What's Really Propping Up The Economy

wenn man sich den anteil der abseits der im gesundheitswesen ,dem immobiliensektor und dem staatlichen sektor ansieht offenbart sich ein desaströses bild.

ich frage euch sieht so eine gesunde wirtschaft aus?

zudem wird das ganze ausschließlich durch schulden finanziert.

What's Really Propping Up The Economy

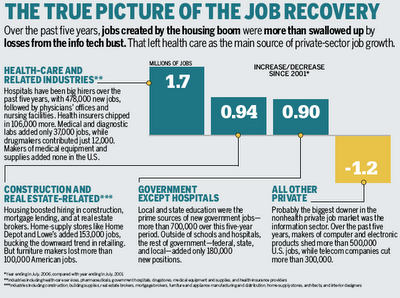

Since 2001, the health-care industry has added 1.7 million jobs. The rest of the private sector? None

http://www.businessweek.com/magazine/content/06_39/b4002001.htm

highlights:

you really want to understand what makes the U.S. economy tick these days, don't go to Silicon Valley, Wall Street, or Washington. Just take a short trip to your local hospital. Park where you don't block the ambulances, and watch the unending flow of doctors, nurses, technicians, and support personnel. You'll have a front-row seat at the health-care economy

For years, everyone from politicians on both sides of the aisle to corporate execs to your Aunt Tilly have justifiably bemoaned American health care -- the out-of-control costs, the vast inefficiencies, the lack of access, and the often inexplicable blunders.

But the very real problems with the health-care system mask a simple fact: Without it the nation's labor market would be in a deep coma. Since 2001, 1.7 million new jobs have been added in the health-care sector, which includes related industries such as pharmaceuticals and health insurance. Meanwhile, the number of private-sector jobs outside of health care is no higher than it was five years ago.

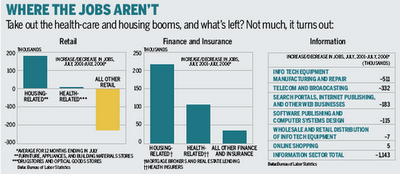

Sure, housing has been a bonanza for homebuilders, real estate agents, and mortgage brokers. Together they have added more than 900,000 jobs since 2001. But the pressures of globalization and new technology have wreaked havoc on the rest of the labor market: Factories are still closing, retailers are shrinking, and the finance and insurance sector, outside of real estate lending and health insurers, has generated few additional jobs. details jobs bausektor / details jobs contruction sector http://immobilienblasen.blogspot.com/2006/09/anteil-immobiliensektor-am.html

Perhaps most surprising, information technology, the great electronic promise of the 1990s, has turned into one of the biggest job-growth disappointments of all time. Despite the splashy success of companies such as Google and Yahoo! , businesses at the core of the information economy -- software, semiconductors, telecom, and the whole gamut of Web companies -- have lost more than 1.1 million jobs in the past five years. Those businesses employ fewer Americans today than they did in 1998, when the Internet frenzy kicked into high gear.

zur vergößerung/to enlargehttp://www.businessweek.com/magazine/content/06_39/b4002008.htm

ATTITUDE SHIFT

Meanwhile, hospitaL administrators like Steven Altschuler, president of Children's Hospital of Philadelphia, are on a hiring spree. Altschuler has added the equivalent of 4,000 new full-time jobs since he took over six years ago, almost doubling the hospital's workforce. To put this in perspective, all the nonhealth-care businesses in the Philadelphia area combined added virtually no jobs over the same stretch.

"Health care is the major engine for the economy of the city of Philadelphia," says Altschuler.

U.S. hospitals and physician offices never stopped growing. Take away health-care hiring in the U.S., and quicker than you can say cardiac bypass, the U.S. unemployment rate would be 1 to 2 percentage points higher.

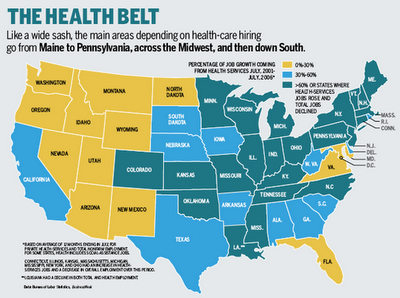

Almost invisibly, health care has become the main American job program for the 21st century, replacing, at least for the moment, all the other industries that are vanishing from the landscape. With more than $2 trillion in spending -- half public, half private -- health care is propping up local job markets in the Northeast, Midwest, and South, the regions hit hardest by globalization and the collapse of manufacturing (map).

