addicted to debt / uk auf den spuren der usa

shocking!

dank an http://www.housepricecrash.co.uk/

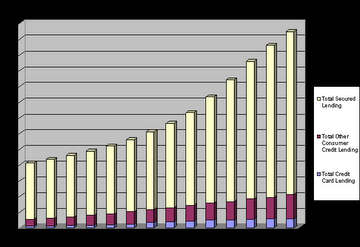

Total UK personal debt

http://www.creditaction.org.uk/debtstats.htm

Total UK personal debt in September will have exceeded £1 ¼ trillion for the first time. (1,85 billionen€, 2,36 trillion$)

At the end of August 2006 the total UK personal debt was £1,247bn. The growth rate increased to 10.4% for the previous 12 months which equates to an increase of £105bn.

Total secured lending on homes has exceeded £1 trillion (£1,000 billion) and in August 2006 it stood at £1035.4bn. This has increased 11.2% in the last 12 months.

Total consumer credit lending to individuals in August 2006 was £211.8bn. This has increased 6.6% in the last 12 months.

Total lending in August 2006 grew by £9.9bn. Secured lending grew by £9.1bn in the month. Consumer credit lending grew by £0.8bn.

Average household debt in the UK is approximately £8,575 (excluding mortgages) and £50,494 including mortgages.

Average owed by every UK adult is approximately £26,525 (including mortgages). This grew by ~ £200 last month.

Average interest paid by each household on their total debt is approximately £3,123 each year.

Average consumer borrowing via credit cards, motor and retail finance deals, overdrafts and unsecured personal loans has risen to £4,504 per average UK adult at the end of August 2006.

Britain's personal debt is increasing by ~ £1 million every four minutes.

Plastic card / Personal Loans:

Research by uSwitch has found that 3.4 million credit cardholders in the UK regularly make only the minimum repayment on their credit card. 11% of those with a credit card only ever make the minimum repayment – increasing to 18% for the 25-34 age group.

It has been estimated that in 2005 banks and finance companies sent 1.26billion items of junk mail such as credit card offers and invitations for loans. This equates to approximately 27 enticements to take on new credit per adult.

Credit card arrears rose consistently throughout 2005. The proportion of balances more than three months in arrears increased to 8.5%.

The number of people refused credit by mainstream lenders is estimated to increase from 9.1m in 2005 to 9.4m in 2010.

Total credit card debt in August 2006 was £55.4bn.

According to the BBA the proportion of credit card balances bearing interest was 74.6% in July 2006.

The average interest rate on credit card lending is currently 16.32 %, around 11.5 percentage points above base rate.

Plastic cards in issue were 183m in 2005. This works out at an average of 4 plastic cards for every adult in the UK.

The number of credit card holders who repaid in full each month the outstanding balance was 59% in 2005.

282 plastic transactions took place every second in the UK in 2005. There were 86 withdrawals made every second (equal to £5,455 / second) from UK’s 58,000 cash machines in 2005.

Debit cards accounted for 37% of all retail spend in 2005, ahead of cash at 34%. Plastic cards were used for 63% of all UK retail spending last year

There are more credit cards in the UK than people according to APACS. At the end of 2005 there were 74.6m credit and charge cards in the UK compared with around 60 million people in the country.

Servicing Debt:

Homeowners could be at risk of getting into serious debt by over-committing themselves with loans and other forms of credit, say national charity Citizens Advice. A recent survey shows that some 770,000 people throughout Great Britain, with a mortgage have missed one or more mortgage payments in the last twelve months. The survey showed that younger people are more likely to have missed a mortgage payment, with 13% of 21-24 year-olds surveyed said they had missed one or more mortgage payments in the last twelve months. This suggests that some people who are new to homeownership may be getting straight into difficulties. http://immobilienblasen.blogspot.com/2006/09/great-britain-bubble-world-tour.html

The number of people hit with a County Court Judgement (CCJ) - ordering repayment of outstanding debts - has leapt by 18per cent. 165,000 people had CCJs imposed on them between April and June of this year, which is up by 25,050 on the same period in 2005. Lenders were aiming to recover around £½billion of bad debts through CCJs last quarter.

A recent report from Datamonitor reveals that the UK is responsible for a third of all unsecured debt in Western Europe and that the average UK consumer owes over twice as much as the average western European owes.

Over two million households are estimated to be struggling to pay council tax according to a new report for the Joseph Rowntree Foundation.

Approximately 9.8% of individuals consider unsecured debt to be a “heavy burden”. A further 31% saying they are keeping up, but struggle from time to time

One person is falling victim to insolvency every minute of the working day - 26,021 people became insolvent between April to June 2006 which is a 66% increase on the same quarter last year. The number of people becoming insolvent in 2006 is likely to exceed 100,000.

In the last four years the average age of a bankrupt has fallen from 43 to 41 and the proportion of younger bankrupts, aged between 18 and 29, has more than doubled.

