petrodollars for london properties

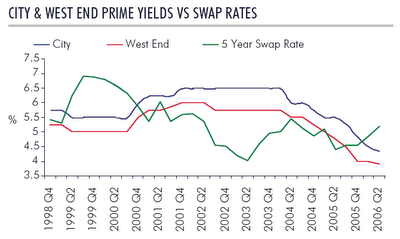

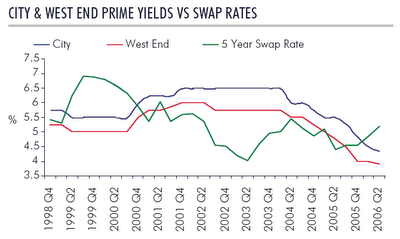

this story shows you very good that nobody is buying for the rentyield. the gilts (gouverment bonds) are yielding higher (risk free!). at least dubai has enough money to waste........

http://immobilienblasen.blogspot.com/2006/09/dubai.html#links

das ganze zeigt klar das in lonfon keiner wegen der guten mietrendiete kauft. britische staatsanleihen rentieren risikofrei höher! immerhin kommt es bei dubai nicht auf die kohle an......

http://immobilienblasen.blogspot.com/2006/09/dubai.html#links

make sure you read this story about london/bitte unbedingt diese story über london lesen.

http://immobilienblasen.blogspot.com/2006/10/london-calling-new-skyline.html#links

Dubai Buys London's Adelphi for 300 Million Pounds http://tinyurl.com/wkbva

Nov. 15 (Bloomberg) -- The Emirate of Dubai bought the Adelphi, one of London's best-known art deco buildings, for about 300 million pounds ($567 million) to capitalize on surging rents in the city.

(i doubt that the yields are good...., see chart)

Istithmar PJSC, a private-equity company owned by the government of Dubai, purchased the 300,000 square-foot building in London's West End on Nov. 13, said Alan Rogers, head of the firm's real estate unit. Tenants of the 68-year-old Adelphi, located near the Strand on the river Thames, include the U.K.'s Department of Work and Pensions and Hess Corp., the fifth- biggest U.S. oil company.

Istithmar PJSC, a private-equity company owned by the government of Dubai, purchased the 300,000 square-foot building in London's West End on Nov. 13, said Alan Rogers, head of the firm's real estate unit. Tenants of the 68-year-old Adelphi, located near the Strand on the river Thames, include the U.K.'s Department of Work and Pensions and Hess Corp., the fifth- biggest U.S. oil company.

``Adelphi is a trophy office building,'' Rogers told reporters in Dubai, United Arab Emirates today. ``It is in a prime location and is complementary to our earlier investment in Trafalgar Square.''

Middle Eastern investors, flush with oil wealth after crude prices almost doubled since 2003, spent $6 billion on overseas property in the first half of 2006, mainly in London and New York, according to a report by Jones Lang LaSalle Inc. published last month. Prime West End office rents are the highest in the world. ( yields not!)

http://immobilienblasen.blogspot.com/2006/09/dubai.html#links

das ganze zeigt klar das in lonfon keiner wegen der guten mietrendiete kauft. britische staatsanleihen rentieren risikofrei höher! immerhin kommt es bei dubai nicht auf die kohle an......

http://immobilienblasen.blogspot.com/2006/09/dubai.html#links

make sure you read this story about london/bitte unbedingt diese story über london lesen.

http://immobilienblasen.blogspot.com/2006/10/london-calling-new-skyline.html#links

Dubai Buys London's Adelphi for 300 Million Pounds http://tinyurl.com/wkbva

Nov. 15 (Bloomberg) -- The Emirate of Dubai bought the Adelphi, one of London's best-known art deco buildings, for about 300 million pounds ($567 million) to capitalize on surging rents in the city.

(i doubt that the yields are good...., see chart)

Istithmar PJSC, a private-equity company owned by the government of Dubai, purchased the 300,000 square-foot building in London's West End on Nov. 13, said Alan Rogers, head of the firm's real estate unit. Tenants of the 68-year-old Adelphi, located near the Strand on the river Thames, include the U.K.'s Department of Work and Pensions and Hess Corp., the fifth- biggest U.S. oil company.

Istithmar PJSC, a private-equity company owned by the government of Dubai, purchased the 300,000 square-foot building in London's West End on Nov. 13, said Alan Rogers, head of the firm's real estate unit. Tenants of the 68-year-old Adelphi, located near the Strand on the river Thames, include the U.K.'s Department of Work and Pensions and Hess Corp., the fifth- biggest U.S. oil company. ``Adelphi is a trophy office building,'' Rogers told reporters in Dubai, United Arab Emirates today. ``It is in a prime location and is complementary to our earlier investment in Trafalgar Square.''

Middle Eastern investors, flush with oil wealth after crude prices almost doubled since 2003, spent $6 billion on overseas property in the first half of 2006, mainly in London and New York, according to a report by Jones Lang LaSalle Inc. published last month. Prime West End office rents are the highest in the world. ( yields not!)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home