refinanzierungen bei freddie mac

ähnlich wie ebi uns zum tüv geht man in den staaten anscheinend zur bank/broker um seinen hypothekenkredit umzuschulden oder vornehmer ausgedrückt zu refinanzieren. the american way of life

http://www.freddiemac.com/news/archives/rates/2006/2Qupb06.html

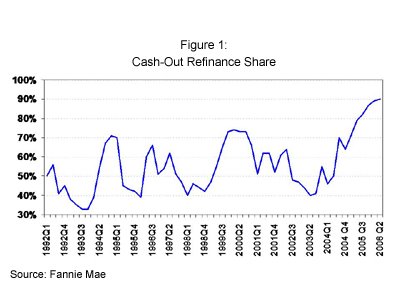

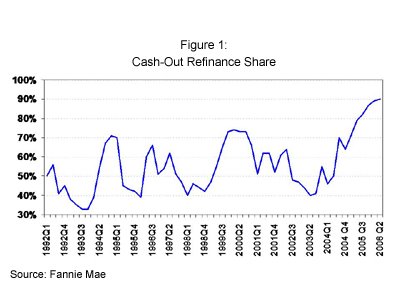

REFINANCE ACTIVITY SLIPS, BUT STILL REMAINS STRONGER THAN EXPECTED IN SECOND QUARTER

Cash Out Figures Have Not Been Higher Since Second Quarter of 1990

highlights:

McLean, VA – In the second quarter of 2006, 88 percent of Freddie Mac-owned loans that were refinanced resulted in new mortgages with loan amounts that were at least five percent higher than the original mortgage balances, according to Freddie Mac's quarterly refinance review. This percentage is up from the first quarter of 2006, when the share of refinanced loans that took cash out was a revised 86 percent, and is the highest since the second quarter of 1990. (fast 90% ziehen also neue kohle aus den krediten und schichten nicht wg. günstiger raten um)

"The incentive to take cash out of home equity is partially driven by the rapid rise in short-term interest rates like the prime rate. Many borrowers have seen their rates on home equity lines of credit – which are tied to the prime rate – rise. Now they are consolidating those HELOC loans into a new first lien mortgage to reduce their mortgage payments," said Amy Crews Cutts, Freddie Mac deputy chief economist. "This quarter we saw $81.0 billion cashed out, up from a revised $74.1 billion cashed out in the first quarter of 2006. Cash out activity should remain strong throughout the rest of the year as interest rates are expected to continue to gently climb. (und das alleine bei freddie mac!)

This is second consecutive quarter in which the median refinance borrower increased the rate on their first lien mortgage. For the 20 quarters prior to 2006, the median refinance borrower was reducing his or her first lien mortgage rate."

("endlich!" möchte man fast sagen steigen die finanzierungskosten so das die kreditnehmer jetzt zumindest nen höheren zinssatz zahlen müssen )

The Cash-Out Refinance Report also revealed that properties refinanced during the second quarter of 2006 experienced a median house-price appreciation of 33 percent during the time since the original loan was made, up from 31 percent in the first quarter 2006. For loans refinanced in the second quarter of 2006, the median age of the original loan was 3.2 years, about two months older than the median age of loans refinanced during the first quarter of 2006.

(donnerwetter. im schnitt alle 3 jahre zur refinanzierung. schonmal den nächsten termin im kalender eintragen.........lustig auch das die kredite auf basis des äußerst brüchigen wertzuwachses gegeben werden. die verbrieften abs von freddie und fannie werden übrigens lustig von den notenbanken, pensionskassen usw gekauft.)

möchte nur noch mal auf die dimensionen hinweisen. die haben per ende 2005 1,68 trillionen $ an hypotheken in ihrer bilanz stehen.

die schwester faennie ist noch größer und hat seit ca. 2 jahren keine bilanz mehr vorlegen können. es gibt wohl ein paar kleine probleme mit bewertung von zinsderivaten. wahrscheinlich besser wenn die nie mehr ne bilanz vorlegen......

the american way of life sucks.

gruß

jan-martin

http://www.freddiemac.com/news/archives/rates/2006/2Qupb06.html

REFINANCE ACTIVITY SLIPS, BUT STILL REMAINS STRONGER THAN EXPECTED IN SECOND QUARTER

Cash Out Figures Have Not Been Higher Since Second Quarter of 1990

highlights:

McLean, VA – In the second quarter of 2006, 88 percent of Freddie Mac-owned loans that were refinanced resulted in new mortgages with loan amounts that were at least five percent higher than the original mortgage balances, according to Freddie Mac's quarterly refinance review. This percentage is up from the first quarter of 2006, when the share of refinanced loans that took cash out was a revised 86 percent, and is the highest since the second quarter of 1990. (fast 90% ziehen also neue kohle aus den krediten und schichten nicht wg. günstiger raten um)

"The incentive to take cash out of home equity is partially driven by the rapid rise in short-term interest rates like the prime rate. Many borrowers have seen their rates on home equity lines of credit – which are tied to the prime rate – rise. Now they are consolidating those HELOC loans into a new first lien mortgage to reduce their mortgage payments," said Amy Crews Cutts, Freddie Mac deputy chief economist. "This quarter we saw $81.0 billion cashed out, up from a revised $74.1 billion cashed out in the first quarter of 2006. Cash out activity should remain strong throughout the rest of the year as interest rates are expected to continue to gently climb. (und das alleine bei freddie mac!)

This is second consecutive quarter in which the median refinance borrower increased the rate on their first lien mortgage. For the 20 quarters prior to 2006, the median refinance borrower was reducing his or her first lien mortgage rate."

("endlich!" möchte man fast sagen steigen die finanzierungskosten so das die kreditnehmer jetzt zumindest nen höheren zinssatz zahlen müssen )

The Cash-Out Refinance Report also revealed that properties refinanced during the second quarter of 2006 experienced a median house-price appreciation of 33 percent during the time since the original loan was made, up from 31 percent in the first quarter 2006. For loans refinanced in the second quarter of 2006, the median age of the original loan was 3.2 years, about two months older than the median age of loans refinanced during the first quarter of 2006.

(donnerwetter. im schnitt alle 3 jahre zur refinanzierung. schonmal den nächsten termin im kalender eintragen.........lustig auch das die kredite auf basis des äußerst brüchigen wertzuwachses gegeben werden. die verbrieften abs von freddie und fannie werden übrigens lustig von den notenbanken, pensionskassen usw gekauft.)

möchte nur noch mal auf die dimensionen hinweisen. die haben per ende 2005 1,68 trillionen $ an hypotheken in ihrer bilanz stehen.

die schwester faennie ist noch größer und hat seit ca. 2 jahren keine bilanz mehr vorlegen können. es gibt wohl ein paar kleine probleme mit bewertung von zinsderivaten. wahrscheinlich besser wenn die nie mehr ne bilanz vorlegen......

the american way of life sucks.

gruß

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home