hussman "signs of a downturn"

http://www.hussman.net/wmc/wmc060828.htm

signs of o downturn

highlights:

Still, given that the market hasn't yet experienced even a 10% correction, and that recession warnings continue to emerge, the likelihood of a sustained advance here seems fairly slim. Certainly stocks could advance for a while if investors focus on forward operating P/E's and adhere to the thesis that "the Fed is done and we've got a Goldilocks economy," but there's no statistical evidence that forward operating P/E's have predictive short-term value, nor that the market does anything favorable, on average, in the 18 months or so after the Fed finishes a rate-hike cycle.

With recession signals increasing (though not yet enough to predict a recession with a high probability), it's useful to remember that stocks generally turn lower before the economy, with a lead-time of about 6 months. That may very well be the window we've entered here.

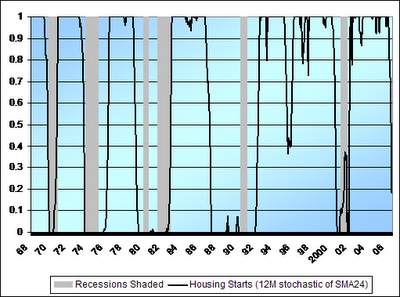

On the economy, the most recent data on housing starts continues to confirm a downturn in housing, which was also evident in the 4.10% drop in new home sales last month. That gives us a new point on our housing starts oscillator, which is already at a level consistent with potential recession.

Meanwhile, a few writers including Floyd Norris of the New York Times and Jim Stack of Investech have noted that new car sales are now down on a year-over-year basis. Norris notes that declines in new car sales by more than -2% on a year-over-year basis have always been followed by recessions. The latest year-over-year figure is -2.4%.http://immobilienblasen.blogspot.com/2006/08/car-dealer-indikator.html

In terms of price/volume behavior, Lowry's notes that the market's recent bounce hasn't been driven by measurably increased buying demand, but rather by a “backing off” of sellers. That's not characteristic of sustained market advances. In a solid market advance, you'll tend to see a persistence of strong upside volume and price action, rather than the tepid and sporadic “wait and see” attitude we've observed from investors in recent weeks.

As always, our investment position will respond quickly to any change in the Market Climate we observe, and I don't rule out the possibility that such a change could be favorable. Still, my impression is that the market is displaying a sort of “calm before the storm.”

Hope you had a good summer. Things may be about to get interesting.

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home