housing´s hidden headache / barrons mal wieder bearishh

wie man allerdings vom august http://immobilienblasen.blogspot.com/2006/08/barrons-bullish-on-homebuilder-mal.htmlwo die homebuilder als valueaktien gepriesen worden sind binnen 4 wochen genau diesen valuegedanken wieder in frage stellt ist doch schon mehr als merkwürdig.

http://tinyurl.com/g682f

HOME BUILDERS HAVE THRIVED IN THE PAST five years as easy money fueled enormous demand for houses -- as well as abundant supply. The role of low interest rates and novel loan structures in helping buyers enter the market -- or trade up to McMansions -- has been well-documented. Less understood is the potentially problematic financing that has enabled developers to increase their supply of land to meet, and perhaps exceed, this unprecedented demand.

Unlike in past housing cycles, when they borrowed heavily from banks, home builders today also use options and off-balance-sheet joint ventures to buy land. When times were flush, these financing vehicles enabled the industry to expand without bulking up its debt. But now that the housing market has weakened, land options and joint ventures could come back to haunt some companies, their financial partners and the broader economy -- not to mention stockholders. (off balance sheet um schulden nicht in bilanzen aufzeigen zu müssen... hatten wir doch schon mal, oder?)

The pain could be twofold: If orders dry up and home builders are forced to write off their option deposits or joint-venture investments, which are considered assets, some could face substantial hits to book value. Alternately, builders' earnings could be nicked if joint-venture gains turn to losses.

Housing bulls argue that concerns about the deteriorating health of the residential real-estate market largely are reflected in building-company shares. After all, the Standard & Poor's Supercomposite Homebuilding Index is down 41% from its high of July 2005. If the housing recession proves mild and short-lived, the stocks could rally, much as Barron's argued in a cover story in late Augusthttp://immobilienblasen.blogspot.com/2006/08/barrons-bullish-on-homebuilder-mal.html. So far, that's been a savvy call: Most are up almost 20% from their lows this past July.

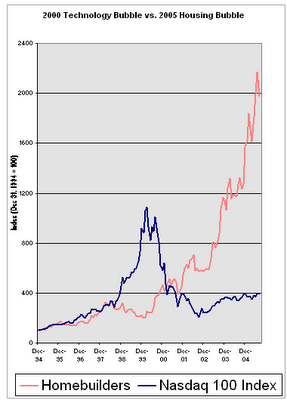

(dank geht an charles hugh smith für chart nasdag/homebuilder)

If the downturn is severe and protracted, however, as it may be in locales where home prices and speculative development have soared, the industry's use of options and joint ventures is likely to prolong the pain. "The home builders are going to abandon a significant amount of their options and attempt to dissolve the joint ventures that no longer meet their return requirements," Ivy Zelman, an analyst at Credit Suisse, predicts.

Most housing companies today trade at slight premiums to book value, which is considered a more reliable indicator of their worth than price-earnings multiples. And any impairment to book (roughly defined as assets minus liabilities) could result in similar markdowns in the companies' shares.

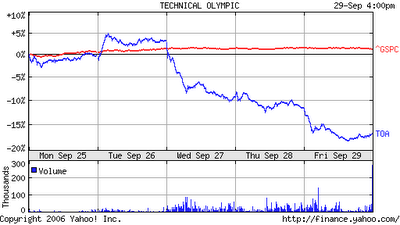

FOR SOME COMPANIES, the problems of Technical Olympic USA (ticker: TOA) may be a sober warning. Last week the U.S. unit of the Greek construction company announced that, because of softness in the Florida real-estate market, the revised sales and delivery projections of one of its residential joint ventures won't be adequate to support the JV's capital structure. The company is requesting waivers from its lenders regarding potential defaults, among other things.

http://biz.yahoo.com/pz/060927/105875.html

The JV was created in August 2005 to buy the assets of Transeastern Properties of Coral Springs, Fla., and was financed aggressively, with equity equal to only 20% of the purchase price, versus the 40% common in most JV deals. News of its problems sent Technical Olympic's shares down about 15% on the week, to 9.83, though it had been trading below book value before the disclosures.

The company's senior and junior debt fell to levels implying its equity in the JV and loans and advances to the JV, which total $141 million, could be wiped out. The company, which has said it does not intend to contribute additional capital to the venture, declined to comment. But Technical Olympic's parent acknowledged in a press release that in a "worst-case scenario," its sub would take an after-tax charge of $89 million, or $1.50 a share. It estimates book value will decline 4% from the June quarter.

