change of power / wachablösung

ist momentan ja auch praktisch. china liefert güter und bekommt dafür höchst angeschlagene $

und darf zum dank noch fragwürdigere us staatsanleihen oder schlimmer noch bonds von fannie mae und co erwerben. dadurch werden die zinsen niedrig gehalten und die usa können sich sowohl auf staats als auch privatebene weiter lustig günstig verschulden. wenn die chinesen dann man "real assets" wie z.b. die ölfirma "unical" von den knapp 1 trillionen $ kaufen wollen wird das wg. "nationaler interessen/sicherheit" unterbunden. wäre ich angepißt!

zudem haben die usa die nerven china wg. währungsmanipulation zum aufwerten ihrer währung zu drängen. bin mir sicher das dies vor allem dazu dient um die wähler zu beeindrucken. nicht umsonst ist die ganz drastische haltung gegenüber china in dieser frage ja auf dem g7 gipfel plötzlich abgeschwächt worden.

man muß die usa dafür bewundern das sie es immer noch schaffen täglich ca. 2,5b$ aus dem ausland anzuziehen um ihren konsumrausch und ihre ausufernden staatsausgaben und damit indirekt auch ihre militäroperationen (größter posten us haushalt) zu finanzieren. davor ziehe ich ehrlich meinen hut.

die rationalität der käufer kann ich aber beim besten willen nicht verstehen. sie bekomen zum dank ne (fast) negative realverzinsung und ne währung die zudem noch an boden verliert. china im besonderen kauft sich damit ausserdem noch massiv inflation ein. http://immobilienblasen.blogspot.com/2006/08/wie-rational-ist-china-importierte.html

dank geht an mish und sein http://www.markettradersforum.com/forum1/1752.html

In the Exporting Horse Race, It’s China by a Nose Over the U.S.

http://www.nytimes.com/2006/09/16/business/16charts.html?ex=1316059200&en=97fa34c75e389415&ei=5088&partner=rssnyt&emc=rss

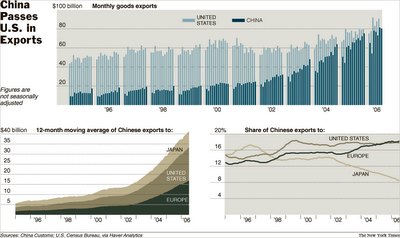

FIVE years ago, total United States exports were worth about three times as much as exports from China. China’s figure was growing — the ratio had been about 5-to-1 five years before that — but there was little doubt that it would be decades before Chinese exports equaled those of the United States.

But now it has happened.

This week, the United States reported it had exports of goods — a figure that excludes exports of services — of $80.313 billion in July. China had already reported its July figure, $80.337 billion.

It was the first month ever that China reported higher exports than the United States.

To be sure, the figures are not seasonally adjusted, something that China does not do for its statistics. If they were, it is probable that the United States would still be ahead, perhaps for a few more months.

Nonetheless, “there is no doubt about the trend,” said Robert J. Barbera, the chief economist of ITG. He noted that China had already released its August figure, showing an increase to $90.77 billion.

The large chart shown here gives monthly figures back to 1995, for both the United States and China. The other charts show the share of China’s exports going to its three largest trading partners: the United States, Europe and Japan. Those data use 12-month moving averages to smooth the figures.

As can be easily seen, exports to all three countries have soared over the years. But the final chart shows the market share of the three trading partners for Chinese exports over time, and there have been changes. Japan was China’s largest customer in the mid-1990’s, buying a sixth of what China sold at the peak.

But the United States moved into the No. 1 position in 1997 and held it until last year, when Europe — measured as a continent — began to take a larger share of Chinese exports than the United States.

One way to look at exports over a long period of time is to measure the compound annual rate of increase. For the 10 years through July, Chinese exports rose at an annual rate of 19.5 percent, quadruple the 4.8 percent rate of growth for the United States. (The figures are not adjusted for inflation, and are measured in dollars.)

By contrast, Germany’s exports rose at an annual rate of 7.0 percent, and it remains the largest exporter, with July sales of $92.7 billion. Growth rates were 5.0 percent for France, 7.5 percent for Spain and 5.6 percent for Britain. Japan, notwithstanding the fact it still runs substantial trade surpluses, showed export growth at a rate of just 4.0 percent.

China’s exports to the United States rose at an annual rate of 22.3 percent, faster than its overall rate but slower than the 23.3 percent growth rate of exports to Europe. Exports to Japan rose at a slower rate, 11.4 percent.

For the United States, exports to China have risen at an annual rate of 15.5 percent, the fastest growth in sales to any large country but not nearly enough to keep the trade deficit with China from becoming a political issue. But over the decade, exports to Japan have actually declined, at an annual rate of 1.6 percent.

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

5 Comments:

Grüss Got, JMF

I read lots of your postings and comments, also on 'thehousingbubbleblog'. Since yesterday evening it's impossible to get in. Are you having the same problem and do you know the reason.

Greetings from a Fleming in France.

bonjour :-)

thanks for the kind words.

yes. you´re right. i have also problems today.

havn´t tried it yesterday evening.

in the afternoon german time i have posted 2 or 3 stoeries on the "bits bucket" section.

greeting from the northsea

Ben must have major problems with his server.

http://housingpanic.blogspot.com/

Or, he has been 'frühstücken' with Alan Greenspan.

:-)

i know he has switched the servers in the last weeks.

lets hope that he is online as soon

as possibel.

for today it dosn´t matter because i´m going to hamburg to a concert

"billy talent / subways"

I got stuck in the '80, 'neunundneunzig luftballonen' kind of stuff.

I don't know Billy, but I'm sure he's got talent.

Have a nice concert!

Post a Comment

<< Home