update ecr

bitte unbedingt den nachfolgenden link erst lesen um die aussagen des management mit denen vor 3 monaten im bezug auf ausreichende vorsorge zu vergleichen

http://biz.yahoo.com/prnews/060814/lam091.html?.v=54

highlights:

The loss for the three months ended June 30, 2006 of $18.6 million includes accounting adjustments to increase reserves $16.4 million for expected losses on repurchased loans and to mark certain loans to the lower of cost or market. In addition, during the second quarter of 2006, ECC Capital disposed of certain aged and repurchased inventory at a significant discount to par, which resulted in an overall loss on sale of loans (excluding accounting adjustments) of $5.5 million (vor drei monaten noch alles in butter und reserven ausreichend, schön zu sehen das der mbs markt doch nicht alles abnimmt und schrottkredite zurückgibt.)

provision for loan losses of $5.4 million, bringing its reserve for losses to a total of $48.9 million as of June 30, 2006. The reserve balance is 1.5% of the total unpaid principal balance of the loans as of that date. The provision for loan losses for the three months ended June 30, 2006 exceeds the $3.5 million provision for loan losses recorded for the three months ended June 30, 2005 as a result of the growth in and seasoning of ECC Capital's loan portfolio.

At June 30, 2006, total delinquencies were approximately 8.0% and serious delinquencies (greater than 90 days) were 4.3% of the unpaid principal balance on ECC Capital's portfolio of loans held for investment. The portfolio was unseasoned at June 30, 2005 and delinquencies were nominal. Delinquencies have increased as expected over the past several quarters as the portfolio has seasoned. ECC Capital believes that it is probable that losses have been incurred and has estimated those losses based upon management's experience in working with nonconforming portfolios. As the portfolio seasons, ECC Capital will experience additional delinquencies and foreclosures, and will realize losses upon the liquidation of the underlying collateral. As a result, management expects that the allowance for loan losses will continue to grow as the portfolio continues to season

http://biz.yahoo.com/prnews/060814/lam091.html?.v=54

highlights:

The loss for the three months ended June 30, 2006 of $18.6 million includes accounting adjustments to increase reserves $16.4 million for expected losses on repurchased loans and to mark certain loans to the lower of cost or market. In addition, during the second quarter of 2006, ECC Capital disposed of certain aged and repurchased inventory at a significant discount to par, which resulted in an overall loss on sale of loans (excluding accounting adjustments) of $5.5 million (vor drei monaten noch alles in butter und reserven ausreichend, schön zu sehen das der mbs markt doch nicht alles abnimmt und schrottkredite zurückgibt.)

provision for loan losses of $5.4 million, bringing its reserve for losses to a total of $48.9 million as of June 30, 2006. The reserve balance is 1.5% of the total unpaid principal balance of the loans as of that date. The provision for loan losses for the three months ended June 30, 2006 exceeds the $3.5 million provision for loan losses recorded for the three months ended June 30, 2005 as a result of the growth in and seasoning of ECC Capital's loan portfolio.

At June 30, 2006, total delinquencies were approximately 8.0% and serious delinquencies (greater than 90 days) were 4.3% of the unpaid principal balance on ECC Capital's portfolio of loans held for investment. The portfolio was unseasoned at June 30, 2005 and delinquencies were nominal. Delinquencies have increased as expected over the past several quarters as the portfolio has seasoned. ECC Capital believes that it is probable that losses have been incurred and has estimated those losses based upon management's experience in working with nonconforming portfolios. As the portfolio seasons, ECC Capital will experience additional delinquencies and foreclosures, and will realize losses upon the liquidation of the underlying collateral. As a result, management expects that the allowance for loan losses will continue to grow as the portfolio continues to season

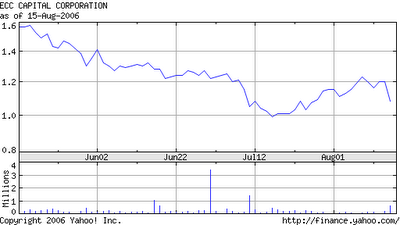

der chart spricht bände. zum vergleich vor einem jahr stand ecr bei über 7$.

gruß

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home