"This won't be the only company that will affected," says Alex Barron, a senior housing analyst at JMP Securities in San Francisco. "All the other home builders will have writedowns of joint ventures, option deposits and land on their balance sheets."

| company | ticker | option deposits / book | JVs / book | price / book | P/E |

| NVR | NVR | 64% | 2% | 3.2 | 8.5 |

| Technical Olympic | TOA | 42% | 23% | .5 | 4.9 |

| Lennar | LEN | 23% | 25% | 1.3 | 12.8 |

| Hovnanian | HOV | 22% | 11% | 1.0 | 9.5 |

| Beazer Homes | BZH | 20% | 7% | 1.0 | 10.9 |

| Standard Pacific | SPF | 7% | 18% | .8 | 9.6 |

| KB Home | KB | 5% | 13% | 1.4 | 8.7 |

| Ryland | RYL | 13% | 1% | 1.4 | 8 |

BULLISH INDUSTRY ANALYSTS BELIEVE concerns about option-deposit and joint-venture writedowns are overblown.

But that might not be true for some companies with large exposure. At NVR (NVR), a Reston, Va., builder, $642 million of option deposits account for as much as 64% of book value. With the shares trading at 553 apiece, or 3.2 times book, investors appear to have given little consideration to the possibility of writedowns. The company declined to comment.

Hovnanian Enterprises (HOV) and Beazer Homes USA (BZH) also could be vulnerable; their options deposits each equal at least 20% of book. Other companies, such as MDC Holdings (MDC) and D.R. Horton (DHI) have little exposure.

"We've used land options for decades. We think they are a very efficient use of capital," says J. Larry Sorsby, CFO of Hovnanian, in Red Bank, N.J.

Beazer, based in Atlanta, didn't return Barron's calls.

Some home builders already have walked away from land deals and taken modest losses. Miami-based Lennar (LEN) last week reported it wrote off $15.8 million in option deposits and related costs and made a "$16.5 million valuation adjustment" to the company's joint ventures, which contributed to a $5.9 million joint-venture loss in the third quarter, versus a gain of $16.8 million a year ago. Total profits in the latest quarter, ended August, fell to $206.7 million from $337.3 million a year earlier.http://immobilienblasen.blogspot.com/2006/09/lennar-warns-again.html

By using land options and development joint ventures, Lennar doesn't have to take on 100% of the risk of a project, explains Bruce Gross, the company's CFO. It also can team up with strategic partners to enter new markets or to buy large parcels of land. Many JVs were created years ago and have significant pent-up value, he adds.

Among the country's major home builders, Lennar has the largest exposure to joint ventures; $1.45 billion of equity in these ventures represents about 25% of the company's book value. That's in addition to $1.3 billion of option deposits and lines of credit outstanding, equal to an additional 23% of book.

At Standard Pacific (SPF), an Irvine, Calif.-based builder, equity in joint ventures amounts to 18% of book value. At KB Home (KBH), in Los Angeles, it represents 13% of book, and at Hovnanian, 11%.

Other companies, including MDC Holdings and D.R. Horton, have no joint-venture exposure. Standard Pacific and D.R. Horton didn't return calls. MDC and KB Home declined to comment.

While all option deals are structured differently, their intent is the same: A home builder that wants to buy land for future use but doesn't want to put the property -- or the debt needed to purchase it -- on the balance sheet, buys an option to purchase the land from its owner at a set price over an agreed-upon period.

When the land is owned by a farmer, industry experts say, the option might cost 5% of its full, agreed-upon value. When an investor group, known in the industry as a land bank, owns the property, terms typically have been much steeper, with deposits ranging from 10% to 20%. In addition, a builder subsequently might make monthly payments of 15% to 20% of the value of the land, minus the deposit -- well above the 6.5% to 9% it would cost to borrow funds in the capital markets.

Some of the largest land bankers include IHP Capital Partners, Acacia Capital and Hearthstone. Hedge funds such as Stark Investments and Farallon Capital Management reportedly have jumped into the business, as well; both declined to comment. "I've seen a lot more hedge-fund involvement over the last five years," says Dale Goldsmith, a lawyer with Armbruster & Goldsmith, a Los Angeles firm specializing in land use and entitlements. (klar das hedge fonds und private equity nicht fehlen dürfen)

In turning to land bankers, are home builders really using "financing that's hidden?" asks Joseph Snider, a senior credit officer at Moody's Investors Service. Moody's now rates the home builders based on numbers adjusted for option and joint-venture liabilities. While it has yet to change any debt ratings, Snider warned in a recent report that companies with significant use of options and joint ventures should increase disclosure of their terms and related liabilities or face the risk that these deals will put downward pressure on their ratings relative to companies with less complex structures.http://immobilienblasen.blogspot.com/2006/08/immobilienblasen-homebuilder-bonds.html

In recent years, land options have worked wonderfully. Most have a duration of three to five years, and those acquired before 2003 are money good if exercised this year, given the enormous appreciation in land values. Writeoffs have been small to date; Zelman of Credit Suisse estimates that the home builders have written off nearly $300 million in option deposits through this year's second quarter, a small fraction of industry earnings.

