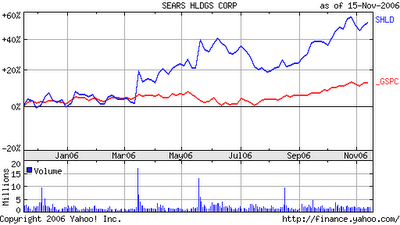

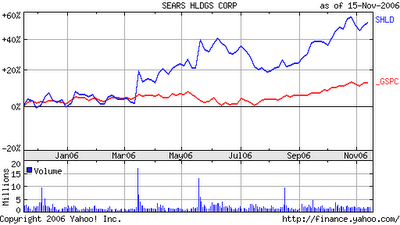

hedge funds sears / shld

as postet before shld is more and more a hedgefunds than a retailer.

http://immobilienblasen.blogspot.com/search?q=sears

man stelle sich vor karstadt würde im großen maße als hedgefonds operieren......

http://immobilienblasen.blogspot.com/search?q=sears

http://biz.yahoo.com/prnews/061116/nyth069.html?.v=65

Sears Holdings Corporation ("Holdings" or the "Company") today reported net income of $196 million, or $1.27 per diluted share, ....... Third quarter results for 2006 include $101 million (or $0.42 per diluted share) of income from the Company's investment of a portion of its surplus cash.

total return swap income 2006 101 mio$ vs 0$ 2005!!!!!!!!!!!!!

The Company, from time to time, invests its surplus cash in various securities and financial instruments, including total return swaps, which are derivative contracts that synthetically replicate the economic return characteristics of one or more underlying marketable equity securities

During the third quarter of fiscal 2006, the Company entered into total return swaps and recognized $101 million of investment income consisting of realized gains of $66 million and unrealized gains of $38 million less $3 million of interest cost. As of October 28, 2006, the total return swaps had an aggregate notional amount of $387 million and a fair value of $38 million. These investments are highly concentrated and involve substantial risks. Accordingly, the Company's financial position and quarterly and annual results of operations may be positively or negatively materially affected based on the timing, magnitude and performance of these investments.

(former) core business is in trouble.

For the quarter, domestic comparable store sales declined 3.0% in the aggregate, with Sears Domestic comparable store sales declining 4.8% and Kmart comparable store sales declining 0.7%

disclosure: short shld

BLOOMBERG agrees

Sears, Not Just a Retailer, Is Now Lampert Hedge Fund http://tinyurl.com/y22q45

http://immobilienblasen.blogspot.com/search?q=sears

man stelle sich vor karstadt würde im großen maße als hedgefonds operieren......

http://immobilienblasen.blogspot.com/search?q=sears

http://biz.yahoo.com/prnews/061116/nyth069.html?.v=65

Sears Holdings Corporation ("Holdings" or the "Company") today reported net income of $196 million, or $1.27 per diluted share, ....... Third quarter results for 2006 include $101 million (or $0.42 per diluted share) of income from the Company's investment of a portion of its surplus cash.

total return swap income 2006 101 mio$ vs 0$ 2005!!!!!!!!!!!!!

The Company, from time to time, invests its surplus cash in various securities and financial instruments, including total return swaps, which are derivative contracts that synthetically replicate the economic return characteristics of one or more underlying marketable equity securities

During the third quarter of fiscal 2006, the Company entered into total return swaps and recognized $101 million of investment income consisting of realized gains of $66 million and unrealized gains of $38 million less $3 million of interest cost. As of October 28, 2006, the total return swaps had an aggregate notional amount of $387 million and a fair value of $38 million. These investments are highly concentrated and involve substantial risks. Accordingly, the Company's financial position and quarterly and annual results of operations may be positively or negatively materially affected based on the timing, magnitude and performance of these investments.

(former) core business is in trouble.

For the quarter, domestic comparable store sales declined 3.0% in the aggregate, with Sears Domestic comparable store sales declining 4.8% and Kmart comparable store sales declining 0.7%

disclosure: short shld

BLOOMBERG agrees

Sears, Not Just a Retailer, Is Now Lampert Hedge Fund http://tinyurl.com/y22q45

Labels: hedge funds, sears, shld

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home