According to recent research by a leading debt solutions consultancy, the number of consumers facing personal insolvency is growing fast. Of adults with a high level of unsecured debt (£10,000 or over), 20% of those interviewed said they were ‘quite likely’, ‘very likely’ or ‘certain’ to declare themselves bankrupt or take out an IVA (Individual Voluntary Arrangement). This equates to 1.1 million adults across Great Britain

The Bank of England raised the base lending rate to 4.75% in August 2006. This was the first increase for 2 years.

Citizens Advice Bureau (CAB) dealt with 1,128,000 debt enquiries last year. In the last decade the number of consumer debt problems dealt with by CAB has increased 118%. CAB clients have an average of £13,000 of debt which is nearly 17.5 times their monthly income. On average it would take CAB clients 77 years to pay back their debts in full.

The average debt of a client coming to Consumer Credit Counselling Service (CCCS) for advice is now £32,000. The number of people earning more than £30,000 a year who are asking it for help has risen by 257% in the past three years.

Three quarters (74%) of British couples find money the hardest subject to talk about with their partners according to a recent survey by the Financial Services Authority (FSA). They also found that over a quarter (27%) of couples regularly argue when they try to discuss their finances; about a third (32%) of couples lie to their partners about how much they spend on their credit cards; over a third (35%) of British couples are kept awake at night worrying about their money situation

Research from AXA shows money worries are a significant cause of worry, anxiety and stress according to GP and leading mental health expert, Dr Roger Henderson, who recently published a paper identifying the condition Money Sickness Syndrome (MSS). Almost half (43%) of the UK adult population is affected by money worries and have experienced MSS symptoms. 3.8m people admit money worries have caused them to take time off work and more than 10.76m people suffer relationship problems because of money worries, with almost one in five complaining of a sex life slump.

A quarter of those in debt are receiving treatment for stress, depression and anxiety from their GP.

Young people (under 30): Graduates leaving university this year had average debts of £13,252, a 5% increase on 2005, according to a survey by NatWest bank. 62% of graduates leave university with debts of over £10,000.

Sixth-formers heading for college this year expect to leave their courses with debts of nearly £15,000. For those starting university this summer, the biggest concern was money being tight. Students are now increasingly relying on part time jobs to finance their life at university. A massive 87% of this year’s intake believes that they will have to get a part time job and 46% of current students have to rely on their income from term time work to get by, working an average of 14 hours a week.

Recent research shows that budgeting is the last thing on many students’ minds as the vast majority (80%) of 16-24 year olds admit they don’t keep track of their finances. Also, despite the likelihood of being on a tight budget, 1 in 5 doesn’t know within £100 what their financial state might be.

A recent FSA report highlighted:

29% of 16-24 year olds said they would not know how to prepare and manage a weekly budget;

19% of 22-24 year olds have short-term debts over £5,000;

62% of young people said if they got into money trouble or debt they would not be able to name any advice or support services they could turn to for advice

One in five students dropped out of courses; Of undergraduates who considered dropping out financial difficulty was a strong factor for 34.4%;

94% of 16 year olds believe it is important to know how to manage money; only 53% have been taught how to

Pensioners / Pensions:

1.4 million pensioners (14% of the UK’s pensioner population) live on an income of £5,000 or less each year. After council tax, water and electricity bills, this leaves only £3,092 per annum – which is equivalent to £59.46 each week or £8.49 a day. More than 38 per cent (3.6 million people) get by on £10,000 or less, and over half of the British pensioner population live on £15,000 or less each year.

A major report published by Scottish Widows, reveals a dramatic deterioration over the last 12 months in the number of people saving adequately for retirement. The percentage of the population saving adequately for retirement falls from 55% in 2005 to 46% in 2006. The percentage of people who do not know where their main income in retirement will come from has almost doubled, and is now nearly a quarter of the population (23%)

Research from Scottish Widows Bank reveals one in six (over 1 million), pensioner homeowners in the UK have an outstanding mortgage on their home – each with an average debt of £45,313 – making a nationwide debt of almost £47 billion. What is more, one in three owe more than £50,000 and one in ten more than £100,000 putting increased pressure on retirement income.

Over 8 million British workers (21%) don’t have any pension provision according to a recent report issued by Virgin Money. This is despite continued warnings from the Government and the pension industry of the need to save now to avoid inadequate income at retirement.

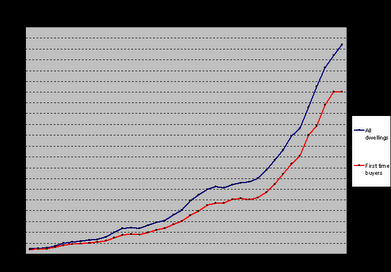

Housing: According to the Department for Communities and Local Government (DCLG) the average house price in the UK in July 2006 stood at £194,454 (£202,660 in England/300.000€/383.000$). UK annual house price inflation rose by 6.0%. Annual house price inflation in London rose by 7.1%.

Note: the weightings used by DCLG were changed for the February 2006 figures.

The average Mortgage Interest rate at the end of August 2006 was 5.29%.

28% of mortgages taken out in July 2006 were “interest only” mortgages compared with only 12% taken out in June 2003. 22% of these “interest only” mortgages were taken out without a repayment plan specified to repay the capital.

