canada / kanada

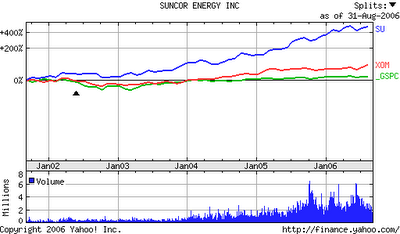

ein ganz wichtiger faktor im gegensatz zu den usa ist hier allerdings der echte boom der ausgelöste worden ist durch die explodierende ölsandförderung in alberta.(siehe auch cart suncor/su). hier liegt zumindest für diese region ne teilerklärung vor. den exzess erklärt das aber sicher nicht.

Bubble trouble

http://calsun.canoe.ca/Business/2006/08/31/1789681.html

highlights:

The bubble watch is on in Calgary.

According to a report released by TD Economics today, the city could be experiencing a housing bubble."The speed of the rise in prices is troubling and cannot be sustained

"There is no question that the recent dramatic price gains in Calgary and Vancouver are unsustainable and that these urban centres are vulnerable to significant moderation, including the possibility of a pullback in prices," said the report.

"If prices continue to rise at a close to 40-percent rate, affordability will quickly become a problem and fear of being priced out of the market may encourage hasty decisions," the study said.

•The average home price in Calgary during the second quarter was $345,903, which was less than Toronto ($351,680), Victoria ($421,637) and Vancouver ($509,606). The average price in Edmonton was $232,932.

•Resale home prices in Calgary jumped 25.5% year-over-year in the first quarter and 43.3% in the second quarter.

•Alberta is responsible for almost half of the gain in the national average of new home prices. (siehe chart suncor/ölsand im vergleich zu exxon und dem sp500)

•After falling for the first five months of 2006, new listings in Calgary were up 25% year-over-year in June and 41% in July. (anfang vom ende)

•During the second quarter, home ownership costs in Calgary were 24% of median household labour income, up from 15.5% in 2005. That affordability indicator was lower than Montreal (26%), Toronto (27%), Vancouver (50%) and Victoria (50%), but higher than Edmonton (18%).

jan-martin

disclosure: long suncor

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home