hypothekenanträge / mba mortages

dank geht an calculated risk

The Market Composite Index, a measure of mortgage loan application volume, was 599.1, a decrease of 5.5 percent on a seasonally adjusted basis from 633.9 one week earlier. On an unadjusted basis, the Index decreased 5.3 percent compared with the previous week and was down 13.3 percent compared with the same week one year earlier.

The seasonally-adjusted Refinance Index decreased by 5.8 percent to 1857 from 1970.8 the previous week and the Purchase Index decreased by 5.3 percent to 383.3 from 404.6 one week earlier.

The Market Composite Index, a measure of mortgage loan application volume, was 599.1, a decrease of 5.5 percent on a seasonally adjusted basis from 633.9 one week earlier. On an unadjusted basis, the Index decreased 5.3 percent compared with the previous week and was down 13.3 percent compared with the same week one year earlier.

The seasonally-adjusted Refinance Index decreased by 5.8 percent to 1857 from 1970.8 the previous week and the Purchase Index decreased by 5.3 percent to 383.3 from 404.6 one week earlier.

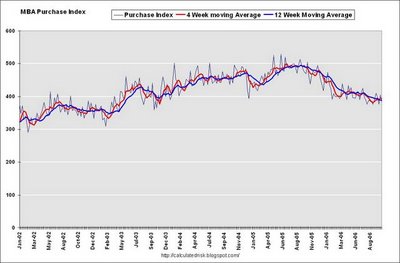

This second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002.

for much more details as always to one of the best in the blogworld http://calculatedrisk.blogspot.com/2006/10/mba-mortgage-applications-decrease.html

jetzt wird es langsam spannend um zu sehen ob die neuen richtlinien/guidelines für die kreditvergabe durchschlagen.http://immobilienblasen.blogspot.com/2006/10/lending-guidelines-kreditrichtlinien.html

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home