis zu 30% der derivatekäufer heutzutage hedgefonds sind.

more on credit mania

http://immobilienblasen.blogspot.com/2006/10/dangerexplosive-loans-another-credit.html

http://immobilienblasen.blogspot.com/2006/09/shadows-of-debt-economist.html

http://immobilienblasen.blogspot.com/2006/09/credit-machine-is-running-amok-mother.html

http://immobilienblasen.blogspot.com/2006/10/money-supply-is-running-wild.html

http://immobilienblasen.blogspot.com/2006/10/private-equity-excess-business-week.html

Buttonwood

Premium bonds

http://www.economist.com/finance/displaystory.cfm?story_id=8150178

FEAR and greed are supposed to govern financial markets. Right now, investors seem far more like lumberjacks at an all-you-can-eat buffet than claustrophobes trapped in a lift. Despite nagging concerns about the American economy, global stockmarkets are at multi-year highs. ....

If there is one market that sums up the insouciant attitude to risk, it would have to be corporate debt. After an extremely good run, the difference between the interest rate companies pay and that which (much safer) treasury bonds pay has fallen substantially. Until recently, most investors expected that as the American economy slowed, companies would run into difficulty, forcing those borrowing costs higher.

why worry...?

But it hasn't and bankers are coming up with increasingly ingenious ways to offer fixed-income investors additional returns. Enter the newest symbol of the corporate-bond bonanza: an instrument known cryptically as the constant proportion debt obligation, or CPDO.

CPDOs are built on the back of credit-default swaps—the greatest credit innovation of the past decade—which give investors the chance to insure against a company going bust. Now CPDOs offer the same option for an entire index. And with the help of a lot of borrowed money, they offer some juicy returns. (right, more leverage/mehr hebel)

Like a swap, issuers of CPDOs get premium income upfront but have to pay out if a company in the index defaults. The beauty of the structure is that the insurance is sold only on a rolling six-month basis. The chance of one of the index's components defaulting within the next six months is very low. Even if the company's finances do deteriorate, it will probably be dropped from the index by the time the six months are up.

That means the credit agencies are happy to award CPDOs their highest (AAA-style) rating. But unlike other top-rated debt instruments, CPDOs pay a succulent interest rate of as much as two percentage points over cash.

Gary Jenkins of Deutsche Bank points out that, historically, investors have been overpaid for the default risk on high-quality corporate bonds. CPDOs take advantage of this anomaly. They employ another gimmick, too. If the markets move against them, the issuer borrows more money to sell more insurance. The extra premiums earned make up for the capital loss suffered in the market. In theory, a CPDO could have 15 times more debt than capital. (read this twice!even more leverage)

The structure was pioneered only in August, and has yet to be tested in a crisis. However, Georges Assi of Lehman Brothers says it is inherently market-stabilising: CPDO issuers will be buying when others are selling. (until the music stopps....)

The CPDO craze is just one sign of investors' appetite for corporate debt. Sales of corporate bonds and leveraged (high-risk) loans are breaking records. Investors are happy to take the extra yield today and worry about the risk later.

Similar sang froid is being displayed about America's stockmarket. By the start of this week, the S&P 500 index had not fallen by 1% in 111 days, one of its longest winning streaks in the past 25 years. http://immobilienblasen.blogspot.com/2006/10/remember-what-1-decline-feels-like.html

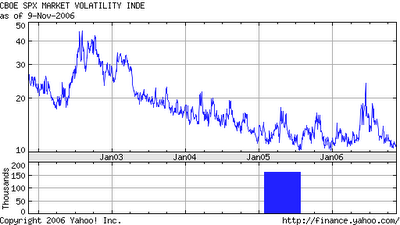

If investors were worried about losing those gains, they would be paying up for options to protect against a sudden fall in share prices. But the VIX index of American stockmarket volatility (a measure of the cost of buying options) was close to a ten-year low in late October.

... isn't there too much complacency? America's recent economic data have sown confusion

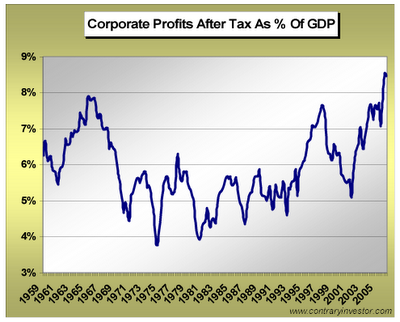

, but even where the news has appeared positive, dangers lurk. The biggest threat for companies is that unit labour costs are growing faster than 5% a year. A combination of slower overall growth and rising wage costs should squeeze profit margins. With profits at a 40-year high as a share of GDP, it is hard to see the news getting much better.

But though investors may realise that something is bound to go wrong eventually, getting the timing right is a completely separate question. Over the past three years, those who have acted out of fear have generally lost money. With tasty morsels such as CPDOs on the table, greed is the much more tempting option.

i bet that the next creditinnovation in already in the making/jede wette das die nächste innovation schon in der mache ist.......

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home