dow 36,000 wasn't wrong, just early.

i´m shocked and also pleased that these fools/clowns are back in the media. to me this is a sure sign taht the top is not far away. the only way their predictions will com etrue in the near future is that inflation is near or above double digits. unfortunatly that says nothing about the real return of the dow.

`Dow 36,000' Optimists, Unbowed, Say Market Still Headed Higher http://tinyurl.com/yeoh44

Oct. 24 (Bloomberg) -- James Glassman says his seven-year- old prediction that the Dow Jones Industrial Average will rise to 36,000 wasn't wrong, just early.

Two years after Glassman and co-author Kevin Hassett published their theory, the Dow average had sunk 29 percent. Their ``Dow 36,000,'' a New York Times bestseller, and Charles Kadlec's ``Dow 100,000'' became metaphors for the investing excesses of the late 1990s. The two books were released within a month of each other in late 1999.

``Anyone who followed their advice in 2000 got their butts handed to them,'' said Barry Ritholtz,(yeah barry. kick them!) .....

The Dow has since recovered and set a record, rising above 12,000 last week in a four-year bull market. The surge has improved some portfolios and may eventually do the same for the reputations of the authors, who stand by their forecasts.

``I'm more confident today than I was five years ago that we're in the early days of prosperity and the Dow will reach 100,000 by the mid-2020s,'' said Kadlec, 60, managing director at closely held J&W Seligman & Co. in New York. The company manages more than $19 billion.

Glassman, 59, defends ``Dow 36,000's'' original premise as well. The prediction -- that the Dow would triple by 2005 -- is still valid, he says, although he's pushed the deadline out to 2021. (in the long run we are all dead../ am ende sind wir alle tot. was für ein witz!)

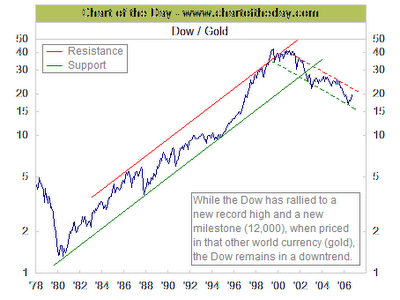

Investors who bought the Dow's 30 stocks in October 1999, when the book was published, waited more than four years to pull even. From the bull market peak reached four months after it came out to the bear market low of Oct. 9, 2002, the average lost 38 percent. ( add to this the rampant inflation and you are still under water. when you compare the dow to gold the high is still far away. rechnet die inflation dagegen und man ist immer noch deutlich unter dem rekord. in gold sieht das ganze noch schlimmer aus.)

http://immobilienblasen.blogspot.com/2006/10/dow-vs-gold-chart.html

http://immobilienblasen.blogspot.com/2006/10/dow-vs-gold-chart.html

Still Relevant

Glassman and Kadlec say their out-of-print books, offered for sale on Amazon.com for as little as one cent, are still relevant. (still overpriced, but maybe a good comedy or satirebook/immer noch überbezahlt, aber evtl. als satirebuch zu empfehlen)

.....``There's nothing that's occurred over the past few years that's changed our minds about the original thesis,''.....

Faster Pace

The average has risen in value by about 5 percent a year since 1928, although that pace has more than doubled to 12 percent during the past three decades. With a 2021 deadline, Glassman's prediction of 36,000 would require the Dow to grow by 7.6 percent annually. ( he still can pushes the deadline in his testament out 2050/ in seinem testament kann er immer noch die deadline ins jahr 2050 setzen).....

Siegel had noted that since the early 1800s, equities had never offered a negative return, after inflation, if held for 17 years or more. To Glassman, that meant stocks were a safe bet for long-term investors if they could stomach short-run volatility.

`Very Scary'

``One of lessons of the 12,000 mark is that over the long term, stocks are remarkably consistent,'' Glassman said. ``In the short term, stocks are very, very scary.''

Kadlec's book pointed to several trends he said should spur a climb to 100,000 by 2020: higher productivity, baby boomers' investments, lower taxes, mild inflation and an absence of war. Except for the latter, most of those trends have held, Kadlec says today. ( he forget skyhigh deficits+debt (consumer+gouverment), manipulatet stats on inflation+employement etc, creative financing, off balancesheet acounting from the gouverment+companies, one bubble that must replace another bubble to keep the game going, etc....../er hat wohl in seiner aufzählung rekorddefizite und schulden von staat und konsumer, fragwürdige statistiken zu inflation und arbeitsmarkt, kreative finanzierungen aller art, den obligatorischen nächetn buuble, etc vergessen......)

To reach 100,000 by 2025, the Dow needs to rise by about 12 percent annually.

``I'm very diversified,'' Glassman said. ``I was down 20 percent in some years, but I put more money in. I've done pretty well.''

At the end of 2002, Kadlec was down about 40 percent from his 1999 high, and by 2003 was ``almost even.''

``In late 2004, the same portfolio was up, somewhere in the teens,'' he said. ``I followed my own advice.''

wv 2007/ we will take a look back in 2007

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home