zusammenhang $ / oil

du bist einer der besten!

The Dollar and the Price of Oil

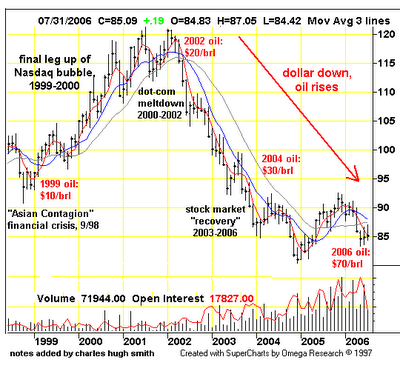

Is there any connection between the value of the dollar and the price of oil? Let's look at a monthly chart of the dollar index over the past 8 years.

Recall that the global market for oil is made in dollars. That is, when exporting nations sell their oil, they receive dollars in exchange for their oil. While there has been some movement in Iran and Venezuela to create a market for oil in euros, the reality is that oil is still priced in dollars. Thus, the value of the dollar relative to a basket of other currencies is of great interest to oil exporting nations. And the cost of oil in dollars is of great interest to us residents of the U.S., who cannot count on currency appreciation to offset the rising price of oil.

(NOTE: For instance: the dollar fetched 90 euros in 2002. It now fetches 120--about 33% less. But since oil is priced in dollars, holders of euros enjoyed a 33% decline in the cost of oil in that timeframe. So even though oil has more than doubled in dollars, it has risen considerably less in euros due to the sharp devaluation of the dollar/appreciation of the euro.)

good place to start is the "Asian Contagion" financial crisis of Fall 1998, which included Russian bond defaults and the Long Term Capital Management derivatives debacle. As most Asian economies stumbled under the onslaught of currency devaluations and general recession, the price of oil dropped along with demand. Oil exporting nations, loathe to lose income, kept the supply well above the reduced demand. The net result: the price of oil collapsed to $10/barrel

As the U.S. economy pulled the rest of the global economy out of the hole, the dollar gained and the price of oil recovered, reaching $20 in 2002. Even the dot-com meltdown didn't curtail global or even American demand for oil, but the dollar's rise gave the oil exporting nations another nice boost. Not only were they getting more money for each barrel, they were getting more value for the dollars they received in payment: about 30% more value as the dollar climbed from 95 to 120.

But then the dollar began a long decline. Oil exporters received a hefty 50% nominal gain in the price of oil--from $20 in 2002 to $30 in 2004-but they also received a 33% haircut in the value of the dollar. Net result: their big gain was largely eviscerated by the decline in the dollar.

That's why I placed the U.S. stock market "recovery" in quotations marks. If you were a foreign holder of U.S. stocks, the "recovery" wasn't that great, as the 50% rise in U.S. stocks was largely offset by the 30% decline in the value of the dollar. (genau diese thematik ist für mich die einzige/größte sorge bei meinen us shorts. für anleger die long in den staaten sind muß schon nominell ne ganze menge zu ner postiven performance nach währungsverlusten rausspringen. von daher kann ich auch das geschreie nach den tollen anlagerenditen in den usa nicht nachvollziehen mit denen immer geworben wird (propaganda). wer um himmels der bei klarem verstand ist soll denen 700 mrd$ zur finanzierung des defizites geben? gut das es die chinesen und ander notenbanken gibt die sich mit negativrenditen zufrieden geben....)

As the dollar approached 80 in 2005, oil exporters were suffering from a nearly 50% decline in the purchasing power of the money received for their oil. In a fortuitous coincidence, rising demand and constrained supply raised the price of oil from $30 to $70, more than offsetting the decline in the value of the dollar.

The correlation between the falling dollar and rising oil is certainly striking. But is it causal? That is, did the price of oil in dollars rise because the dollar was dropping in relative value? Possibly; but it is also possible that the dollar and the price of oil are independent of each other. The value of each is set by the global forces of supply and demand; and as the world was flooded with massive quantities of dollars in the liquidity boom of 2001-2006, then the value of the dollar declined. As the supply of oil reached a limit of about 84 million barrels a day, even as demand reached 84-85 MBD, then the price rather naturally rose.

In another interesting correlation, U.S. interest rates have been rising in apparent tandem with rising oil prices in dollars. Coincidence again? Perhaps; again, the cost of money in the U.S. does not seem to have a direct causal link to the cost of oil in dollars. But there is one correlation: as high oil costs seep into the supply chain of the entire U.S. economy, that basic material inflation feeds consumer and producer inflation, which can only be offset by a tightening of money supply and/or borrowing costs.

The trillion-dollar question is: what happens to the price of oil (in dollars) if the dollar breaks its long-term support level at 80? If the oil exporting nations want to keep the high value they currently receive, then they will either have to buy the dollar, driving it back up above 80, or they will have to engineer a corresponding rise in the price of oil to compensate for the decline in the dollar. Can we expect a 20% rise in the cost of oil if the dollar falls 20%? Perhaps the question should be stated, why wouldn't we?

ich stelle mal die behauptung auf das jedes andere land mit den kennzahlen der usa längst in eine massive finanzkrise geschliddert wäre. ist einer der vielen gründe warum ich long gold, goldminen und suncor (su/ölsand kanada) und short $ bin.

gruß

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home