fineprint / kleingedrucktes

man fragt sich inzwischen immer mehr ob die builder, broker, makler usw. häuser oder doch etwa autos verkaufen. die aktionen die initiert werden ähneln immer mehr denen von gm, ford, chrysler etc.. es werden immobilien verkauft nach dem motto:

wie hoch soll die rate sein?

preis und gesamtkosten spielen keine rolle. warum auch? hat ja eh kaum einer vor je den kreit zurückzubezahlen.......

nicht neu aber besonders unserös sind die angebote wo man ne lupe benötigt um das keingedruckte zu lesen. hier ein paar besispiel die exemplarisch für die gängige praxis stehen. sind also nicht die ausnahme sondern leider inzwischen der regelfall.

dank geht an seth jayson und ejamie plus ben

http://www.fool.com/news/commentary/2006/commentary06090716.htm?source=ifwflwlnk0000003

http://thehousingbubbleblog.com/?p=1405#comment-177025

Fiction leads the way

There's a first-season episode of The Simpsons in which Homer has to have an RV so he can keep up with the neighbors. So, he heads to Bob's RV Roundup, where the sales office is decorated with signs that read "Bankruptcy, Shmankruptcy" and "We give credit to everyone." Unfortunately for Homer, he can't quite qualify for the loan big enough to buy him the "ultimate behemoth," but he falls for a lesser vehicle. Desperate to bolster his status among men, he asks what this smaller RV costs and is told "$350 a month." He takes the deal.

The joke, of course, is that "$350 a month" is not a price, it's a fleecing. A blatant ripoff attempt. How long does this loan last? What are the terms? Only someone as stupid as Homer Simpson could fall for such a transparent ruse, right?

Don't tell that to the home selling industry.

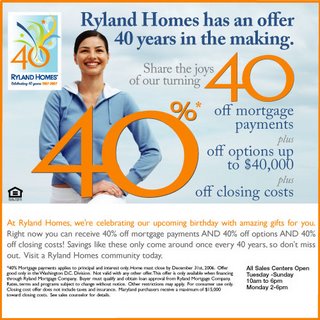

RV Bob at Ryland Homes?This morning I spotted a high-end homebuilder in the Washington, D.C., area using sales tactics that could have been cribbed directly from that episode. Via a full-page newspaper ad, Ryland Group is trying to entice buyers with lavish digs, promising a variety of living arrangements at what seem like rock-bottom prices. Take this one: "3-4 bedroom garage townhomes... $1,174 per month." Or this one: "Single family and manor homes... $1,478 per month."

Luckily, our universe isn't quite as skewed as the Simpsons'. Ryland discloses, in microscopic print, that these payments are in fact based on teaser rates of 2.75%, a rate that disappears after one year. After that, you're stuck with a 6.25% rate on a 40-year mortgage. You got that right, 40 years.

Truth: Uglier than either fiction or advertising

I've had few kind words for this type of bait-and-switch lending. While the Countrywide Financials and Accredited Home Lenders out there -- along with builder-sponsored mortgage businesses, like Ryland's -- may think they've got perfectly reasonable folks on the hook for their "affordability" products, I am seeing more and more evidence that borrowers have been anything but rational

When 80% of option-ARM holders -- according to some reports -- are paying less than their monthly interest, so that their loan balances are actually increasing while their home values may be dropping, well, I'm pretty sure rationality has taken a vacation.

I've actually read news stories in which accountants, career bean counters, claimed they simply had no idea what their payments were going to look like when their loans readjusted. Now they're stuck with doubled payments, no way to refinance, and no one willing to buy

Some dirty details

Personally, I don't much believe in the "I didn't know" excuse. It's your responsibility to know when you sign on the dotted line.

But to provide just one more example of how scary things can get when you believe what you want to believe, rather than what the math tells you, I played with Ryland's online payment calculators and some of the homes in that RV Bob advertisement of theirs.

For a sub-2,000-square-foot townhome located a full 45 miles from downtown Washington, D.C., this is what reality will look like.

First of all, forget $1,174 per month, my friend.

After that first year is over and the mortgage adjusts, according to the Ryland calculator, your monthly payments go toward $2,081 per month. That's right, your payments will turn out to be 75% bigger than the teaser payment in their ad -- which seems to exclude insurance, taxes, and mortgage insurance, expenses which, alas, we don't get to dodge in real life. (Wanna discuss the 400 miles per week of gasoline expense, plus two to four hours a day of the third-worst traffic in the country? I didn't think so.)

Teaser Rate | Years 2-40 | 30-Year | |

|---|---|---|---|

P&I | $1,083 | $1,788 | $1,940 |

Tax, Insurance | $183 | $183 | $183 |

Mortgage Insurance | $110 | $110 | $110 |

Total Monthly Payment | $1,376 | $2,081 | $2,233 |

Those are the numbers, assuming a $350,000 home, 10% down payment, and Ryland's auto-generated tax and insurance figures (which look low to me). As you can see, there's an incredible difference between ad copy and abject reality. A traditional, 30-year mortgage at 6.50% shows what a typical payment on a home of this price would look like.

Think that's incredible? I'm just getting warmed up.

You pay an awful lot by going from a 30-year loan to a 40-year in order to ensure yourself "affordability." Here's what that $150 a month savings costs you in the end.

40-Year, Teaser year 1 | 40-Year, No Teaser | 30-Year | |

|---|---|---|---|

Total Monthly Payment | $1,376 | $2,081 | $2,233 |

Interest subsidy (1st year) | $11,029 | NA | NA |

Total Interest Paid | $532,393 | $543,422 | $383,223 |

Overpayment vs. 30-year | $149,170 |

As you can see, the total interest paid on a 40-year mortgage is much more than on a traditional 30-year.

Try this trick on one of their pricier homes, and it gets much worse. On a $650,000 home, your payment will jump from $2,491 in year one to $3,905 in years two through 40. And you'll pay $291,000 more interest over the life of the loan than if you'd opted for a 30-year mortgage

Desperate House-shills

Why is Ryland doing this? I think the answer could be that it's desperate to sell homes. And more than that, it's desperate to keep prices artificially inflated. Remember, much of the bubble depends on popular acceptance of the myth that home prices don't fall. As I've discussed here, sellers, builders, and realtors are doing backflips to cut discounts to buyers -- discounts that don't get registered in the sale price. Teaser rates and 40% off closing costs (another Ryland special this month) are prime examples.

die perfekte ergänzung ist der bericht von nem insider der noch deutlicher ist. dank ghet an socalmtgguy!http://housingbubblecasualty.com/?p=38 (genial/klasse)

jan-martin

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home