a lot of room for disappointments / Investors Are Turning Optimistic

only wall street can judge this kind of data and expect more gains...... . the wonderful thing is that that leaves a lot of room for disappointments.......

bei der faktenlage kann wohl nur wall street mehr gewinne erwarten. das positive daran ist das heir sehr vile enttäuschungspotential lauert......

dank geht an mish und sein http://www.markettradersforum.com/

http://www.nytimes.com/2006/11/26/business/yourmoney/26fund.html?_r=1&oref=slogin

.. 59 percent of fund managers now say they believe that the economy next year will remain as strong as it is now or will improve, according to a recent survey by Merrill Lynch. That’s up from 32 percent of fund managers who thought so in October

The percentage of investors who think that the economy is likely to slip into recession, meanwhile, has shrunk to 8 percent from 20 percent last month.

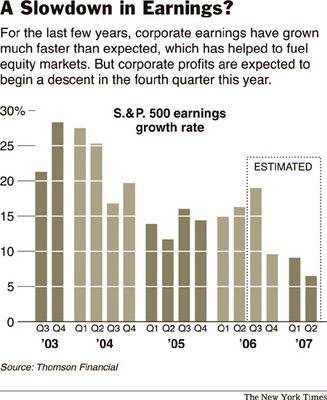

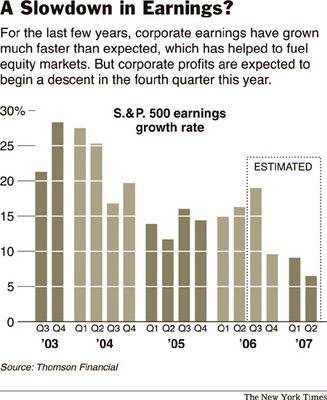

That’s not the whole story. Investors are also growing more bullish about the outlook for corporate profits. Today, half of all domestic fund managers think that earnings will remain steady or improve in the coming 12 months. A similar survey in September showed that only 18 percent felt that way....

IN reality, profits for most S.& P. 500 companies are growing much slower than 9.6 percent this quarter. If you stripped out the financial sector, where a profit surge of 32 percent is expected, corporate earnings would be likely to grow by only 3.1 percent......

bei der faktenlage kann wohl nur wall street mehr gewinne erwarten. das positive daran ist das heir sehr vile enttäuschungspotential lauert......

dank geht an mish und sein http://www.markettradersforum.com/

http://www.nytimes.com/2006/11/26/business/yourmoney/26fund.html?_r=1&oref=slogin

.. 59 percent of fund managers now say they believe that the economy next year will remain as strong as it is now or will improve, according to a recent survey by Merrill Lynch. That’s up from 32 percent of fund managers who thought so in October

The percentage of investors who think that the economy is likely to slip into recession, meanwhile, has shrunk to 8 percent from 20 percent last month.

That’s not the whole story. Investors are also growing more bullish about the outlook for corporate profits. Today, half of all domestic fund managers think that earnings will remain steady or improve in the coming 12 months. A similar survey in September showed that only 18 percent felt that way....

IN reality, profits for most S.& P. 500 companies are growing much slower than 9.6 percent this quarter. If you stripped out the financial sector, where a profit surge of 32 percent is expected, corporate earnings would be likely to grow by only 3.1 percent......

remember when you see this kind of data that a lot of the eps growth comes in the form of (often) debt fueled buybacks. the earningsquality isn´t always as good as wall street wants to make us believe.

bedenkt bitte bei betrachtung dieser grafiken das ein großer teil dieser gewinnzuwächse auf (oft) schuldenfinanzierten aktienrückkäufen basiert. die gewinnqualität ist also nicht immer so gut und schön wie wall street gerne unterstellt.

Labels: investor sentiment, pe

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home