Home Sweet Home Builders / technical analysis

bin zu meinem leidwesen kein experte in technischer analyse. finde es trotzdem interessant wie diese oft genug ins schwarze trifft.

dank geht ggg bear und schaeffersresearch

http://www.schaeffersresearch.com/commentary/observations.aspx?ID=17520

Behind the Headlines: Home Sweet Home Builders

Technical andSentiment Analysis of D.R. Horton (DHI), KB Home (KBH), and M/I Home (MHO)

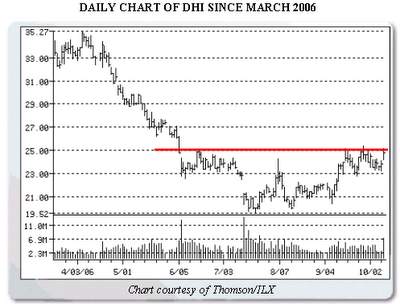

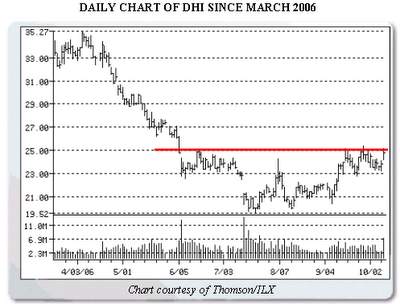

D.R. Horton: .......stopped by resistance at the 25 level. This region has hindered the stock's rally attempts since June. What's more, the 25 strike is the site of peak front-month call open interest with more than 16,400 contracts. This hefty accumulation of bullish bets could also serve as a layer of options-related resistance during the near term.

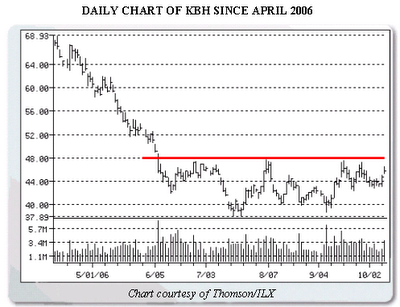

KB Home: ..... This area has tripped up the equity since June. However, the stock has a little room to run before it encounters potential options-related resistance. Peak October call open interest sits at the 50 strike, with roughly 10,200 contracts. In other words, the stock can increase approximately 9.3 percent before hitting the 50strike.

KB Home: ..... This area has tripped up the equity since June. However, the stock has a little room to run before it encounters potential options-related resistance. Peak October call open interest sits at the 50 strike, with roughly 10,200 contracts. In other words, the stock can increase approximately 9.3 percent before hitting the 50strike.

dank geht ggg bear und schaeffersresearch

http://www.schaeffersresearch.com/commentary/observations.aspx?ID=17520

Behind the Headlines: Home Sweet Home Builders

Technical andSentiment Analysis of D.R. Horton (DHI), KB Home (KBH), and M/I Home (MHO)

D.R. Horton: .......stopped by resistance at the 25 level. This region has hindered the stock's rally attempts since June. What's more, the 25 strike is the site of peak front-month call open interest with more than 16,400 contracts. This hefty accumulation of bullish bets could also serve as a layer of options-related resistance during the near term.

KB Home: ..... This area has tripped up the equity since June. However, the stock has a little room to run before it encounters potential options-related resistance. Peak October call open interest sits at the 50 strike, with roughly 10,200 contracts. In other words, the stock can increase approximately 9.3 percent before hitting the 50strike.

KB Home: ..... This area has tripped up the equity since June. However, the stock has a little room to run before it encounters potential options-related resistance. Peak October call open interest sits at the 50 strike, with roughly 10,200 contracts. In other words, the stock can increase approximately 9.3 percent before hitting the 50strike.

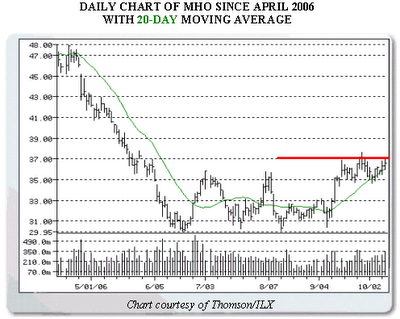

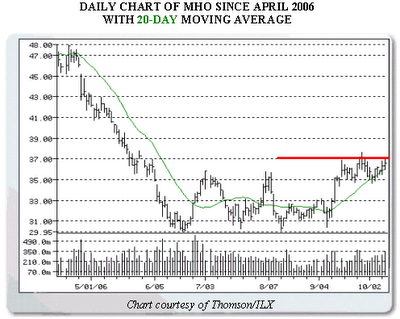

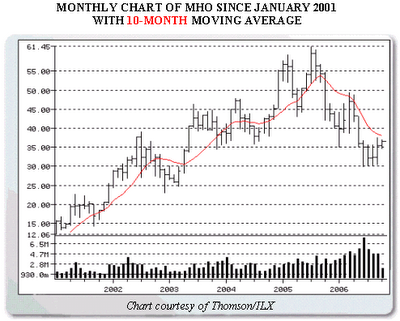

M/I Home: ...... but continues to be hampered by resistance at the 37 level. From a longer-term perspective, the equity has created a series of lower highs, and appears poised to start the next leg of its downtrend. Furthermore, the stock is facing staunch resistance at the 38 level, which is home to its 10-month moving average.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home