Health care is highly labor intensive, so most of that $2 trillion ends up in the pockets of workers. And at least so far, there's little leakage abroad in terms of patient care. "Health care is all home-produced," says Princeton University economist and health-care expert Uwe Reinhardt. The good news is that if the housing market falls into a deep swoon, health care could provide enough new jobs to prevent a wider recession. In August, health-services employment rose by 35,000, double the increase in construction and far outstripping any other sector.

John Maynard Keynes would nod approvingly if he were alive. Seventy years ago, the elegant British economist proposed that in tough times the government could and should spend large sums of money to create jobs and stimulate growth. His theories are out of fashion, but substitute "health care" for "government," and that's exactly what is happening today.

Make no mistake, though: The U.S. could eventually pay a big economic price for all these jobs. Ballooning government spending on health care is a major reason why Washington is running an enormous budget deficit, since federal outlays for health care totaled more than $600 billion in 2005, or roughly one quarter of the whole federal budget. Rising prices for medical care are making it harder for the average American to afford health insurance, leaving 47 million uninsured.

Moreover, as the high cost of health care lowers the competitiveness of U.S. corporations, it may accelerate the outflow of jobs in a self-reinforcing cycle. In fact, one explanation for the huge U.S. trade deficit is that the country is borrowing from overseas to fund creation of health-care jobs.

There's another enormous long-term problem: If current trends continue, 30% to 40% of all new jobs created over the next 25 years will be in health care. That sort of lopsided job creation is not the blueprint for a well-functioning economy. One solution would be to make health care less labor-intensive by investing a lot more in information technology. "Low productivity in health is mostly a product of low investment," says Harvard University economist Dale Jorgenson.

vergrößerung/enlargehttp://www.businessweek.com/magazine/content/06_39/b4002005.htm

For now, though, health-care hiring is providing a safety net in areas where manufacturing and retailing are no longer dependable sources of jobs.

RIPPLE EFFECT

Even more promising, health care has taken over the role manufacturing used to play in providing opportunities for less skilled workers to move up. .

The expansion of health care is also spinning off related jobs. Cleveland Clinic Innovations, a unit that funds startups, has already created 19 companies in its five years of existence. Together they employ about 186 people, including more than 50 in the Cleveland area. One, Cleveland BioLabs Inc., went public in July and trades on NASDAQ. "We like to say that the New Economy is alive and well in the 40 blocks of the Cleveland Clinic," says Christopher Coburn, executive director of Cleveland Clinic Innovations.

UNBALANCED

Shah of Cleveland's BioEnterprise cautions that biotech may not be the right economic development strategy for many places. For one, it's hard to develop a local biotech industry from scratch. "I've seen a lot of regions that take a swing at that," says Shah. Besides, he says, biotech mainly provides jobs for a small number of highly paid workers. For many communities, Shah favors a broader strategy of encouraging health-care delivery and medical equipment and supplies.

Still, using health-care spending to create the vast majority of new jobs, while beneficial in the short run, is not desirable over the long run. A well-balanced economy needs to provide a wide variety of jobs, not just positions for doctors, nurses, and medical technicians.

The biggest worry is that demand for health care will absorb too much of the workforce and squeeze out other types of jobs. If medical spending rises to 25% of gross domestic product by 2030, as many economists expect, health care's share of jobs could grow to 15% or 16% of the labor market from today's 12%, based on historical patterns.

Such a shift in employment would require health care to be the single biggest creator of jobs in the economy for the foreseeable future. And while the U.S. could in theory afford to spend 25% of GDP on health care, it's hard to imagine a world in which our children have to choose between working for the local hospital or the local health insurer.

jan-martin

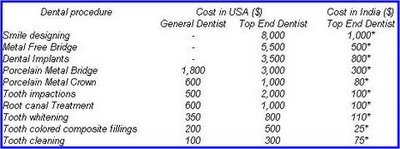

update: what will the us do when "medical tourism" emerges? was wird aus den usa wenn sich der trend in sachen "medizintourismus" durchsetzt.

mehr dazu von mishhttp://globaleconomicanalysis.blogspot.com/2006/07/medical-tourism.htmlalysis.blogspot.com/2006/07/medical-tourism.html,http://globaleconomicanalysis.blogspot.com/2006/08/healthcare-fiasco.html,http://globaleconomicanalysis.blogspot.com/2006/08/healthcare-fiasco-continued.html

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home