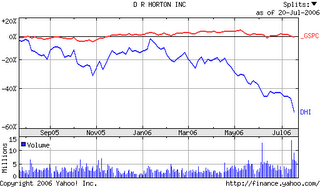

bernanke vs. dr horton

Friday, July 21, 2006

Cajoling the Markets

2006-07-21Today's Thought of the Day comes from John Succo at Minyanville.

http://www.minyanville.com/

Cajoling the Markets

The comparison of what Mr. Bernanke said to Congress..."the housing market slowdown appears to be orderly decline"...to what the CEO of DR Horton (DHI) said..."sales are falling off the Richter scale"...should say a lot of how the government attempts to cajole markets. (dr horton ist der größte builder in den usa mit ca. 50.000 einheiten p.a. und baut im ganzen land)

The company "senses there are three to four quarters of inventory adjustments ahead for homebuilders."

From the flawed statistics they release to their subjective commentary, I can't believe anyone still listens to them.

Government intervention and control of markets has a very negative cumulative effect. Easy credit allows unproductive companies to survive when they should not. It interrupts the system from cleansing itself which creates stronger growth in the future. Our economic growth becomes more and more dependent on speculation. All that stability investors "feel" is an illusion: the cumulative effect is actually very destabilizing.

There is much anecdotal evidence that investors have become very dependent on government to keep asset prices going higher. This is absolutely necessary for an over-levered economy so it can keep borrowing to consume.

This is where I differ from the bulls. They stay with shallow arguments that growth is this and earnings are that without looking at the why of it. The why of it is that speculation in asset prices is all that is driving growth (companies buying back stock with debt is helping earnings per share dramatically) and this is called a ponzi (dürfte am besten mit schneeballsystem umschrieben sein). It depends on the next guy paying a higher price.

When the next guy does not pay a higher price it falls apart. If asset prices like stocks start going down you will see how quickly growth stalls. Then all that leverage that the Fed has been trying to infuse will unwind. The markets that they have "controlled" will control them.

aus meiner sicht weise gesprochene worte. bernanke ist in der tat nicht zu beneiden und muß jetzt mit greenspans erbe (easy money/im zweifel immer liquidität fluten usw.) fertig werden.

man kann bernanke nicht übel nehmen das er obwohl er es sicher besser weiß die us wirtschaft schönredet und den crash am immomarkt nicht erkennen mag/darf. wenn man ihn an taten beurteilt (ende der zinserhöhungen trotz massiver infaltion) ist klar zu erkennen das er es besser weiß. gut gemachte propaganda..........

kann jedem den letzten call von dhi http://phx.corporate-ir.net/phoenix.zhtml?p=irol-eventDetails&c=67920&eventID=1346397 empfehlen. leider haben die nicht mehr calls von vor einme jahr im archiv. unterschied wie tag und nacht.

gruß

jan-martin

update:

passend dazu kommt am sonntag ein bericht in barrons der vom wortlaut her ziemlich genau das oben gesagte wiedergibt. wortlaut nachzulesen auf http://bigpicture.typepad.com/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

2 Comments:

Greets to the webmaster of this wonderful site. Keep working. Thank you.

»

Hi! Just want to say what a nice site. Bye, see you soon.

»

Post a Comment

<< Home