"capitalized interest" optioan arms

alleine diese tatsache würden wir hier für einen aprilscherz halten. weit gefehlt. diese art der verbuchung steht im einklang mit den buchführungsschriften. denke das wird sich erst ändern wenn demnächst die ersten banken aufgrund dieser problematik dichtgemacht werden müssen. dann wird der aufschrei groß sein und alle fragen sich wie es jemals soweit kommen konnte. wäre ja nicht das erste mal.....

dank ghet an joe und ben http://thehousingbubbleblog.com/?p=1659#comments

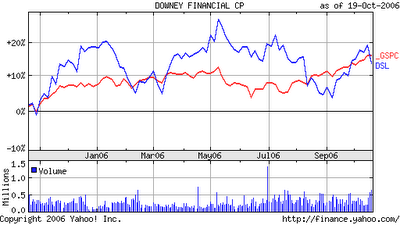

Let’s look in detail at Downey because it is a relatively straight forward option ARM lender (close to 90% of their portfolio is option ARMs).

viel platz zum fallen / 17% short

viel platz zum fallen / 17% short

The amount of negative amortization included in loan balances increased from $229 million at June 30 to $277 million at September 30th. This is 2.25% of loans subject to negative amortization. In Downey’s case their option ARM portfolio shrank by $895 million to $12.327 billion. So negative amortization increased 21% despite the fact their option ARM portfolio shrank 7% during the quarter.

28% of their loan interest income is non-cash interest due to negative amortization, up from 26% in the second quarter. Now remember this is loan interest income, not net interest income. If and when the day comes that this non-cash income isn’t there because of problems, it will have a leveraged impact on their bottom line because there is no “non-cash” interest expense. They will still need to pay their depositors and creditors in cash.

Now we know the negative amortization trends have been bad, but the trend in non-performing assets (NPAs) and delinquent loans is very interesting:

Dollars in millions

June 30 2005 Sept. 30 2005 Dec. 31 2005 March 31 2006 June 30 2006 Sept 30 2006

NPA $25.2 $30.3 $35.2 $38.9 $39.3 $66.5

Del Loans $41.7 $46.2 $56.2 $59.4 $64.2 $101.2

All loans delinquent 90 days or more go non-accrual and are in NPAs. So the trend here is accelerating, and, amazingly, Downey only provided (thru their income statement) $9.6 million for credit losses during the quarter. Yet their NPAs and delinquent loans increased by over $64 million in the last quarter.

Some extracts from Washington Mutual’s third quarter report regarding trends in their option ARM portfolio. Again, they missed estimates largely due to weakness in their mortgage business:

Capitalized interest recognized in earnings that resulted fromnegative amortization within the Option ARM portfolio totaled$278 million, $239 million and $86 million for the three monthsended September 30, 2006, June 30, 2006 and September 30, 2005.

Capitalized interest recognized in earnings that resulted fromnegative amortization within the Option ARM portfolio totaled$706 million and $159 million for the nine months ended September30, 2006 and September 30, 2005.

The total amount by which the unpaid principal balance of OptionARM loans exceeded their original principal amount was $654million at September 30, 2006, $461 million at June 30, 2006,$291 million at March 31, 2006, $157 million at December 31,2005, and $76 million at September 30, 2005.

From Wachovia’s third quarter. Their acquisition of GDW closed Oct 1. But they did release some results for GDW. Specifically, the deferred interest included in loan balances increased to $1.2 billion.

The trend is as follows:

Deferred Interest in Loan Portfolios (millions)

9/30/2004 $36

12/31/2004 $55

3/31/2005 $90

6/30/2005 $160

9/30/2005 $279

12/31/2005 $449

3/31/2006 $666

6/30/2006 $915

9/30/2006 $1,200

dank geht an shawn und ben http://thehousingbubbleblog.com/?p=1656#comments

Comment by Shawn

2006-10-19 09:09:08

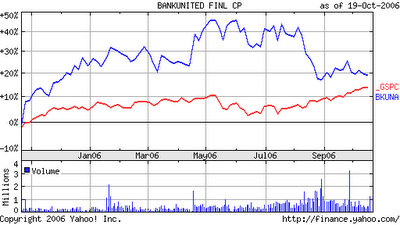

Here’s a quote from BKUNA’s CFO that never gets old (is from 2005, next earning end of october. can´t wait...). I read it on occasion to laugh myself to sleep.

short 21,30%

In the middle of one of the hottest U.S. markets, Coral Gables (Fla.)-based BankUnited Financial Corp. (BKUNA ) posted a $14.8 million loss for the quarter ended June, 2005. Yet it reported record profits of $23.8 million for the quarter ended in June of this year — $20.9 million of which was earned in deferred interest.

Some 92% of its new loans were option ARMs. Humberto L. Lopez, chief financial officer, insists the bank underwrites carefully. “The option ARMs have gotten a bit of a raised eyebrow because we generate and book noncash earnings. But…it’s our money, and we do feel comfortable we’ll get it back.”

to be continued.........

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

1 Comments:

Great blog, JMF! Thanks again.

--Vega

Post a Comment

<< Home