$ und "strong dollar policy"

der us finanzminister sagt wie selbstverständlich das die usa eine politik des starken $ verfolgen. was soll er anderes sagen wenn sein land jeden tag zwischen 2b$ und 3b$ (entspricht ca. 80% aller weltweit verfügbaren ersparnisse) benötigt um die defizite aller art zu finanzieren. das irgendjemand diese aussagen noch für bare münze nimmt kann ich mir nicht wirklich vorstellen. ist eher ein ausdruck von hilflosigkeit. der vorgaänfer von paulsen, john snow konnte sich teilweise das lachen bei beantwortung dieser frage nicht verkneifen.

hier nun ein guter bericht von j.taylor. dank geht auch an mish und markettraderforum

http://www.markettradersforum.com/forum1/1467.html

http://www.howestreet.com/articles/index.php?article_id=2884

Mr. Secretary, Why is a Strong Dollar Good? Why no Answer?

highlight:

This past week, Treasury Secretary Paulson made his first important speech since taking office. One of the things he said was that he favored a “strong dollar policy.” The last time we had an ex-Goldman Sachs guy as Treasury Secretary, he constantly pounded home the strong dollar theme. Robert Rubin never said what the strong dollar policy was. He never said how it was carried out, only that a strong dollar was a good thing. Therefore we would have it! Some of us pro-GATA people think the dollar was made strong vis-à-vis other currencies by a market manipulating dishoarding of gold by the world’s central banks. I do not think the establishment can usher in a strong dollar now by trashing the gold price. Foreign central banks would not cooperate as they did in the 1990s when Russia had fallen out of world super power status. Of course, Russia is now back.

But that’s not the point I wish to make now. What I found really strange was the Treasury Secretary’s refusal to answer a question from a Bloomberg Radio reporter who tried twice to get the Treasury Secretary to say why a strong dollar policy was in the best interest of the American economy when we are running such huge trade deficits. First Paulson in effect said, “trust me, a strong dollar policy is good,” but did not offer any reasons why that was true. The second answer escapes me but as I recall, it was even more evasive than the first non answer.

Here is my theory about why the Treasury Secretary did not answer the question. If he had answered the question honestly, he would have had to say something like, “so foreign savers would continue to fund America, which is in effect a bankrupt country.” He then could have noted a paper published on the St. Louis Fed’s Web site suggesting that America is indeed bankrupt. But can you imagine what pandemonium that would have in the world’s markets?

Just like Robert Rubin, Paulson refused to give any idea about how a strong dollar would be orchestrated. Now this might be even more problematic for the markets if this question were answered honestly. With the U.S. now much, much worse off in terms of its ability to manufacture things the world needs and wants than we were during the 1990s, he would have had to say the only way to keep the dollar from plunging would be to raise interest rates even as the U.S. economy is clearly slowing down.

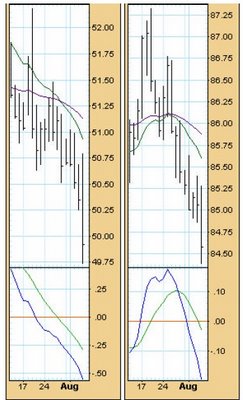

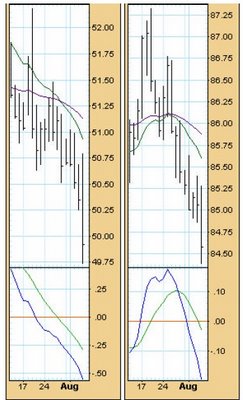

Do you see how the dollar plunged as rates on the 30-Year Bond fell from 5.2% to 4.975%? (s.grafik links)

Do you see how the dollar plunged as rates on the 30-Year Bond fell from 5.2% to 4.975%? (s.grafik links)

As we have said all along, the key point on the dollar index chart and as such virtually all the markets in the world is the 0.80 level. You can see from the chart below that the dollar index over the past 15 years has touched 0.80 four times but has never fallen below for any significant length of time or very far below 0.80. If this level breaks, it could lead to a freefall for the dollar. In that event, the U.S. may be toast as the world’s leading superpower.

hier nun ein guter bericht von j.taylor. dank geht auch an mish und markettraderforum

http://www.markettradersforum.com/forum1/1467.html

http://www.howestreet.com/articles/index.php?article_id=2884

Mr. Secretary, Why is a Strong Dollar Good? Why no Answer?

highlight:

This past week, Treasury Secretary Paulson made his first important speech since taking office. One of the things he said was that he favored a “strong dollar policy.” The last time we had an ex-Goldman Sachs guy as Treasury Secretary, he constantly pounded home the strong dollar theme. Robert Rubin never said what the strong dollar policy was. He never said how it was carried out, only that a strong dollar was a good thing. Therefore we would have it! Some of us pro-GATA people think the dollar was made strong vis-à-vis other currencies by a market manipulating dishoarding of gold by the world’s central banks. I do not think the establishment can usher in a strong dollar now by trashing the gold price. Foreign central banks would not cooperate as they did in the 1990s when Russia had fallen out of world super power status. Of course, Russia is now back.

But that’s not the point I wish to make now. What I found really strange was the Treasury Secretary’s refusal to answer a question from a Bloomberg Radio reporter who tried twice to get the Treasury Secretary to say why a strong dollar policy was in the best interest of the American economy when we are running such huge trade deficits. First Paulson in effect said, “trust me, a strong dollar policy is good,” but did not offer any reasons why that was true. The second answer escapes me but as I recall, it was even more evasive than the first non answer.

Here is my theory about why the Treasury Secretary did not answer the question. If he had answered the question honestly, he would have had to say something like, “so foreign savers would continue to fund America, which is in effect a bankrupt country.” He then could have noted a paper published on the St. Louis Fed’s Web site suggesting that America is indeed bankrupt. But can you imagine what pandemonium that would have in the world’s markets?

Just like Robert Rubin, Paulson refused to give any idea about how a strong dollar would be orchestrated. Now this might be even more problematic for the markets if this question were answered honestly. With the U.S. now much, much worse off in terms of its ability to manufacture things the world needs and wants than we were during the 1990s, he would have had to say the only way to keep the dollar from plunging would be to raise interest rates even as the U.S. economy is clearly slowing down.

Do you see how the dollar plunged as rates on the 30-Year Bond fell from 5.2% to 4.975%? (s.grafik links)

Do you see how the dollar plunged as rates on the 30-Year Bond fell from 5.2% to 4.975%? (s.grafik links)As we have said all along, the key point on the dollar index chart and as such virtually all the markets in the world is the 0.80 level. You can see from the chart below that the dollar index over the past 15 years has touched 0.80 four times but has never fallen below for any significant length of time or very far below 0.80. If this level breaks, it could lead to a freefall for the dollar. In that event, the U.S. may be toast as the world’s leading superpower.

denke der cahrt des $ index zeitgt sehr eindrucksvoll wie wirksam die nicht definierte politik des "starken $" in der praxis gelebt wird........

gruß

jan-martin

disclosure: short $ / long gold

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home