what about commercial real estate ?

wenn man die zahlen unten sieht und im jahr 2005 36 mio square feet, in 2006 46 mio square feet und in 2007 65 mio square feet an neuen flächen geschaffen werden muß man sich schon leise fragen ob sich das alles jemals rechnen kann.

ausser frage steht für mich das der gewerbliche bau auch nur ansatzweise die ausfälle des residential buildings wettmachen kann.

Building Materials Go Commercial

By Nicholas YulicoTheStreet.com Staff Reporter8/25/2006 7:20 AM EDT

Homebuilder stocks aren't the only ones that have been hammered by the housing-market slowdown

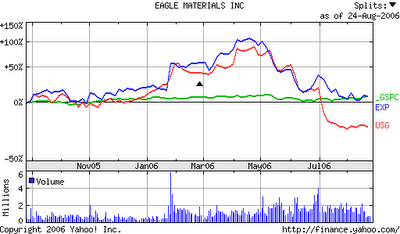

Shares of the homebuilders' suppliers have also taken a hit, as investors fret about the health of the residential construction market. In particular, USG Corp. (USG - news - Cramer's Take) and Eagle Materials (EXP - news - Cramer's Take), the two largest publicly traded building-material suppliers in the U.S., have both seen their share prices fall over 50% since April.

But with new-home construction slowing, material suppliers believe that building in the commercial real estate sector and home-remodeling market will offset the weakening demand. (sicher.....)

Both Eagle and USG specialize in providing gypsum wallboard, otherwise known as drywall, or "Sheetrock," which is the brand that USG sells. Wallboard represents the bulk of USG's revenue and about 50% of Eagle's business (the company also sells a lot of cement).

Rough estimates from analysts and materials suppliers say that 40% to 50% of wallboard demand comes from new residential construction. And there's little doubt the residential market is slowing, as evidenced by Thursday's disappointing new-home sales data and bleak forecasts from homebuilders such as Toll Brothers (TOL - news - Cramer's Take) and D.R. Horton (DHI - news - Cramer's Take).

The remaining wallboard demand comes from nonresidential commercial construction and home remodeling. Over the past few years, building suppliers were cranking out so much wallboard because of booming new-home sales that they didn't have to worry about trends in the other two segments.

Now the companies are banking on strength in the commercial construction market and home-remodeling market to prevent wallboard prices from declining.

A recent report from Longbow Research said wallboard demand began slowing in July, even though pricing remained stable. Since the wallboard industry is currently operating at a mid-90% capacity utilization rate, analysts say it could take some time for prices to drop."This industry is absolutely maxed in terms of capacity right now," says Jefferies & Co. analyst Craig Peckham. Additional factories have been announced, but won't come online until the second half of 2007, he says. Even if pricing holds up, unit volume is set to slow along with the housing market. (das nenne ich schlechtes timing..../bad timing.....)

"If 40% to 50% of your business is coming from new residential construction, it's very difficult to grow units in the aggregate," Peckham says.

Still, while most investors have already cut forecasts on the residential wallboard side, an additional question is where construction trends are heading in the remodeling and commercial real estate markets. Initial indications are that both markets remain strong, but it's questionable how meaningful these segments really are to these suppliers.

USG declined to comment for this story. An Eagle spokesman said the company's chief executive is away and unavailable to comment.

Nonresidential construction spending totaled $303 billion in June, up from $249 billion a year earlier, according to Census Department data. During the same period, residential construction spending remained flat at around $642 billion.

Construction is increasing across all major commercial property segments, but office is leading the boom, according to real estate data provider Reis Inc.

After construction peaked in the office sector in the 1999 to 2001 period, new development fell off after the dot-com bust. But as office vacancy rates continue to drop, developers are now more willing to build. This year, about 47 million square feet of new office space is expected to be completed, up 30% from last year, according to Reis. Next year, office completions are projected to increase 37% to 65 million square feet, which signals strong demand for wallboard suppliers. (nächster bubble?)

Of course, there are some wild cards in the commercial real estate market

"The primary risks are around the job market," says Sam Chandan, chief economist with Reis, citing the government's recent weak new jobs data. "If the market underperforms through the end of 2006 on a consistent basis, developers may be concerned that pre-leasing might not materialize for planned projects." ( wie aktuell bei den condoprojekten zu beobachten)

Another concern is rising construction costs, which threaten to curtail some medium-term development, Chandan says. The producer price index for construction materials increased 8.3% in July from a year earlier.

On its fiscal first-quarter earnings call in late July, Eagle Materials CEO Steve Rowley said the overall wallboard market remains strong.

"All the indicators are that commercial construction is really buoying up the demand for wallboard," he said. He also said, however, that Eagle's overall forecast for wallboard demand might shift if housing starts fell below the 1.85 million annualized mark in June. Government data released in mid-August showed the annualized level falling to 1.75 million.

The remodeling side of the business is a trickier one to gauge for Eagle and USG. In the second quarter, the National Association of Homebuilders' Remodeling Market Index fell to 45.6 from 48.1 in the first quarter, which shows that a majority of remodelers view market conditions as declining.

However, the remodeling market should remain healthy, says Vince Butler, the chair of NAHB's Remodelers Council and owner of Butler Brothers, a private builder based outside Washington, D.C.

"As long as rates stay low, historically, remodeling has been very strong when new-home starts or resales slow," he says.

Butler says a recent new client of his exemplifies the issue. The couple were early retires looking to sell their home and move out of the area. However, after several months of not getting offers on their house, the homeowners decided to wait out the real estate market and sink some money into their homes.

Of course, even if remodeling remains strong, wallboard demand from this segment represents a much different business for Eagle Materials and USG. Remodeling requires less material than building a new house.

"Most remodeling projects use wallboard, but probably not in quantities that the manufacturers would like to see," Butler says.

Still, despite all these factors, some bulls on Eagle and USG say the stocks are cheap and already factor in a declining business.

"People shouldn't be buying these stocks because they think the wallboard market has a lot of growth over the next 12 months because it doesn't," says Peckham, the Jefferies analyst, who rates USG a buy, but doesn't cover Eagle. "The stock is a buy because the market has undervalued the cash-flow stream for next year."

One believer is Warren Buffett. Since early August, Buffett's firm Berkshire Hathaway (BRK.A - news - Cramer's Take) has purchased 2.1 million shares of USG to raise its stake to 15.6 million shares, or about 17.3% of the company. (deep under water, sogar buffet macht mal fehler bzw. hat ein schlechtes timing)

gruß

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home