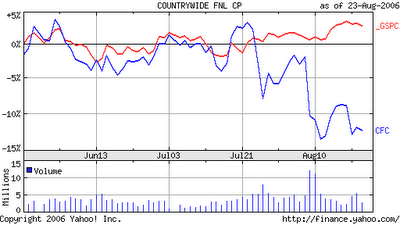

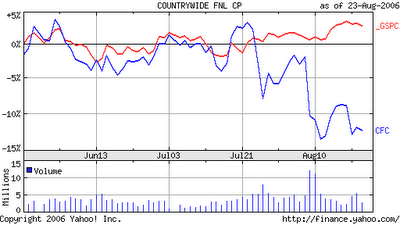

10 k contrywide / cfc

dank geht an herb greenberg

Posted: 23 Aug 2006 02:04 PM CDT

From hedge-fund manager Jeff (no, not Matthews):

It was obvious to anyone who uses common sense, or has a memory that goes back at least to 2000! (Wasn't the lesson from the last bubble bursting impressed on these fools? Or is this just the continuation, thanks to Greenspan, of the same decline and fall of the US empire/dollar/ standard of living? First you lose your savings, then you lose your house.)

But check this language from Countrywide's (CFC) last 10-Q out: (and they added this then) "... substantially all of the pay-option loans we originate are underwritten based on 'reduced documentation standards' whereby the loan applicant's income is not fully documented." In other words, "our goofy loans are primarily made to people who probably lied to us about being able to make even those minimal payments, and we'll probably end up with lots of houses on our balance sheets after we write off the 'income' we are booking on the negative amortization of principal!"

In other words, I could have bought a $10 million SOHO loft easier than renting the Tribeca apartment I live in!!! Of course, I would have had to ultimately give the keys back to CFC, but what the hey; it's not like I own the apartment I rent either.Bingo!

P.S.: And countrywide is probably at the high-side of underwriting quality!

das ist wohl ne ziemlich deutliche ansage das haufenweise probleme im kreditbuch sind.

tonnenweise trifft es wohl besser......

gruß

jan-martin

Posted: 23 Aug 2006 02:04 PM CDT

From hedge-fund manager Jeff (no, not Matthews):

It was obvious to anyone who uses common sense, or has a memory that goes back at least to 2000! (Wasn't the lesson from the last bubble bursting impressed on these fools? Or is this just the continuation, thanks to Greenspan, of the same decline and fall of the US empire/dollar/ standard of living? First you lose your savings, then you lose your house.)

But check this language from Countrywide's (CFC) last 10-Q out: (and they added this then) "... substantially all of the pay-option loans we originate are underwritten based on 'reduced documentation standards' whereby the loan applicant's income is not fully documented." In other words, "our goofy loans are primarily made to people who probably lied to us about being able to make even those minimal payments, and we'll probably end up with lots of houses on our balance sheets after we write off the 'income' we are booking on the negative amortization of principal!"

In other words, I could have bought a $10 million SOHO loft easier than renting the Tribeca apartment I live in!!! Of course, I would have had to ultimately give the keys back to CFC, but what the hey; it's not like I own the apartment I rent either.Bingo!

P.S.: And countrywide is probably at the high-side of underwriting quality!

das ist wohl ne ziemlich deutliche ansage das haufenweise probleme im kreditbuch sind.

tonnenweise trifft es wohl besser......

gruß

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home