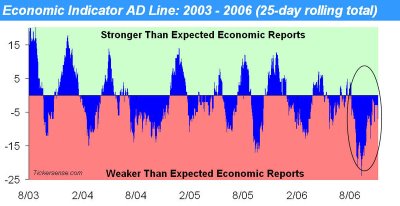

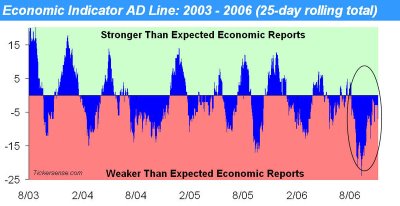

Economic A/D Line

i´m not sure what to make of this indicator. better or worse than expected isn´t a usefull tool. wall streets always works the way to set the bar very low and then surprise to the upside. regardless if the real number is good or bad.(or as in the past month really ugly) even if the numbers are bad they are willing to exclude some items (doesn´t matter if corporate or federal numbers) to spin the in the end positive.

bin mir nicht sicher ob dieser indikator überhaupt ne aussagekraft hat. besser wie erwartet scheint mir keine aussagekraft zu haben. an wall street regiert immer dassselbe prinzig. schätze niedrig damit du positiv überrsacht sein kannst. unabhängig davon ob die nominelle zahl/nummer gut oder schlecht ist. dabei spielt es keine rolle ob das unternehmens oder offizielle angaben sind. wenn einzelne zahlen zu schlecht ausfallen werden i.d.r. einige komponenten "herausgerechnet".

nevertheless/trotzdem thanks/dank an ticker sense http://tickersense.typepad.com/ticker_sense/

Today’s release of the minutes from the Fed’s October meeting showed that Fed governors saw a decline in the risk of downside growth. With that in mind we updated our economic indicator Advance/Decline line where we calculate the net number of economic indicators which came in stronger than forecasts over a 25 day period. As the chart details, we are well off the lows we saw in August, but still remain in negative territory i.e,. the economy continues to surprise to the downside.

This chart also illustrates how most of the indicators we spend so much time analyzing are rear view in their nature. In late September, when this indicator was at its lowest reading in over three years, the Dow was hitting new highs for the year and on its way to new all-time highs.

bin mir nicht sicher ob dieser indikator überhaupt ne aussagekraft hat. besser wie erwartet scheint mir keine aussagekraft zu haben. an wall street regiert immer dassselbe prinzig. schätze niedrig damit du positiv überrsacht sein kannst. unabhängig davon ob die nominelle zahl/nummer gut oder schlecht ist. dabei spielt es keine rolle ob das unternehmens oder offizielle angaben sind. wenn einzelne zahlen zu schlecht ausfallen werden i.d.r. einige komponenten "herausgerechnet".

nevertheless/trotzdem thanks/dank an ticker sense http://tickersense.typepad.com/ticker_sense/

Today’s release of the minutes from the Fed’s October meeting showed that Fed governors saw a decline in the risk of downside growth. With that in mind we updated our economic indicator Advance/Decline line where we calculate the net number of economic indicators which came in stronger than forecasts over a 25 day period. As the chart details, we are well off the lows we saw in August, but still remain in negative territory i.e,. the economy continues to surprise to the downside.

This chart also illustrates how most of the indicators we spend so much time analyzing are rear view in their nature. In late September, when this indicator was at its lowest reading in over three years, the Dow was hitting new highs for the year and on its way to new all-time highs.

größer/bigger http://tickersense.typepad.com/./photos/uncategorized/economic_indicator_ad_line_nov.jpg

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home