The numbers could grow, however, if the price of land tanks, along with housing prices. Home builders don't disclose when their options were struck. Nor do they reveal the economics of options and joint ventures, Moody's notwithstanding. At most, companies say they review their option and joint-venture investments each quarter, writing down deals as necessary.

IF HOME BUILDERS WALK AWAY FROM LAND OPTIONS, the impact is likely to be widespread. The land owner presumably would shop the property anew, and at a reduced price, particularly if it has associated debt.

Jeff Barcy, CEO of Hearthstone, a San Francisco-based land banker with access to $4 billion of equity capital, cites a deal in which a publicly traded home builder recently walked away from an option to buy land in Florida for $60 million. The parcel recently was resold for $32 million.

The Florida deal "definitely put pressure on the broader market, and affects all the deals" in that market, Barcy says. "Everything is connected in a local market. We're seeing more weakness across the U.S. on a daily basis."

A number of home builders have said they're working to renegotiate the terms of some of their land options, in the hope of reducing purchase prices or extending the time periods in which they agreed to exercise them. If they don't reach acceptable terms, some indicate they'll walk.

Hovnanian Enterprises, which has $454 million of option deposits and letters of credit outstanding, wrote off $11.4 million of deposits in its fiscal third quarter, ended July, and expects to walk away from additional options, says CFO Sorsby.

Management told analysts it couldn't quantify the exact impact of option renegotiations until such talks conclude. Therefore, its earnings guidance for its fiscal fourth quarter ranges widely, from $1.05 a share to $1.80. Hovnanian's stock has been among the industry's strongest performers of late, up about 20%, to 30, since Aug. 14. Still, it's down more than 50% from its highs in 2005.

If home builders forfeit their option deposits, they could face additional costs. Among other things, they might have to spread the sunk costs of developing a community -- which range from architectural plans to the construction of model homes and swimming pools -- over fewer homes, one land banker explains.

There's also reputation risk. "Companies with 50 homes built don't want to walk away from [unfinished] communities. It would kill their reputations," says John Burns, president of John Burns Real Estate Consulting in Irvine, Calif.

Joint ventures, too, have allowed home builders to buy land, and even other builders, while keeping both the land and leverage off their balance sheets.

For example, a developer seeking to purchase a $100 million piece of land with 40% equity might put up $19.6 million, or 49% of that equity stake, with a partner contributing $20.4 million, or 51%. The JV would fund the remaining $60 million with debt, which, because the builder's equity stake is less than 50%, would not appear on the company's books. Private-equity funds have been active participants in such deals

Lennar used a joint venture to purchase the 3,718-acre El Toro Marine base in Irvine last year, with equity partners including MSD Capital, the investment vehicle for Michael Dell; Rockpoint Group; and Blackacre Institutional Capital, the real-estate arm of Cerberus Capital Management, a hedge fund.

Hovnanian likewise used a joint venture in 2005 to acquire the assets of Town & Country Homes, a Lombard, Ill., home builder. Its equity partner: Blackstone Real Estate Advisors. Hovnanian's total investment in unconsolidated joint ventures was $217 million at the end of the July quarter, about 11% of its book value.

So far, none of the nation's top 13 home builders, save Lennar, appears to have written off equity in joint ventures. On the other hand, earnings from joint ventures have declined at some companies. Beazer's share of income from joint ventures declined to $127,000 in the June quarter, from $2.95 million a year earlier.

Some home builders guarantee the debt of their joint ventures, which could come back to bite them if market conditions worsen. Lennar, for example, guarantees $1.2 billion of debt for its JVs and enters into option contracts to buy land from them. When the builder is also the guarantor, industry insiders say, a joint venture tends to get more favorable terms from lenders. But if things unravel, the company could wind up with a lot more debt than it discloses on its balance sheet.

In a worst case, or one close to it, the home builder might opt to prop up a joint venture with additional equity financing. If its interest exceeds 50%, under accounting rules it would have to consolidate the JV, with all its liabilities, into its own operations.

Every real-estate cycle is different, and it's too soon to tell whether this one will end with a whimper or a bang -- one that rivals, and maybe exceeds, the Nasdaq's collapse in 2000. Land options and off-balance-sheet joint ventures are designed to mitigate corporate risk in the event of calamity. If market conditions worsen, however, they might provoke it.

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home