credit availability / kass+cara

I alerted readers early to the developing fungus in subprime lending months ago. Not surprisingly, the perma bulls, buoyed by an unrelenting bull market, denied the existence of this turn in credit quality and experience. Bears like myself were seen as Cassandras -- incapable of seeing a glass half full.

I alerted readers early to the developing fungus in subprime lending months ago. Not surprisingly, the perma bulls, buoyed by an unrelenting bull market, denied the existence of this turn in credit quality and experience. Bears like myself were seen as Cassandras -- incapable of seeing a glass half full. We warned that years of abusive mortgage lending were destined to lead to rising credit losses and debt downgrades, and we called attention to the vulnerability of subprime (the BBB-tranche of the ABX Index), which at the time was trading near par at 100.

Meanwhile, the price of the BBB- (subprime) tranche of the ABX Index steadily declined from par to the low 80s. ( now already at 69! / see chart!) "Don't worry, be happy" was the clarion call of the bulls, the logic being that a healthy economy and rising employment would contain the problem.

Indeed, credit contractions and credit crises typically come in periods of prosperity -- they occur when least expected as leverage and lending are abused. Such was the case with the implosion of the junk bond market in the 1980s and in the failure of Long Term Capital in the late 1990s.

Indeed, credit contractions and credit crises typically come in periods of prosperity -- they occur when least expected as leverage and lending are abused. Such was the case with the implosion of the junk bond market in the 1980s and in the failure of Long Term Capital in the late 1990s. Those who pooh-pooh the potential contagion of subprime lending say that we have not yet seen expanding credit losses in prime mortgage lending. Unfortunately, we will, as even prime borrowers partook in the teasers that produced the rapid growth in the mortgage market. But teasers are just that -- not permanent -- and re-sets will produce strain and credit losses in the prime market in the months to come.

As my stock Bible says, defaults beget reassessments of risk. This begets a pullback in lending and a turn in the credit cycle, which begets an economic contraction.

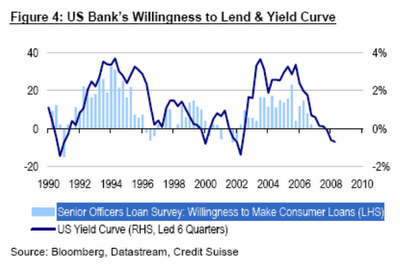

So even more important than rising prime mortgage lending credit losses, foreclosures and delinquencies is the impact that a more circumspect mortgage-lending community will have on consumer spending. In each of the downbeat homebuilder conference calls over the past week, managements emphasized that mortgage lenders were reining in credit. And my contacts with originators in the subprime and prime market lending communities confirm the current pullback in lending -- and the more stringent standards being imposed.

The chart , provided by Goldman Sachs, the Department of Commerce and the Federal Reserve Board, shows the relationship between credit availability and real personal consumption expenditures, and it speaks volumes about the future for consumer spending ... and, in time a overall reassessment of risk and credit spreads.

The chart , provided by Goldman Sachs, the Department of Commerce and the Federal Reserve Board, shows the relationship between credit availability and real personal consumption expenditures, and it speaks volumes about the future for consumer spending ... and, in time a overall reassessment of risk and credit spreads.

i think the impact this time is postponed because of the "willingness to lend" to private equity. this chart must have gone parabolic..........when you look at charts liek this lbo chart remember that only a tiny portion is equity and the rest is leverage/debt/credit

denke das der einfluß dieses mal keine auswirkungen zeigt bzw gezeigt hat weil die bereitschaft an private equity gelder zu verleihen amok gelaufen ist. man sollte zudem bedenken wenn man sich den chart ansieht das nur ein winziger tiel eigenkapital der private equity ist und der rest kredit/schulden

Labels: credit availability, tightening credit, willingness to lend

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)