paying twice / hussman

good stuff!

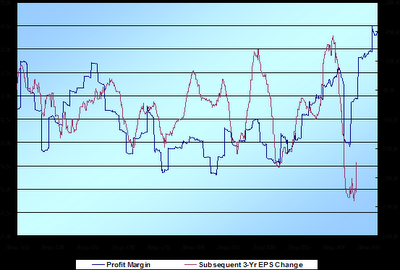

At present, I don't see much value in this market. As I've frequently noted, investors are currently paying rich P/E multiples on peak earnings, and those peak earnings are based on record profit margins. In effect, they are paying a premium - twice - for every dollar of normalized earnings. While profit margins have historically been both cyclical and mean-reverting (so high margins tend to normalize over the full economic cycle), the recent upswing has been unusually strong, but I suspect just as temporary.

If profit margins were anywhere near historical norms (even in the healthy range that we saw during the 1990's), the P/E ratio on the S&P 500 would currently be about 23, still on record earnings. Bill Hester has an outstanding research piece on profit margins this week: Profit Margins, Earnings Growth, and Stock Returns. (I'll add another link to his article at the end of this comment).make sure you read the whole pieceabout margins!!!!/must read!!!!!! http://www.hussmanfunds.com/rsi/profitmargins.htm

bigger/größer to see details/scale http://www.hussmanfunds.com/rsi/profitmarginsh.gif

That said, there's still a good amount of relative value ..... The difficulty, as I've noted lately, is that our normally strong stock selection approach has lagged the major indices by about 3% over the past 6 months. Short periods like that are nothing unusual, but at present, it makes for flat and unimpressive returns at the exact time that the indices are enjoying a speculative blowoff.

The more-than-doubling of the NYMEX initial public offering on Friday was also interesting. The equities of securities exchanges like the NYSE and NASDAQ, among others, have soared lately. Among offbeat indicators of sentiment used to be the price of seats on the NYSE (which are now no longer traded). Soaring seat prices were generally a good sign of the exuberance of market tops. Friday's NYMEX “shooter” brought that element together with a bubbling IPO market, and is an indication of the increasingly speculative tone of the stock market here......

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home