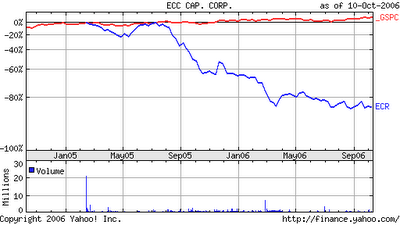

firesale / notverkauf subprime ecr an bear stearns

another investmentbank goes subprime. after morgan stanley, merril lnychhttp://immobilienblasen.blogspot.com/2006/09/notverkauf-bei-subprime-new.html, deutsche bank now bear.

man muß sich wirklich fragen was die "großen" gerade jetzt in diesem sektor suchen wo doch die aussichten sich doch gerade jetzt massiv verschlechtern (kreditrichtlinien, qualität, wirtschaftsabschwung etc). evtl. ist das aber auch ein zeichen das inzwischen auf der suche nach rendite einfach immer mehr risiken ausgeblendet werden.

you really wonder why they jump now in this segment. right when the fundamentals for this business are deterioating (new guidelines, creditquality, downturn in the economy etc.....). maybe this is a sign how desperate even the big ones try to find extra yield despite the rising risks

immerhin hat bear clevererweise nur die plattform und nicht die bisher emitierten papiere mit den ganzen risiken gekauft.

at least bear was so clever to buy only the plattform and no underlying assets with risks.

http://immobilienblasen.blogspot.com/2006/08/update-ecr.html

ECC Capital Announces Agreement to Sell Its Subprime Wholesale Mortgage Banking Division to Bear Stearns

http://biz.yahoo.com/prnews/061010/latu136.html?.v=34

After Hours: 1.49 0.45 (43.27%)

ECC Capital Corporation a mortgage finance real estate investment trust (REIT) that originates and invests in residential mortgage loans, today announced that it has entered into an agreement to sell certain operating assets used in its subprime wholesale mortgage banking division to Bear Stearns Residential Mortgage Corporation, an affiliate of Bear Stearns & Co., for approximately $26 million in cash and Bear Stearns' assumption of certain lease liabilities.

ECC Capital will retain other obligations arising from its subprime wholesale mortgage banking division, including but not limited to, loan repurchase obligations, remaining leases and personnel related liabilities. ECC Capital will also retain the majority of its core assets, including its residual interests in mortgage-backed securities and associated servicing rights.

no wonder nobody wants to buy them / kein wunder das die keiner kaufen will....http://immobilienblasen.blogspot.com/2006/08/update-ecr.html)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home