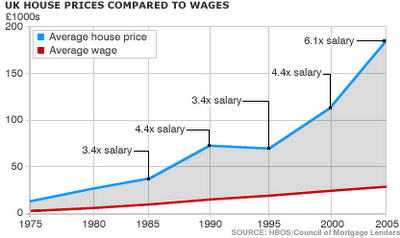

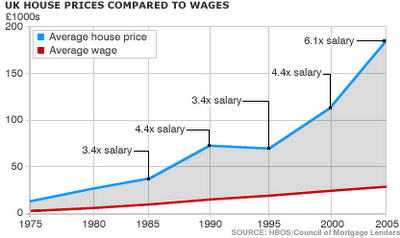

Five-times-salary mortgage offer / GB bubble watch

wer bietet mehr bzw niedrige kreditbestimmungen? im vergleich zu den usa sind selbst diese bestimmungen noch immer streng! aber die briten bewegen sich schnell in die richtung der usa.......

who offers lower lending standarts? in comparisson to the us lending standarts the uk seems to be even with this offer tight. but the brits is moving fast to close the gap....

mehr/more http://immobilienblasen.blogspot.com/2006/09/bubble-goes-global.html

Abbey, Britain's second largest home loan provider, is offering borrowers five times their salary in order to help them get onto the property ladder. http://news.bbc.co.uk/1/hi/business/6104522.stm

The bank is making the offer available to individuals or couples with a 25% deposit for their house and an annual income of £50,000 or more.

Abbey said it was reacting to surging house prices.

But a leading credit counsellor warned that borrowing on this scale meant buyers could be "very stretched".

Encourage

couple borrowing £250,000 with a shared annual income of £50,000 would face repayments of about £1,400 a month - £17,000 a year.

However, only borrowers with good credit ratings and low debt levels would qualify, Abbey said.

"Our customers are continually asking for more money to purchase the house they want and subsequently we looked into the affordability ratings of certain people,"

....The current industry standard is for homebuyers to be offered mortgages of up to three-and-a-half times their salary.

Analysts say Abbey's move is likely to encourage other lenders to follow suit, as they fight for the business of would-be homeowners.

Last week, Bank of Ireland Mortgages and Bristol & West increased their standard salary multiple allowances from 4 to 4.5.

...."For some people this is going to look like an answer to their prayers but it risks taking them into dangerous territory," he said.

"If their salaries do not go up in the way they think, then they are going to be very stretched." ..

who offers lower lending standarts? in comparisson to the us lending standarts the uk seems to be even with this offer tight. but the brits is moving fast to close the gap....

mehr/more http://immobilienblasen.blogspot.com/2006/09/bubble-goes-global.html

Abbey, Britain's second largest home loan provider, is offering borrowers five times their salary in order to help them get onto the property ladder. http://news.bbc.co.uk/1/hi/business/6104522.stm

The bank is making the offer available to individuals or couples with a 25% deposit for their house and an annual income of £50,000 or more.

Abbey said it was reacting to surging house prices.

But a leading credit counsellor warned that borrowing on this scale meant buyers could be "very stretched".

Encourage

couple borrowing £250,000 with a shared annual income of £50,000 would face repayments of about £1,400 a month - £17,000 a year.

However, only borrowers with good credit ratings and low debt levels would qualify, Abbey said.

"Our customers are continually asking for more money to purchase the house they want and subsequently we looked into the affordability ratings of certain people,"

....The current industry standard is for homebuyers to be offered mortgages of up to three-and-a-half times their salary.

Analysts say Abbey's move is likely to encourage other lenders to follow suit, as they fight for the business of would-be homeowners.

Last week, Bank of Ireland Mortgages and Bristol & West increased their standard salary multiple allowances from 4 to 4.5.

...."For some people this is going to look like an answer to their prayers but it risks taking them into dangerous territory," he said.

"If their salaries do not go up in the way they think, then they are going to be very stretched." ..

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home