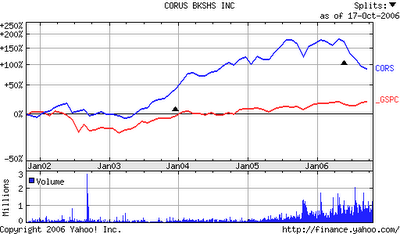

4.3 b$ in condoloans and only 1% loss reserve / corus

the latest news on condominiums from thhe last days

mike morgan

Condo Developer - They have a 600 unit project that is 100% up for resale. This means no one is going to close when the building is completed in January. Every single buyer will walk from their 20% deposits. The developer will simply going to turn the keys over to the bank. And the bank will take a massive hit that will have the Feds on top of them in the blink of an eye

wci

and Tower Homebuilding defaults will also negatively affect the company's earnings for the third quarter. Additionally, the Company expects that combined tower and traditional new orders for the third quarter are expected to fall approximately 80% below the total reported in the third quarter of 2005

even when you consider that the comments above are relatet to the florida market. the trend is in the hot markets is down sharply. florida, california and vegas account for nearly 62% of all cors commitments!

now compare this to the management spin and especially the loan loss reserve!!!!!!!!

first the headline pr(oanganda)

Corus Bankshares Reports Record Third Quarter and Year-to-Date Earnings

http://biz.yahoo.com/prnews/061017/cgtu020a.html?.v=2

"I am pleased to report that Corus' third quarter earnings were the highest quarterly earnings in the company's history. These earnings were primarily fueled by growth in commercial real estate loans, with a 16% increase in average loans outstanding compared to the same quarter of the prior year......

Corus' strong earnings pushed shareholder's equity above $800 million for the first time .......(will maybe not be enough .......)

"It should be no surprise that Corus, with a loan portfolio invested almost exclusively in loans to condominium developers, is feeling the effects of the nationwide slowdown in the housing market. Among other evidence of this slowdown, our pipeline of Pending Loans has decreased by 26% as compared to December 31, 2005. When analyzing our new business originations, it is important to differentiate between conversion loans and new construction loans.

Our originations of construction loans in the third quarter of 2006 totaled $855 million, which was up 24% from the amount of construction loans originated in the same quarter of 2005. Unfortunately, there were virtually no new conversion loans originated in the third quarter of 2006, whereas there were $740 million of conversion loans originated in the third quarter of 2005. The first quarter of 2006 was the last time we originated a meaningful amount of conversion loans, and we don't anticipate that changing in the near future.

Aside from the effects on our new loan origination volumes, the slowdown in the housing market is also impacting Corus in terms of credit quality of loans already on our books. We have seen various projects that are experiencing slower sales of condominium units and/or lower prices than the developer or we would like. While construction projects are clearly not immune to the forces of the slowdown, conversion projects presently seem to be displaying more obvious signs of weakness. So far, we can report that we have only one condominium conversion loan which is nonaccrual and one additional loan listed as a Potential Problem Loan.

However, we have had numerous other loans that have experienced meaningful problems, but in these cases, the borrowers or their financial backers have stepped up to the plate and invested additional dollars, signed financial guarantees or taken other actions that have strengthened the loan from our perspective.

We have yet to experience any situation where we have had to foreclose on a property nor have we incurred any losses, but it would not surprise us if we did....However, we will not hesitate to foreclose if the borrower does not support a loan that is in distress

With all of this discussion of slowing loan volume and potential credit problems, I would like to reiterate that we nonetheless continue to see good opportunities for new loans in the condominium construction market, where Corus' originations are on pace with last year. We continue to believe that many profitable opportunities, for both the bank and its customers, exist in many cities across the country to build and develop high quality condominiums.

While others may be looking for an exit strategy, we see opportunity.(seemes like financial suicide for me...)

from their presentation (pdf)

http://www.corusbank.com/acrobat/Q3%202006%20Earnings%20Release%20FINAL.pdf

cors has almost 100% of the 4.3 b$ in loans in the condo construction and conversation segment! plus whne you add the unfundet comittment you end up with 8.6 b$ (including 574 ex condo commercial real estate)

after now knowing the facts you can guess what they will put in their "allowence for loan losses".

surprise surprise. after knowing that they are in the riskiest business of lending after the market is crashing in real time they put the amount of reserve to a staggering 48 mio$ !!!! (42 mio in 2005) . that represents only 1%!!!!!!!!! of the loanbalance. that makes sense to me.............

at least the have done a "stress test" at the end of the pdf where they play the "recession".

in a severe recession they would loose 1.2 b$.

when i look at the facts it is very clear to me that the condomarket is in a depression!

to me this looks like a desaster with a very big chance that they will go under! when you look at the shorts and the chart you see that nobody believes the management.

short ratio 25,6 shares short 49,2%!

needeless to say that the only two analysts that cover cors have hold and no sell ratings on the stock.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

1 Comments:

Keefe Bruyette just lowered CORS to underperform.

Post a Comment

<< Home