Credit Suisse Lost $120 Million in Korean Derivatives Gone Awry

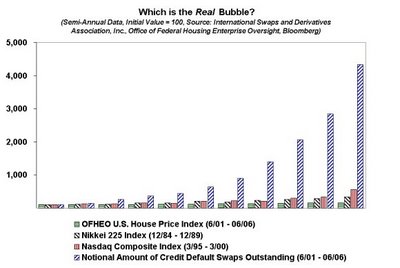

its only small news with no big impact on the markets. but it shows you how risky the gigantic derivatesmarket is these days. the growth in this segment is staggering. it will be interesting to see what happens when the counterpart that is in trouble is not a bank with big pockets but a hedge funds. i think then we will see a real "stresstest".....

auch gibt es auf bestimmte basiswerte wie z.b. gold deriavate die niemlas mit dem basiswert unterlegt sein können weil ganz einfach nicht so viel gold zur lieferung existiert.

it is also scray that the derivates exceeds often the amount of underlying assets like gold, stocks, bonds etc.

wie wichtig das trading inzwischen für die banken ist sieht man hier hervorragend. here you can see how importend the tradingpart for the bankingcomplex ishttp://immobilienblasen.blogspot.com/2006/09/goldman-sachs-bank-oder-hedgefonds.html,http://immobilienblasen.blogspot.com/2006/08/investmentbank-oder-verkappter.html,http://immobilienblasen.blogspot.com/2006/09/goldman-und-jpm-grte-us-hedge-fonds.html

dank geht an russ winter

http://www.xanga.com/russwinter/536768177/tipping-point-for-the-ministry-of-truth.html

Here we learn that hedge funds account for 32 percent of credit-default swap sellers and 28 percent of buyers, up from 15 percent and 16 percent in 2004, according to a British Bankers' Association report last month

http://immobilienblasen.blogspot.com/2006/08/20-fehlerquote-bei-derivaten.html

Credit Suisse Lost $120 Million in Korean Derivatives Gone Awry http://tinyurl.com/y66kjc

Oct. 16 (Bloomberg) -- Credit Suisse Group, Switzerland's second-biggest bank, lost about $120 million on South Korean derivatives in the third quarter, an undisclosed stumble by equity traders struggling to catch the leaders in the securities industry.

The debacle, which wasn't reported to shareholders, resulted from the Zurich-based bank's failure to protect itself against swings in the value of Korean stock options, said two people with knowledge of the matter. The loss equals about 13 percent of Credit Suisse's second-quarter revenue from equities trading.

Brady Dougan, promoted by Chief Executive Officer Oswald Gruebel in 2004 to run Credit Suisse's investment bank, pledged last year to catch up to competitors in derivatives. The bank's equity-trading revenue rose less than half as fast as Goldman Sachs Group Inc.'s and Morgan Stanley's in the second quarter. ......

Korean Market

Credit Suisse was drawn to Korea as options trading in the country surged. In the third quarter of 2005, trading of Korean stock-index options rose 71 percent to $12 trillion, surpassing U.S. volumes for the first time, according to a December report from the Bank for International Settlements in Basel, Switzerland. .....

Reverse-Convertible Notes

When Korean stocks leveled off in the third quarter after slumping in May and June, option values fell. Credit Suisse, which hadn't taken positions to hedge against the decline in market volatility, was then forced to write down the value of its holdings, the people said. ....

French Rivals

Korea's structured-notes market grew 50 percent last year to about $15 billion in sales. Credit Suisse competes in it against companies including Paris-based BNP Paribas SA, Citigroup Inc. in New York, Frankfurt's Deutsche Bank and Zurich-based UBS AG, according to research from Arete Consulting, which tracks the market for structured products.

``The history of banks losing money in exotic derivatives is a fairly extensive one,'' said Robert Benson, who ran the structured-products group at HSBC Holdings Plc until he left in 2001 to set up Arete in London. ``At the end of the day, there will be a bust-up or a blowup somewhere. You just hope there are enough other things going right that you can absorb that.''

UBS, Credit Suisse's larger Swiss rival, booked a loss of 919 million francs in 1998 when the company said ``dramatic increases in volatility'' forced it to cut the value of some equity-derivative positions. The bank's statement said the positions included ``illiquid concentrations of market and event risks.''

Toronto-Dominion Bank and France's Credit Industriel & Commercial, or CIC, both incurred losses last year from structured-equity derivatives.

`Sweet Spot'

CIC, the investment banking arm of Paris-based Credit Mutuel, said in February it had losses of 320 million euros ($400 million) on equity derivatives related contracts in 2005. Toronto-Dominion, Canada's No. 2 bank, recorded about C$164 million ($145 million) of costs to close its structured-products unit outside North America. CEO Edmund Clark said in November that ``the reward for the risk isn't there.''

France's Societe Generale SA and BNP Paribas are the world's leaders in equity derivatives, said Kian Abouhossein, a London- based analyst at JPMorgan Chase & Co. Societe Generale's revenue from equity derivatives will reach $3.6 billion in 2007 and BNP Paribas's will be $2.4 billion, he estimates. Credit Suisse will have $1.1 billion of comparable revenue, he said.

Revenue from equity derivatives is increasing at an annual rate of 15 percent, Abouhossein said.

``Equity derivatives are going to be the hottest area, the sweet spot, for investment banking in the next couple of years,'' Abouhossein said. ``On the structured side, roughly 30 percent of revenues a year come from new products.'' (until the music stopps, bis zum bang)

Bankers Trust

Credit Suisse's equity-trading revenue rose 24 percent from 2003 to 2005, compared with 54 percent at Merrill Lynch & Co., 45 percent at Citigroup Inc. and 34 percent at Morgan Stanley. Equity-trading revenue fell 37 percent at New York-based JPMorgan in the same period.

Credit Suisse's revenue from equity trading rose 63 percent in the first half of this year, trailing gains of 81 percent at Goldman and 73 percent at Merrill.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home