is manhatten really different.......?

was wird aus diesem markt wenn irgendwann mal die bonuszahlungen von wall street ausfallen........?

Changing Course to Avert a Glut http://tinyurl.com/yhxlyw

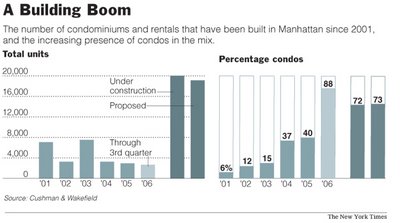

.....There are currently 28,258 new condominium units either under construction or being planned in Manhattan, ...Of these, 14,430 units are in buildings that have already broken ground, and 13,928 units are in buildings that are being planned. If they are all built, the total will approach the borough’s current stock of 36,000 condo units and will be equivalent to a fifth of Manhattan’s 138,000 co-op units,......

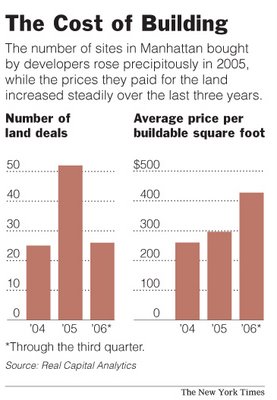

developers paid an average of $428 a square foot for sites to build on in Manhattan, far higher than the average of $297 a square foot they paid in 2005 or $260 a square foot in 2004. That means developers are going to have to add these high prices to increasing construction costs, making new projects much costlier over all.

In one case, Macklowe Properties paid $655 a square foot for the site of a combination hotel and condominium project at 53rd Street and Madison Avenue. That price doesn’t include construction costs or any other expenses associated with building. Now the developer has decided to put up an office tower instead (ouch!!!!, maybe blackrock will buy it......) http://immobilienblasen.blogspot.com/2006/11/reits-going-gaga-blackstone-to-buy.html

Labels: glut, ny, overbuilding

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home