interview with alan greenspan

Breakfast with Al http://www.page88.co.za/cr/greenspanbreakfast.shtml

On the US housing market

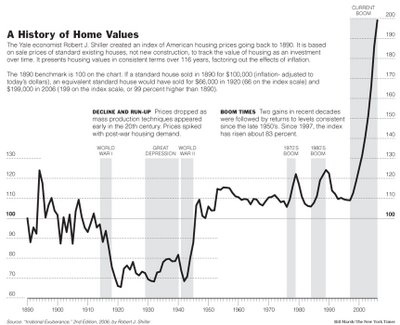

AG: I have never seen anything like the current US housing cycle before. Turnover used to be relatively stable but from about ten years ago turnover began to accelerate. It began to drive the whole asset price structure upwards. (du hast den bubble erst möglich gemacht, you pushed it!)

nur zur erinnerung. alan greenspan hat im juni 2005 "froth/schaum" im immosektor gesehen. just to remember, greenspan saw some "froth" in june 2005.

We now have a slowing down of that whole acceleration process. The level of mortgage rates is not really an issue, even now. (sicher/ sure)

However affordability has been squeezed because of the rise in property prices. We have not yet seen any decline in US house prices. It is hard to believe that we won't but Australian and UK experience suggests that the adjustment process might not be all that difficult.

However affordability has been squeezed because of the rise in property prices. We have not yet seen any decline in US house prices. It is hard to believe that we won't but Australian and UK experience suggests that the adjustment process might not be all that difficult.

watch this from australia / ein paar beispiel aus "down under"

http://immobilienblasen.blogspot.com/2006/08/trouble-in-down-under.html, http://immobilienblasen.blogspot.com/2006/09/down-under-gb-bubble-world-tour.html

das sieht für mich eher nach freefall und crash aus.

On China's capital markets and currency

AG: It's very evident dealing with regulators and the central bank in China that there is a cadre of very capable people who really understand how markets work in a way that is remarkable given that they were educated in a Marxist system. My impression is that reforms are moving forward however (interest) rates still can't move as rapidly as they should. (kommt vom richtigen..../ says the right guy....)

The PBOC is sterilising its intervention but it is only being partially successful and currency intervention is contributing to rapid growth in its monetary base. The potential threat to stability that this implies is large. China's economy is evolving rapidly and it needs flexibility in its financial and currency markets that it does not yet have.

On gold and commodity prices

AG: First of all separate gold from base metals. Base metals are going through a fairly broad inventory accumulation globally. This is the classic driver of industrial resource prices. It is likely to start to change because the inventory cycle is starting to change.

The gold price reflects something different. Gold is the ultimate means of payment in a fiat currency world. Gold is always acceptable. Its price is therefore driven by perceptions of geopolitical risk and it only needs a few people to move the price. This is the same factor that is driving the oil price. In other words the gold price has not been a measure of inflation risk. But it is a good representation of the tail of the curve of expectations of those people that are nervous about the future of the financial system

On negative US savings

AG: We have an interesting dichotomy in the US. If you ask individual households they say that they are saving enough. They point to the capital gains on their investment plans and their 401ks and in fact if you add the value of these capital gains to current income you do end up with decent savings. (wenn dir ein ergebnis nicht gefällt ändere einfach die parameter. diese statistik in eine der wenigen die in den letzten jahren nicht verwässert worden ist und zeigt egal wie man das drehen möchte neinen einbruch/when you can´t deal with the outcome change the statistic)http://immobilienblasen.blogspot.com/2006/08/zeit-fr-ne-neue-inflationsberechnung.html, http://immobilienblasen.blogspot.com/2006/08/statistikvoodoo-von-california.html

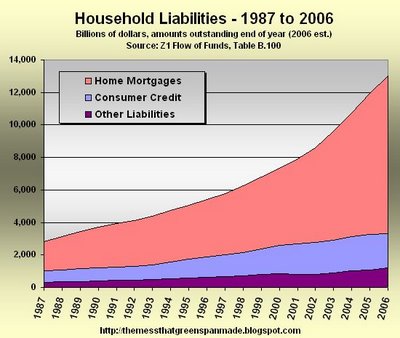

But the problem is that capital gains can't finance new capital investment. The accumulation of new assets can only be financed from saving out of current income. And the liability side of households' balance sheets is now increasing faster than the asset side in book value terms. The removal of equity from property has the effect of reducing the book value of household savings rates but is not seen as damaging by households. The issue is therefore going to relate to how quickly home equity extraction will slow as housing capital gains dwindle. There will then be a rising in saving out of current income and necessarily a fall in the growth of consumption. To date consumption is holding up better than I expected. (nicht mehr lange / this is going to change very soon)

On hedge funds

AG: The combination of hedge funds and private equity finance has been a huge innovation in finance. Also everyone now uses the hedge fund investment procedure to identifying niches. These can only exist where there are pricing inefficiencies. So the hedge fund mentality has eliminated these efficiencies. And increasing market efficiency increases flexibility. Hedge funds are the way of the future. (niches? i call it systematik risk! all chase the same assets and are more and more leveraged ) siehe hedge fonds blow uphttp://immobilienblasen.blogspot.com/2006/09/was-sind-schon-5billionen-verlust.html

Having said that, the number of junior partners that have left investment banking to go into hedge funds has created a surplus. And the law of supply and demand mean that when there is a surplus the price goes down.

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home