According to the Nationwide house prices increased by 1.3% during September, bringing the annual rate up to 8.2% - its fastest annual rate of growth since February 2005.

The average loan approval for house purchases in August increase to £141,500, which is 8% higher than a year earlier.

According to The National Association of Estate Agents (NAEA) the average time between instruction and completion is 16.9 weeks.

Approximately 280,000 mortgages are one month or more in arrears. This represents an increase of 4% from the same period one year ago.

During the second quarter of 2006, 33,180 mortgage possession actions were entered, and a total of 22,254 orders were made – 11,020 of which were suspended orders. This is a 17% increase from the second quarter of 2005.

Gross mortgage lending hit a new record in August, reaching £32.7 billion, according to the latest data from the Council of Mortgage Lenders (CML). This is 21% higher than the same month last year.

The Council of Mortgage Lenders has revised up its forecasts for housing market activity for 2006 and 2007. The CML now expects house prices to end the year 7% higher than at the start, compared with a 2% forecast back in February. Next year, the forecast for house price inflation has been raised from 2% to 3%. (i bet against it, ich halte dagegen)

The amount of unmortgaged property wealth held by UK home-owners currently stands at £3.6 trillion. Housing equity is the largest component of total wealth held by people living in the UK. Mortgage lending has helped fund a dramatic expansion of home-ownership, from 60% to 70% of the population during the last 20 years. Roughly 40% of the housing stock is owned outright, mainly by retired and older middle-aged households,

Housing 1st Time Buyers:

The average house price in the UK in July 2006 for first time buyers now stands at £150,252 which is an annual increase of 5.6%.

Housing costs have risen sharply for first-time buyers: their average mortgage costs are now a third of average earnings. As a consequence a third of all working households under 40 cannot afford to buy even at the low end of local housing markets.

First-time buyer income multiples reached their highest level ever in July at 3.24 times the average income, according to the Council of Mortgage Lenders (CML). This was up from 3.06 times in the same month last year. The average new mortgage for first time buyers has now reached £110,500. The average age of a first-time buyer is 29.

Half of parents feel responsible for helping their children on the property ladder. Parents intend to help their children onto the property ladder by giving them an average of £17,677. One in six are prepared to give or lend their offspring over £30,000.

The average couple needs to save at least £29,000 to pay for the deposit and stamp duty on their first home.

According to the National Association of Estate Agencies (NAEA) first time buyers accounted for 13.4% of properties purchased in August.

High Street Spending:

Britons now spend more on eating out in restaurants, pubs and on takeaway meals than on buying fresh and processed food and drink products to have at home. (until the easy money is gone, nicht mehr lange)

For the first time more than half of all adults made an online purchase during 2005 - 25 million or 52 per cent of all adults.

Parents typically spend £165,668 on raising a child from birth to the age of 21, according to friendly society Liverpool Victoria's most recent annual Cost of a Child survey. This works out at £7,889 a year and represents a rise of 7.8 per cent on last year's survey, more than three times the rate of inflation, and up 18 per cent on the 2003 survey.

The cost of running the average new car has grown to nearly £5,000 a year, or £14 a day, according to the latest RAC Cost of Motoring Index.

The average wedding costs around £19,595. 45% of couples - some 117,000 nationwide - have no financial planning to pay for the big day, a study by stockbrokers Brewin Dolphin Securities found.

Money Education / Financial Literacy:

Classes on personal finance and budgeting in schools could make children richer by up to £32,000 between the ages of 35-49 according to the Institute for Public Policy Research.

25 million Brits (56%) spend 60 minutes or less per week reviewing their finances, with the average amount of time we dedicate as a nation reaching only 1 hour 19 minutes – the least amount of time in Europe, according to a study from Scottish Widows. We spend nearly twice as long (2 hours 11 minutes) chatting on the phone or texting each week, and 6 times as long (8 hours 4 minutes) watching TV.(makes no fun to watch the debt, macht einfach wenig spaß die schulden anzugucken)

A quarter of Brits (25%) have no idea how much they spend in a week, and a similar number (26%) have no idea of their monthly cash flow. This lack of knowledge extends into other financial aspects of life. Only half (51%) the population know the balance on their credit cards and nearly half (46%) have no idea what interest rates they receive on their savings or are paying on their accounts and debts.

Around 15 per cent of 18 to 24- year-olds think an individual savings account (ISA) is an iPod accessory, and one in 10 reckon it's an energy drink. With rising personal debt levels in Britain, and a lack of long-term savings, better money management seems a pressing issue.

Savings:

A massive 72% of UK consumers believe they aren’t saving enough, but out of the people who are in a position to increase the amount they currently save, almost 8 million (18%) claim they enjoy spending their money too much to do so.

Halifax research shows that the UK saving ratio hit a four year high of 6.0% in Q1 2006. The household saving ratio measures the proportion of gross disposable income that households save rather than spend. The savings ratio has varied from a high of 14.1% in 1979 to a low of 3.1% in mid 2004 with a 7.8% average for the last 43 years.

Half the population (52%) could survive financially for just 17 days, should they suffer an unexpected loss of income, according to research by Combined Insurance.

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home