http://immobilienblasen.blogspot.com/2006/09/dubai.html#links

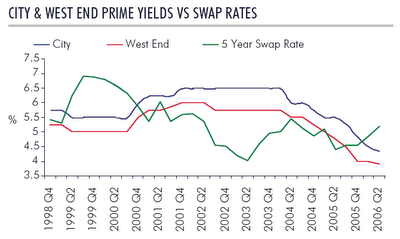

das ganze zeigt klar das in lonfon keiner wegen der guten mietrendiete kauft. britische staatsanleihen rentieren risikofrei höher! immerhin kommt es bei dubai nicht auf die kohle an......

http://immobilienblasen.blogspot.com/2006/09/dubai.html#links

make sure you read this story about london/bitte unbedingt diese story über london lesen.

http://immobilienblasen.blogspot.com/2006/10/london-calling-new-skyline.html#links

Dubai Buys London's Adelphi for 300 Million Pounds http://tinyurl.com/wkbva

Nov. 15 (Bloomberg) -- The Emirate of Dubai bought the Adelphi, one of London's best-known art deco buildings, for about 300 million pounds ($567 million) to capitalize on surging rents in the city.

(i doubt that the yields are good...., see chart)

Istithmar PJSC, a private-equity company owned by the government of Dubai, purchased the 300,000 square-foot building in London's West End on Nov. 13, said Alan Rogers, head of the firm's real estate unit. Tenants of the 68-year-old Adelphi, located near the Strand on the river Thames, include the U.K.'s Department of Work and Pensions and Hess Corp., the fifth- biggest U.S. oil company.

Istithmar PJSC, a private-equity company owned by the government of Dubai, purchased the 300,000 square-foot building in London's West End on Nov. 13, said Alan Rogers, head of the firm's real estate unit. Tenants of the 68-year-old Adelphi, located near the Strand on the river Thames, include the U.K.'s Department of Work and Pensions and Hess Corp., the fifth- biggest U.S. oil company. ``Adelphi is a trophy office building,'' Rogers told reporters in Dubai, United Arab Emirates today. ``It is in a prime location and is complementary to our earlier investment in Trafalgar Square.''

Middle Eastern investors, flush with oil wealth after crude prices almost doubled since 2003, spent $6 billion on overseas property in the first half of 2006, mainly in London and New York, according to a report by Jones Lang LaSalle Inc. published last month. Prime West End office rents are the highest in the world. ( yields not!)

No comments:

Post a Comment